FinTech investment in France is on track to beat the record funding levels from last year

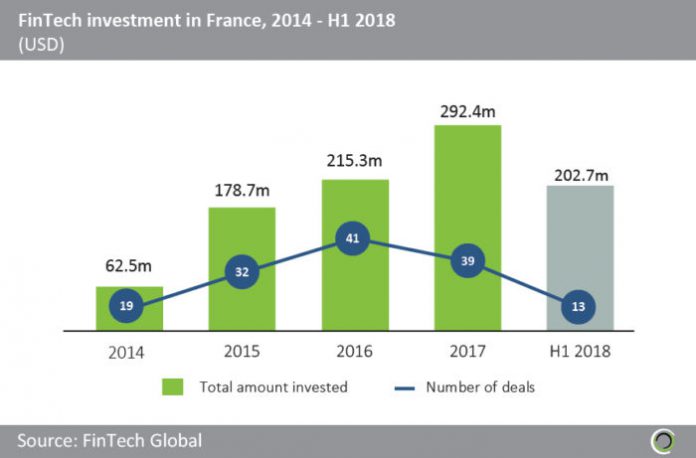

- More than $950m has been invested in French FinTech companies across 144 deals since 2014, with funding increasing at a CAGR of 67.3% between 2014 and 2017.

- FinTech investment in France reached record levels in 2017, nearly topping $300m from 39 transactions. The average deal size last year rose to $7.5m, with over a fifth of transactions valued above $10m.

- FAMOCO, a Paris-based mobile payments solution provider, raised a $11.7m Series B round in Q1, which was the largest Payments & Remittances deal in France last year. This funding was led by Idinvest and has been used to fuel the company’s international growth strategy.

- FinTech companies in France have raised $202.7m so far this year, 70% of what was raised in 2017, setting strong funding expectations for the rest of the year. Alan, a digital health insurance platform, raised a $28.3m Series A round which was one of the largest FinTech investments in France in Q2 2018. This investment, led by Index Ventures, will be used to help Alan reach its target of 100,000 users covered within three years and grow the team to 80 employees by the end of 2018.

FinTech investment in France surpassed $100m in Q1 2018, up two thirds from the previous quarter

- More than 35% of the total investment in FinTech companies in France last year was raised in Q3, as funding increased 2.5x from the previous quarter.

- Nearly half of the total funding in Q3 2017 went to Younited Credit, a crowdlending platform, which raised a $47.8m Series F round as it plans to become the largest crowdlending platform in Continental Europe.

- FinTech investment in France surpassed $105m in Q1 2018, up 68% from Q4 2017 levels. Ledger, a security and infrastructure solution provider for cryptocurrencies, raised $75m in Series B funding, which is the largest FinTech deal in France to date. The company sells hardware wallets for cryptocurrencies and this funding, led by Draper Esprit, will enable Ledger to ramp up production in order to keep up with growing demand.

The top 10 FinTech deals in France have collected two fifths of the total investment since 2014

- Almost $387m was invested in the top 10 FinTech deals in France between 2014 and H1 2018, equal to 40.7% of the total funding raised by FinTech companies in the country during that period. The largest deal went to previously mentioned Ledger, which raised $75m in Q1 2018.

- Marketplace Lending companies dominated the top 10 deals, with $192m raised across five transactions.

- Previously mentioned Younited Credit has been very active, raising $122.1m across seven deals since 2010. In addition to the Series F mentioned earlier, the company raised a $34m Series D round in Q3 2015 from Eurazeo, which enabled it to expand outside of France.

- Lendix, an SME finance provider, raised $37m of venture funding led by Idinvest Partners and Allianz. This was the largest FinTech deal in France in Q2 2018. Lendix currently operates in France, Spain and Italy, with plans of operating in seven countries by the end of 2019.

French FinTech companies have completed 46% fewer FinTech deals than their German peers

- There were 144 FinTech deals completed in France between 2014 and H1 2018, 46.3% fewer than in Germany during that period.

- Payments & Remittances companies in France have claimed 22.2% of all FinTech deal activity in the country, more than any other subsector, with 32 transactions completed since 2014. Paris-based Wynd, point of sale solution provider, raised a $31.7m Series B round in Q4 2016. This funding, led by Sodexo Ventures, is the largest Payments & Remittances deals in France to date, which has enabled the company to increase headcount and expand internationally.

- The French FinTech ecosystem is slightly more diverse than that of Germany, with the top four FinTech subsectors claiming 59% of deal activity in France compared to 69% of deals in Germany.

- France has the potential to gain ground on Germany as the French government, along with private sector participants, are now engaging in very ambitious reforms with plans of making the business climate in France more amenable to entrepreneurship and FinTech innovation.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global