Annual RegTech investment grew 2.5x in 2018

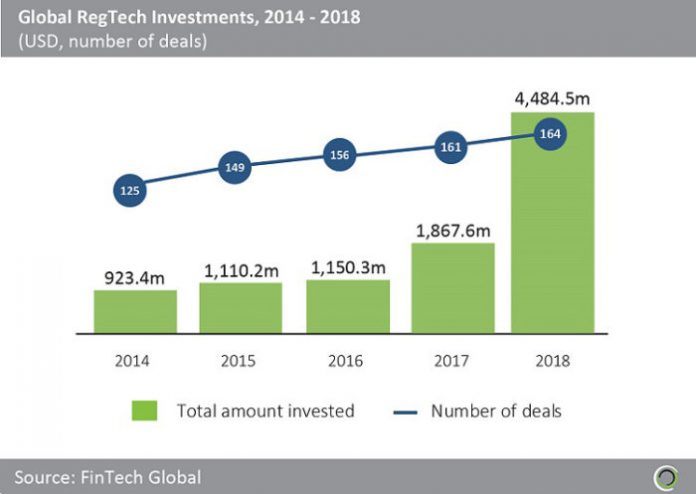

- Global RegTech investment grew almost five-fold between 2014 and 2018. An increase of 48.5% CAGR, in terms of capital invested, has seen funding grow from $923.4m in 2014 to $4,484.5m in 2018.

- Funding doubled between 2014 and 2017, before jumping to just under $4.5bn in 2018 and deal activity increased year on year between 2014 and 2018. Annual deal activity has remained above 120 since 2014, reaching 164 transactions in 2018, with a total of 844 deals completed during the period.

- Funding in 2018 was bolstered by large transactions with SenseTime, a facial recognition solution provider, raising over $2.2bn across three deals. When we exclude the $2.6bn that SenseTime raised across 2017 and 2018, global RegTech funding still grew from $1,467.6m to $2,264.5m during the period. This increase was partly due to there being as many as 11 transactions valued above $50m in 2018.

- Exiger, a New York-based provider of financial crime compliance and risk management solutions, raised $80m of Series A funding from Carrick Capital Partners in Q3 2018. This was one of the largest deals of the year and will enable Exiger to accelerate its growth by continuing to build out and acquire differentiated technology and technology-enabled solutions.

- Checkr, a San Francisco-based automated background checking solution provider, raised a $100m Series C round led by T. Rowe Price, which was one of the largest transactions in 2018 outside of SenseTime funding rounds.

Investment in Q4 2018 was more than two thirds higher than funding in Q4 2017

- Deal activity has remained above 30 transactions per quarter over the past five quarters, reaching a high of 43 deals in Q2 2018.

- Investment reached almost $1.9bn during that that three-month period, primarily driven by the previously mentioned $1.2bn of funding that SenSeTime raised. Checkr raised a $100m Series C round which also boosted funding levels in Q2 2018.

- Funding grew from $437.4m in Q4 2017 to $731.3m in Q4 2018, a 67.2% increase, with deal activity climbing from 30 to 41 during the period.

- Investment in Q3 2018 was nearly double that of Q4 2018, hit almost $1.5bn, as SenseTime raised a further $1bn in a Series D round from SB China Venture Capital in September 2018.

Nearly $6bn has been invested in RegTech solutions that address KYC and AML since 2014

- An analysis of the capital invested in RegTech companies according to the area of regulation addressed by their solutions reveals which pieces of legislation appear to be causing the most problems within financial institutions and are thereby deemed to offer the most attractive opportunities for investors.

- Just over $9.5bn was invested in RegTech companies between 2014 and 2018, with 34.5% of this invested in companies providing KYC solutions. AML follows with 28% of the capital invested, GDPR takes third place with 13.1% and MiFID II in fourth place with 6.4% of total investment.

- KYC and AML regulations have dominated the RegTech landscape due to their cross-industry applications and heightened expectations from regulators. China regulatory landscape has been evolving with the People Bank of China paying greater attention to AML initiatives.

- Much anticipation and uncertainty surrounded MiFID,?implemented in January 2018, with the regulation proving to be one of the biggest shakeups to financial markets following the financial crisis. Symphony Communication Services is MiFID II compliant communications platform and is now one of the most well-funded RegTech companies globally, having raised $296m from investors including Goldman Sachs, JP Morgan and UBS.

- Basel III, PSD2, Solvency II and AIFMD take 5.4% share of the total investment combined, with other legislation accounting for the remaining 12.6%.

Over $500m was raised in the top 10 RegTech deals in Q4 2018

- The top 10 global RegTech deals in Q4 2018 raised $515m, which is equal to 70.4% of the total capital raised in the?quarter.

- United States-based RegTech companies dominated with seven companies listed in the top 10, and the remaining three transactions involving companies based in the United Kingdom, Canada and Indonesia.

- Venafi, a Salt Lake City-based cybersecurity company, raised a $100m Series E round from TCV, QuestMark Partners and NextEquity Partners in November 2018. Of this, $12.5m will be made available to third-party developers in the first tranche of Venafi new Machine Identity Protection Development Fund.

- Ottawa-based Assent Compliance is a supply chain management software company that assesses third-party risks and educates stakeholders on regulatory and data program requirements. The company raised $100m of Series C funding from Warburg Pincus, which will enable Assent to continue the development of its product compliance and vendor management risk platform.

- Egress, a London-based AI-powered cybersecurity company, raised a $40m Series C round led by FTV Capital. The company’s revenue?has?grown by 500% over the past four years, and Egress now has five million users across 2,000?enterprise and government clients.

- Jakarta-based OnlinePajak, a tax compliance solution provider, raised $25m of Series B funding from investors including Warburg Pincus and Sequoia Capital India. This was the largest RegTech deal in Asia in Q4 2018 and in April 2018, OnlinePajak was recognized by the World Economic Forum as one of the world tech pioneers.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ?2019 FinTech Global