More than three quarters of the total capital raised has been invested in deals valued $25m and above

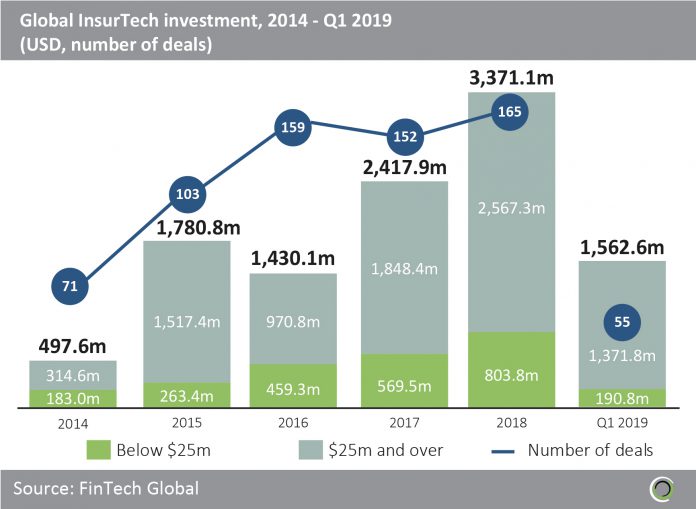

- InsurTech companies globally raised more than $11bn between 2014 and Q1 2019, across 705 transactions, with the average deal size increasing from $7m to $28.4m during the period.

- Almost $8.6bn (77.7% of the total InsurTech investment) has been invested in deals valued at $25m and above over the past five years, a sign of the investor appetite for later stage transactions in the InsurTech space.

- ZhongAn, a Chinese online-only P&C insurer raised a $937.1m Series A round in Q2 2015 in what is the largest InsurTech deal globally to date. The company is backed by investors such as SoftBank, Alibaba and Morgan Stanley and went public in September 2017 with a market cap of $11bn.

- More than $1.5bn was raised by InsurTech companies in Q1 2019 across 55 deals already, setting strong expectations for the rest of the year.

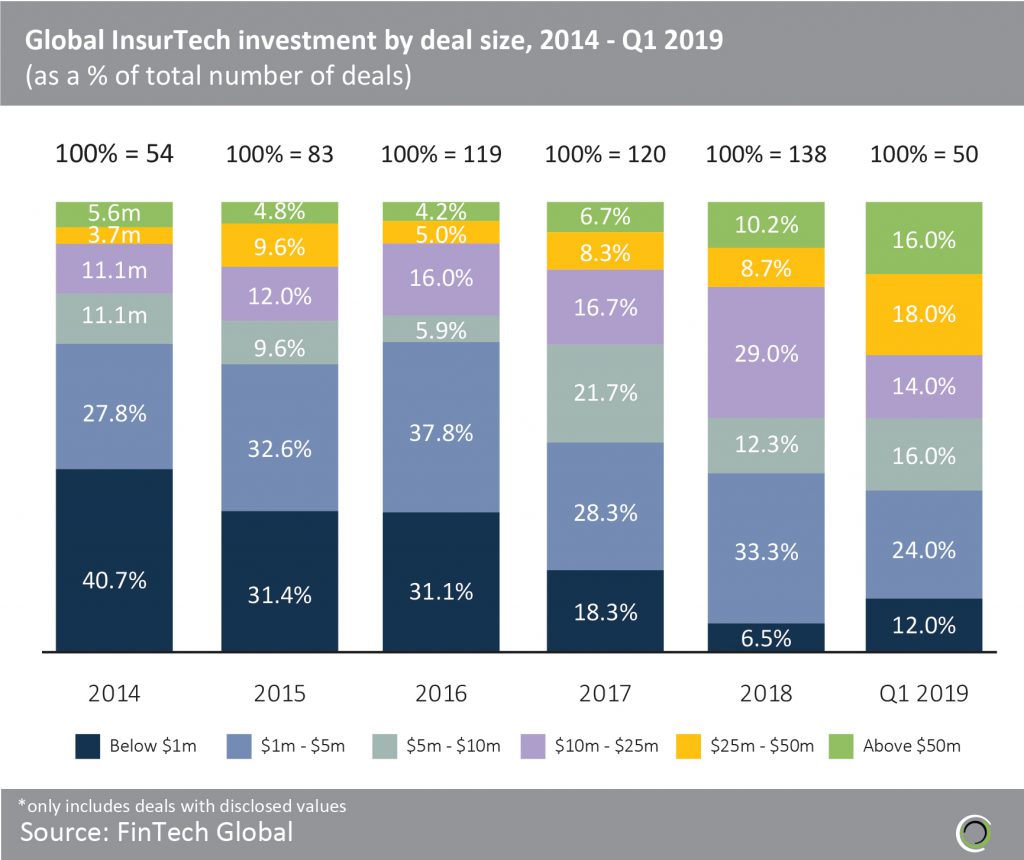

The proportion of InsurTech deals valued above $50m almost quadrupled between 2016 and Q1 2019

- The InsurTech investment landscape has witnessed a shift over the last five years from investors predominantly backing smaller deals towards making more later-stage investments.

- The proportion of deals valued below $5m fell from 68.5% in 2014 to 39.5% last year, dropping again to 36% in Q1 2019 as the subsector shows continued signs of maturity.

- The share of deals valued above $50m increased from 4.2% in 2016 to 16% last quarter, with the proportion of post-Series A venture deals increasing from two fifths of transactions in 2016 to more than half of the venture deals in Q1 2019.

- Berlin-based wefox, an AI-driven provider of health, property and life insurance, raised a $125m Series B round which was the largest InsurTech deal in Germany last quarter. Salesforce Ventures participated in this round, having previously invested in wefox’s $28m Series A round in Q3 2016.

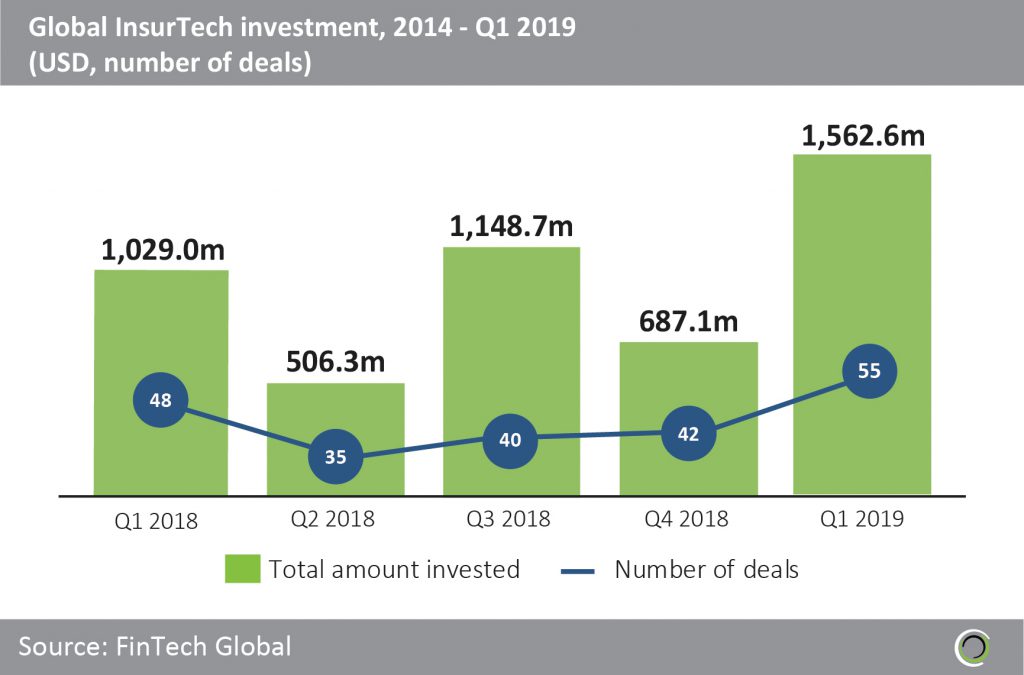

Funding in Q1 2019 reached a five quarter high with almost $1.6bn raised

- InsurTech funding reached almost $1.6bn in Q1 2019, which is 51.9% larger than in Q1 2018. Over the past 12 months, investment trebled between Q2 2018 and Q1 2019, with deal activity increasing from 35 transactions to 55 during the period.

- Large transactions pushed InsurTech funding to nearly $1.6bn last quarter, with eight deals valued above $50m compared to just four transactions in Q1 2018.

- Clover Health, a technology driven health insurance provider based in San Francisco, raised $500m in Series E round from Greenoaks Capital. This was the largest InsurTech deal of Q1 2019, and the unicorn now has revenues in excess of $400m.

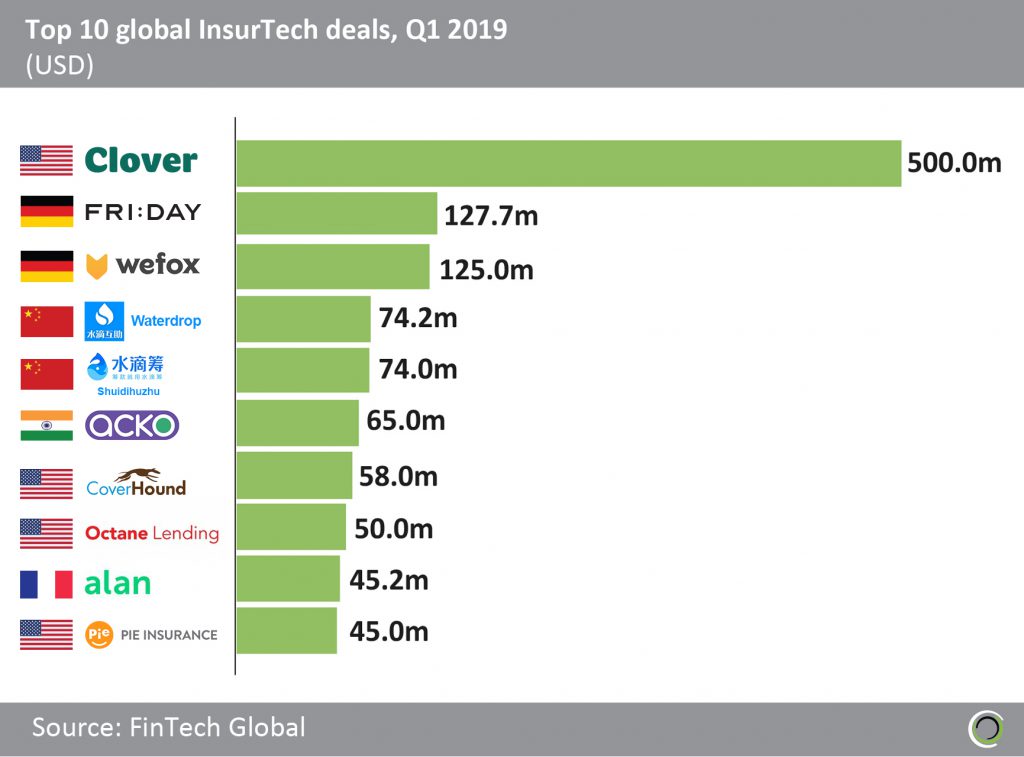

More than $1.1bn was raised in the 10 largest InsurTech deals globally last quarter

- Just under $1.2bn was invested in the top 10 global InsurTech deals last quarter, which is equal to 74.5% of the total capital raised in the subsector last quarter, with deals involving companies based in the United States, Germany, China, India and France.

- Previously mentioned Clover Health raised $500m in the largest deal of Q1 and now provides Medicaid and Medicare coverage to 40,000 members across the United States.

- Alan, a Paris-based health insurance startup, raised a $45.2m Series B round from DST Global and Index Ventures in February 2019. This was the largest InsurTech deal in France last quarter and in 2018, Alan from 5,000 insured people to 27,000, with revenue jumping from $4 million to $25 million by year end.

- Beijing-based insurer Waterdrop Inc raised a $74m Series B round, led by Tencent Holdings in March 2019. This was the largest InsurTech deal in China last quarter and waterdrop will spend the money on developing blockchain technology and automating Insurance reimbursements.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global