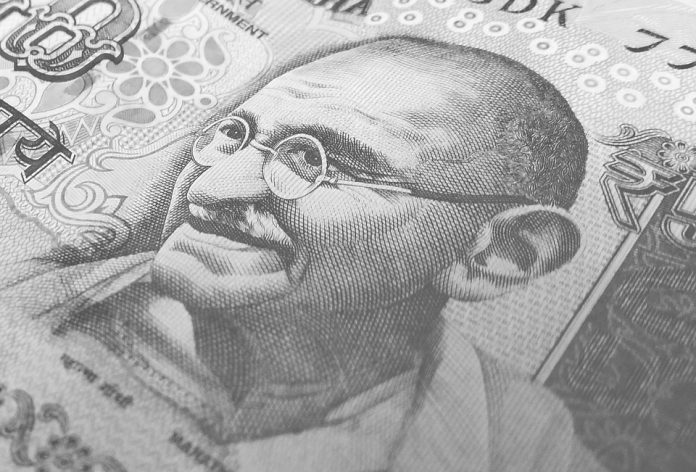

The Reserve Bank of India (RBI) has deployed an INR 10 million ($143,570) fine on HDFC Bank for failing to meet KYC and AML compliance and the reporting of frauds.

RBI issued the fine after HDFC railed to adhere to previous directions it had been given by the regulating body.

Its action is based upon deficiencies in regulatory compliance and not questioning the validity of any transaction or agreement entered between the bank and a customer.

The incident in question began when RBI received a reference from customs authorities regarding the submission of forged bill of entries by certain importers to HDFC for remittance of foreign currency. After examining this, RBI uncovered violations of its directions on KYC, AML, and the reporting of frauds based on which.

Following this, a letter was sent to HDFC advising it to show caused to why a monetary penalty should not be given for the compliance failure.

After considering the bank’s response, RBI decided the charges for non-compliance were warranted.

Earlier in the year, The Reserve Bank of India released the guidelines for the tokenisation of debit, credit and prepaid card transactions. In the new guidelines, RBI permits card payment networks to offer card tokenisation services to third-party app providers, or a token requestor. While this has now been accepted, a number of conditions need to be met, such as necessary security measures.