African telecom company Africell secured a huge loan in May from the US government, which it will now use to build up its infrastructure and FinTech capabilities.

The Overseas Private Investment Corporation (OPIC) is the American government’s private investment fund. It loaned Africell $100m in May.

Ziad Dalloul, founder and CEO of Africell, told Reuters the money would help fund infrastructure investments for its operations in Uganda, the Democratic Republic of Congo, Gambia and Sierra Leone. Africell would also make a bid to become Angola’s fourth operator. He added that Zimbabwe’s market also showed promise as a potential new place to expand to.

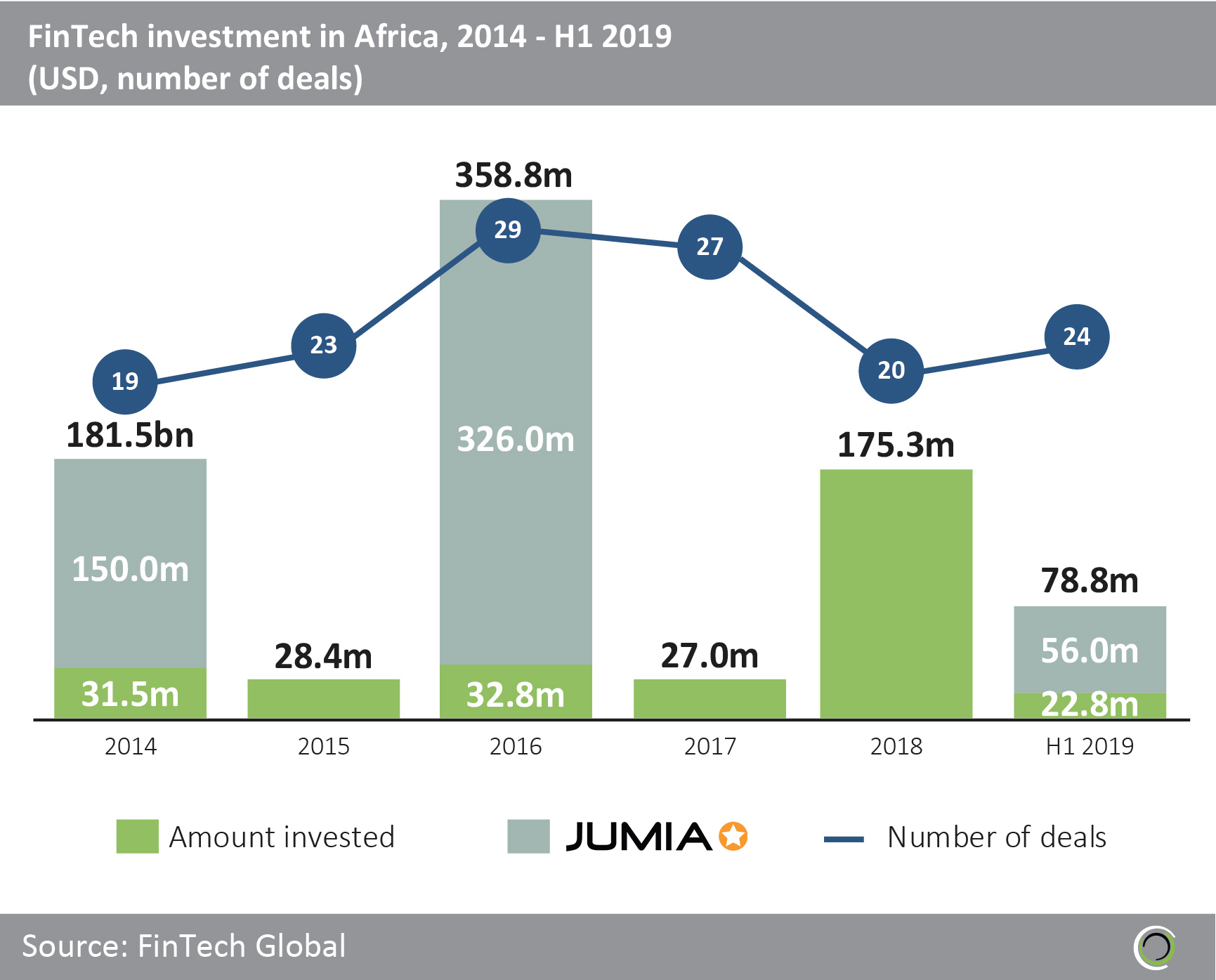

FinTech in Africa jumped from $27m in 2017 to $175.3m in 2018, according to FinTech Global’s own research. However, that is a far cry from 2016 when $358.8m was invested into FinTech companies on the continent. Some of that could be explained by the fact that Jumia Group, the Nigerian e-commerce platform, had received $326m in investment in total that year. The company received no investment in 2017. It is still considered Africa’s only tech unicorn.

Excluding the investments made by Jumia Group, investments in Africa only totalled $320m between 2014 and the first six months of 2019.

FinTech Global have reported about many of the pushes to boost investment in Africa. For instance, in September 2018 FinTech Global wrote about how Goodwell Investments, the pioneering investment firm, fund had launched a €20m fund to support financial inclusion in Africa.

In December 2018, Neobank SOL Wallet launched in South Africa.

Copyright © 2019 FinTech Global