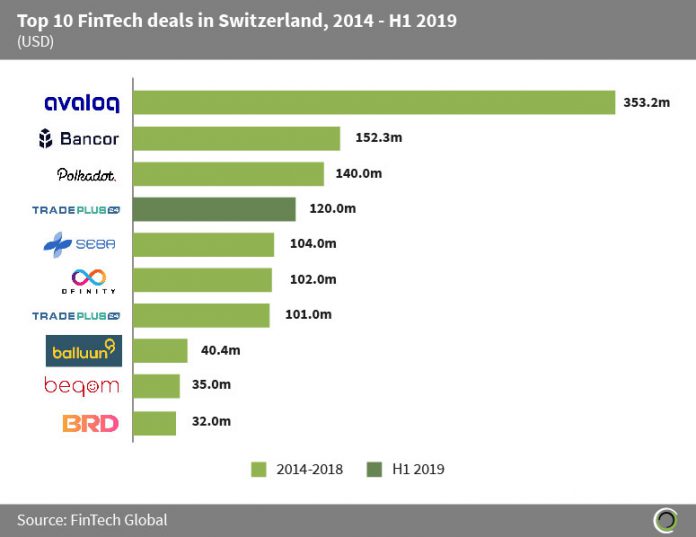

Nearly $1.5bn has been raised in Switzerland in the top 10 deals in the country since 2014, accounting for 70.6% of total capital raised during that period. All the top 10 deals have occurred since 2017, with only one occurring in the first half of this year. The rise in big ticket deals in the last three years raised the average deal size from $2.8m in 2014 – 2016 to $25.2m in 2017 – H1 2019.

Avaloq, a banking software and services provider, raised the largest deal of the period with their $353.2m private equity round in Q1 2017 led by Warburg Pincus. This funding will help accelerate the company’s value creation strategy and support long-term growth.

The only deal to occur in H1 2019 was Tradeplus24’s $120m round lead by SIX Fintech Ventures, Berliner Volksbank Ventures and Credit Suisse. Tradeplus24 provide small to medium enterprises with innovative lending solutions to make raising funds easier and more cost-effective.

Capital allocation of the top 10 transactions was widely distributed across subsectors with Cryptocurrency companies accounting for three transactions, Payments & Remittances companies accounting for one, and Blockchain, Infrastructure and Enterprise Software and Marketplace Lending companies accounting for two deals each.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global