Nigeria is at the centre of Africa’s FinTech revolution. Native Carbon aims to play a pivotal role in creating a thriving ecosystem where men and women have access to financial services.

CEO Chijioke Dozie and Ngozi Dozie founded the FinTech startup in 2012 under the name Paylater. Speaking exclusively with FinTech Global, Chijioke Dozie reveals that he’s always had an interest in banking and financial services. “However, the idea that blossomed into what is now Carbon came to mind after I finished my MBA in 2008 when I began to notice just how big the market for unbanked consumers in Nigeria, and Africa as a whole, was,” he says. “I was confident that something could be done to address this issue but I wasn’t entirely sure how to do so effectively and efficiently.”

The duo first set out to create a paper-based loan service that required applicants to provide supporting documents. “But in a market like Nigeria, where 60% of working adults are in the informal sector and don’t formally record much of the information we need, we couldn’t really deliver our services as effectively as we wanted,” Chijioke Dozie remembers.

Looking for a solution to the dilemma, the co-founders’ eyes fell upon FinTech and the promise inherent in alternative data. This presented the entrepreneurs with the opportunity to reach a bigger clientbase at fraction of the price of doing so with a traditional banking model, which would have required a lot of bricks and mortars branches.

Another obstacle to overcome was to convince potential customers to bank on Paylater. “Gaining customer trust was one of the biggest challenges that we had to navigate at the early stage,” Chijioke Dozie remembers. “Before Paylater, most people thought you had to go into a bank and apply for a loan in person. We had to convince them that it is possible and safe to receive a loan from an institution they could not see.

“We also had to put in a lot of work to challenge cultural attitudes and get people to acknowledge and appreciate that we’ve simplified what used to be a long and tedious process down to five minutes on a smartphone.”

The company has evolved since then. “[Today] Carbon is a digital platform that empowers individuals with access to credit, simple payment solutions, high-yield investment opportunities and easy-to-use tools for personal financial management,” Chijioke Dozie explains.

“We have also developed a machine learning tool to calculate the credit-worthiness of consumers who didn’t have credit history, opening the door to marginalised groups in the financial community. One example of this is the Bloom account, which is targeted at female entrepreneurs. Many of these women have been consistently overlooked but now have access to advisory services, loans and other financial services to help them scale their businesses.”

To highlight the evolution of the company, the founders decided earlier this year that it was time for a rebrand. “As the suite of financial services offered in the app expanded from just loans into payments, investments and personal finance management, the name Paylater became a little limiting,” Chijioke Dozie says. “We rebranded as Carbon in April 2019, signalling our intent to offer the most diverse digital finance platform, anywhere.

Even though the company has evolved from its early days, the issue of trust has still remained, which Chijioke Dozie believes is understandable. “We have not seen a lot of transparency from Nigerian startups in recent years,” he says. “Partly because many FinTechs are concerned that full disclosure could attract the wrong kind of attention or expose flaws and weaknesses to competitors.”

In an effort to boost confidence in the FinTech sector and to highlight that the sector can be trusted, Carbon did something essentially unheard of among Nigeria’s FinTech startups in July by releasing its audited financials to the public. “We want our employees and potential employees to know that we are achieving success and are set to continue to achieve success,” Chijioke Dozie explains the decision.

“We also think it is important to showcase our success to the world,” he adds. “When you look at challenger banks and other similar financial services platforms from across the world, our numbers could easily compare to theirs. Sharing our performance data was an opportunity for us to shine a light on our success and also a chance to tell the world (particularly, potential investors) that you can achieve good success in the markets we’re in.”

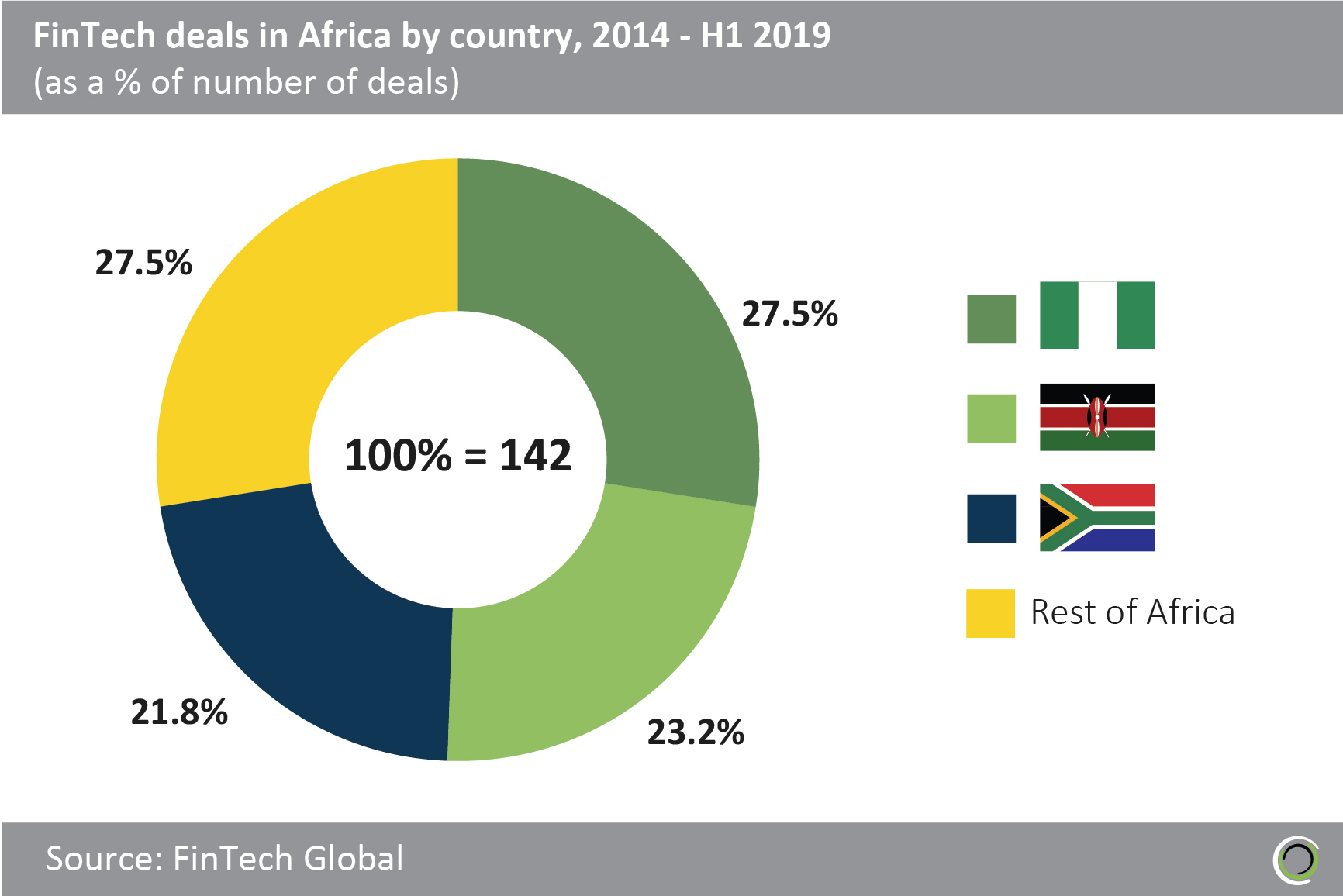

FinTech Global recently reported how Nigeria is at the centre of Africa’s FinTech revolution. The country is one of the three top receivers of this capital, having received 27.5% of the total FinTech investment going into the continent between 2014 and the first half of 2019. Kenya and South Africa had seen 23.2% and 21.8% injected into them respectively during that period.

To Chijioke Dozie, Nigeria’s position as an African FinTech flag-bearer is no coincidence. “I believe the continued rise in FinTech investment in Nigeria is due to the various quantifiable benefits that comes with increased access to mainstream financial services,” the Carbon CEO says. “For many Nigerians, the financial inclusion that comes with access to mainstream financial services is not just about having access to a bank account to deposit your money. It is about having access to advisory and business management services that can enable their businesses and lives to thrive and flourish.

“Also, when you consider that the majority of the financially excluded are women, there is an added incentive to right that wrong. Various studies have shown overwhelmingly that when women are empowered economically, there are greater investments in children, education and healthcare. Poverty is also reduced. With this in mind, we are working to put in place the necessary systems and structures to connect women with the tools and support they need to succeed in business, professionally and personally. And it is great to see that we are receiving investment (from Nigeria and beyond) to make this happen.”

So, what’s next for Carbon? “Financial inclusion has always been high on our agenda and now that The Central Bank of Nigeria has announced plans to broaden access to financial services to people in under-served parts of the country, ensuring that 95% of eligible Nigerians have access to financial services by 2024, we plan to be a huge part of making that happen,” concludes Chijioke Dozie. “Beyond financial inclusion, we are also looking at how we can offer solutions to other money-related issues that affect Africans.”

Copyright © 2019 FinTech Global