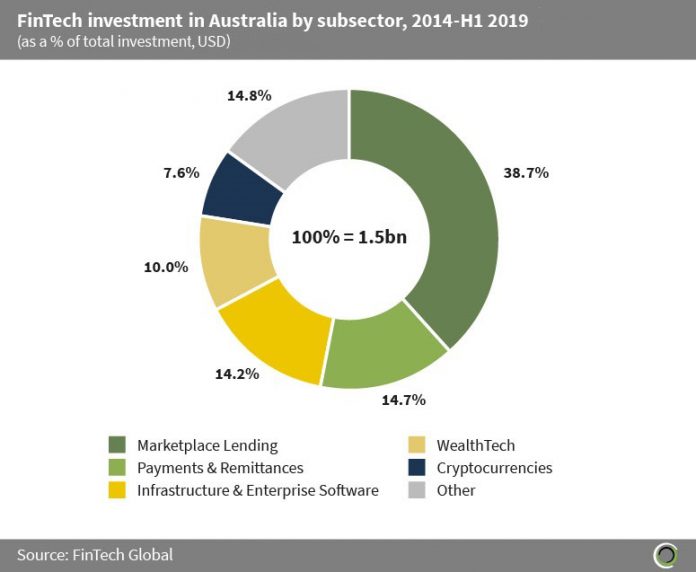

Investors in Australia have been deploying capital across all FinTech subsectors over the past five and a half years, with 38.7% of total investment going to companies within the Marketplace Lending subsector. Payments & Remittances and Infrastructure & Enterprise Software companies also attracted a healthy share of investment with 14.7% and 14.2%, respectively.

The prominence of Marketplace Lending companies comes after the financial crash of 2008 with new lenders looking to capitalise on the distrust of mainstream banks and use technology to offer more competitive interest rates, improved borrower experiences and reach underserved market. Marketplace Lending subsectors such as P2P lending are well established in the US and the UK, however, are still in their infancy in Australia and therefore offer an attractive investment opportunity for investors in the country.

The Payments & Remittances sector has also been flourishing in Australia over the past five and a half years. This is driven by the global trend of moving towards a cashless society which is especially strong in the Asia and Oceania regions. In order to keep up with the rapidly changing payments landscape, Australia has experienced an increase in FinTech investment in companies specialising in digital payments.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global