Singapore is a hotbed for FinTech innovation that has overtaken China as the biggest investment destination in the region. However, its leadership position is far from certain.

“Singapore is rapidly becoming not only the hub of FinTech in South East Asia, but more broadly a global FinTech hub,” says Fady Abdel-Nour, global head of mergers and acquisitions and investments at PayU, the financial services provider owned by Naspers, the global internet and entertainment group and tech investor.

Singapore was not always so prosperous. In the first years after its independence from Malaysia in 1965, it struggled financially. The government responded by embracing globalization and by embarking on a serious modernization strategy. This push saw it weed out corruption and fraud, making it even more attractive for foreign investors. These initiatives saw the country’s GDP annually grow by 6% on average between 1965 and 1995, becoming a key developer of technology. By 1989 it was the world’s biggest producer of disk drives and disk drive parts.

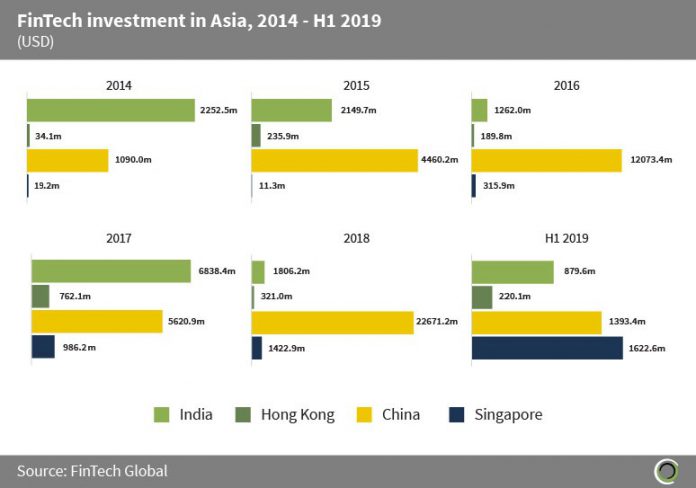

Today, Singapore is the home of over 500 FinTech startups and more than 400 innovation labs. Since 2014, the country’s companies have raised over $4.4bn, according to FinTech Global’s data. The same research also reveals Singapore’s FinTech scene overtook China in terms of investment in the first six months of 2019. Singapore’s FinTech companies raised $1.6bn and Chinese ones attracted $1.4bn in that period.

Payments and remittances enterprises are leading Singapore’s FinTech sector. They have attracted 64.3% of the country’s investment since 2014 as the country is continuously pushing towards a cashless society.

Marketplace lending enterprises is the FinTech group attracting the second biggest slice of the investment pie, with 7.6% of investment being raised by these companies.

However, the victory may not be that straightforward. Sea Limited’s, the digital services and e-commerce company, $1.4bn post-IPO-equity round was the biggest driver behind Singapore’s lead in the first six months of 2019. If you exclude it, the country has only attracted 19.2% of the total funding raised in 2018.

Another reason for Singapore taking pole position is due to the Chinese FinTech sector experiencing an investment slowdown. Between 2014 and 2018, the investment into the Chinese sector skyrocketed from $1.09bn to $22.67bn. This dropped significantly to $1.39bn in the first six months of 2019.

“This is in part due to challenges faced by some of the newer business models, particularly those acting within the lending space,” says Abdel-Nour. “As a result, investors and entrepreneurs continue to look to previously under-served markets for alternative lucrative growth opportunities.”

Nevertheless, Singapore’s FinTech scene has become stronger in the past six years. Back in 2014, it only raised $19.2m. Flashforward to 2018 and that number had increased to $1.42bn.

“Singapore has established itself as a FinTech hub leading the way when it comes to investment and regulations,” Dario Acconci, managing director of South East Asia at Hawksford, an international provider of corporate, private client and funds services, tells FinTech Global.

“A combination of favourable rulings, supportive initiatives from both the private and public sector, an already dynamic startup ecosystem and a world-renowned financial centre, has allowed Singapore to emerge as a global leader in financial innovation. Considering the relatively small size of the domestic market, the Singapore FinTech industry is rather large compared to its Asian neighbours. But the city-state continues to witness developments in the local FinTech scene and attract foreign entrepreneurs.”

These investments are driven in no small part by the government. Over the years, Singapore’s government has introduced several schemes to ensure its FinTech ventures can flex their muscles on a global scene.

It has rolled out cash grants, debt financing schemes, tax incentive schemes and equity financing schemes. For instance, the SPRING Startup Enterprise Development Scheme, which has the popular acronym SPRING SEEDS, sees the government match third-party investments into startups dollar-for-dollar up to S$1m.

“As part of Singapore’s move into deep technology, the government has slated S$19bn as investment capital to build the country into a global R&D hub and in 2016 set up SGInnovate, a government-owned firm aimed at nurturing deep tech startups in the country,” Acconci says. “It has attracted Facebook, Google, LinkedIn and Microsoft, to name a few, to establish their regional headquarters in Singapore.

“Recently, [it also] attracted British electronics company Dyson to move its headquarters to Singapore and to create its electric vehicle. Policies that are friendly to businesses, a coordinated approach between universities and academia with private companies to provide a trained workforce and a high quality of life to attract globally mobile entrepreneurs and top-grade talent who can call anywhere home.”

Singapore’s government has not stopped to encourage the growth of the FinTech sector. In August, the Monetary Authority of Singapore (MAS) unveiled a new sandbox option to boost innovation in the industry, having unveiled its original regulatory sandbox back in 2016.

At roughly the same time, MAS toughened up the country’s cybersecurity rules to protect the financial sector and moved in to close several onshore shell companies it believed contributing to money-laundering.

The government has also paved the way for new digital banks to set up in the country. The nation has announced an application process for five new digital banks licenses and will keep the process open until New Year’s Eve.

It is also worth recognizing that no innovative hub exists in a vacuum. FinTech Global’s data shows that there is a massive appetite to invest in Asian FinTech companies. “The whole region is booming and whilst Singapore’s financial institutions are advanced and have always embraced technology most of the neighbouring countries trail well behind and as a consequence are extremely eager to adopt new solutions speeding up their advancement process,” argues Acconci.

For instance, InsurTech companies have raised over $2.7bn since 2014 and the mobile payments industry have attracted investments to the tune of $29.7bn in the same period.

“Focusing on Singapore as the gateway for South East Asia, we would expect to see continued growth with regards to its fintech investment,” suggests Abdel-Nour. “It will likely follow a similar trajectory to China, albeit it much earlier on that journey. With its robust economic growth and a young, fast-growing population, it will continue to provide an attractive opportunity to investors and FinTech entrepreneurs alike. And with a government so highly supportive of FinTech innovation, the future looks bright for Singapore.”

Copyright © 2019 FinTech Global