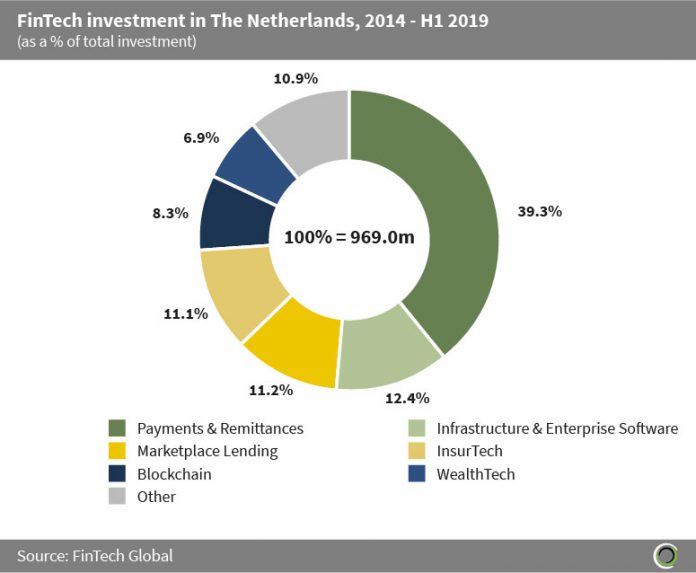

Nearly 40% of FinTech investment in The Netherlands has been raised by Payments & Remittances companies

- Investors in The Netherlands have been deploying capital across all FinTech subsectors over the past five and a half years, with Payments & Remittances companies being responsible for $381.0m of FinTech investment in the region between 2014 and H1 2019.

- As the world heads towards becoming cashless, Payments & Remittances companies offer an attractive investment opportunity as companies compete to create innovative payments solutions in order to keep up with the rapidly changing landscape.

- Infrastructure & Enterprise Software companies also attracted a healthy share of investment in the region with 12.4% of investment going to the subsector. The largest deal in this segment went to Ohpen in a $31.1m Series C round. The company plans to use the capital to build a team in the third-party market and develop their platform further with country-specific requirements.

- The other category includes companies in the Cryptocurrencies, Data & Analytics, Funding Platforms, Institutional Investments & Trading, Real Estate and RegTech subsectors.

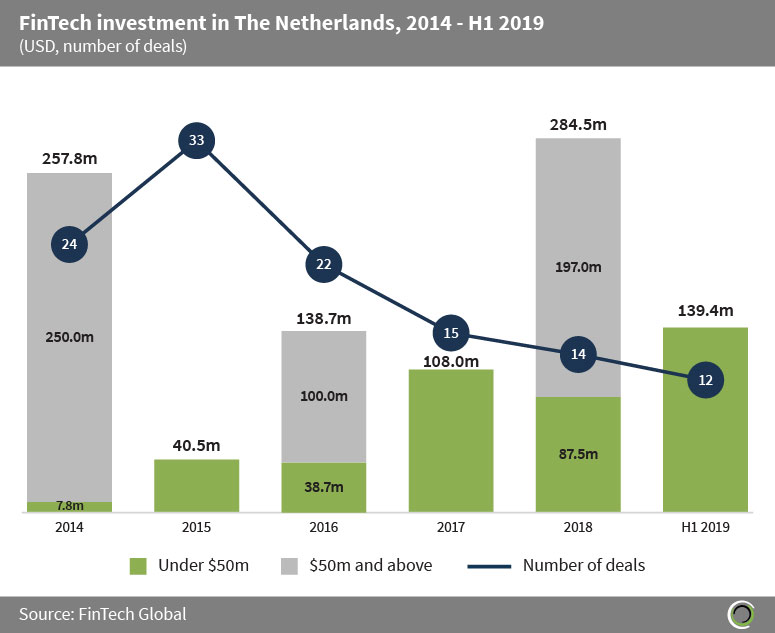

Over $950m has been invested in FinTech companies in The Netherlands since 2014

- Companies in The Netherlands have raised $969.0m across 120 deals since 2014. Investment reached nearly $140m in the first six months of the year, and reaching a record total for deals under $50m.

- In terms of deal activity, 12 deals have been completed in the first half of 2019, 85.7% of last year’s total, setting deal activity on track to increase compared to last year. However, none of these deals have been over $50m, hence investment total is only on track to match last year rather than exceed it, despite more deals being closed.

- Funding grew at a CAGR of 91.5% between 2015 and 2018 with average deal size increasing over 16-fold from $1.2m in 2015 to $20.3m in 2018, indicating the growing maturity of the landscape as the Dutch FinTech industry is picking up steam.

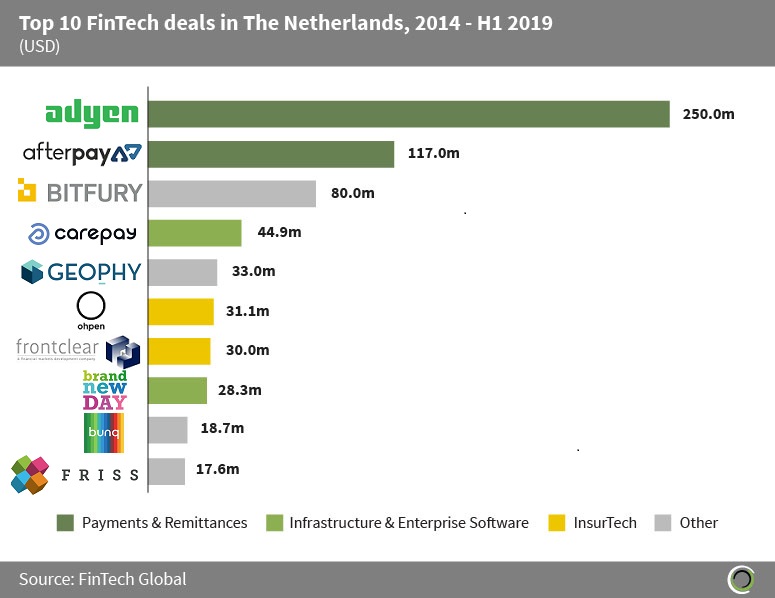

The top two deals in The Netherlands since 2014 have involved Payments & Remittances companies

- The top 10 transactions in The Netherlands have collectively raised $650.6m since 2014, which is equal to 67.1% of the total capital invested during the period.

- Capital allocation was diversely spread across the top 10 with Payments & Remittances companies, Infrastructure & Enterprise Software companies and InsurTech companies accounting for two deals each, and the other four deals involving companies in the other category. The other category includes WealthTech, Real Estate, Blockchain and RegTech companies who account for one deal each.

- The largest deal of the period came from Adyen, a payments platform which allows businesses to accept payments anywhere on any device. They raised $250m in a Series B round in Q4 2014 with the capital used to expand their international payments platform and to invest in their mobile point-of-sale system Shuttle.

- The largest deal in the other category came from Bitfury’s $80m private placement in Q4 2018. Bitfury is the leading full-service blockchain technology company which develops software and hardware solutions for both individuals and companies to securely move assets across the blockchain.

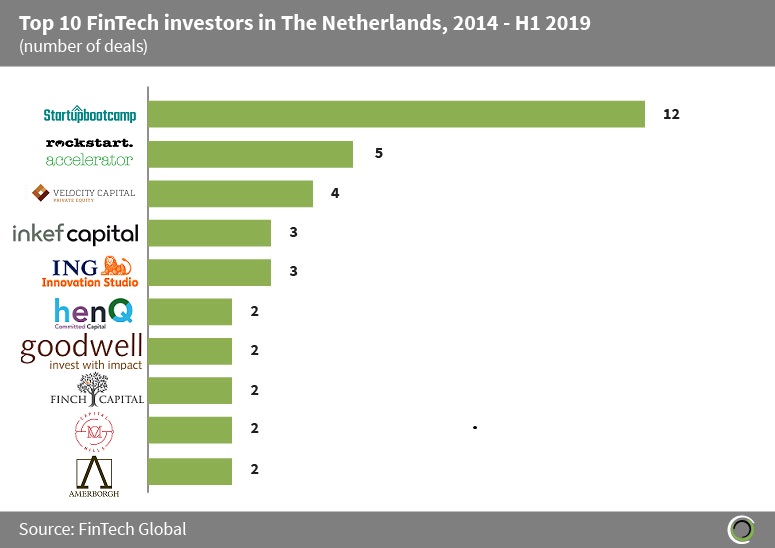

The top 10 investors in The Netherlands participated in over 30% of all FinTech deals in the region since 2014

- Startupbootcamp was the most active investor in The Netherlands between 2014 and H1 2019, participating in 10% of all deals in the region during the period. Startupbootcamp is a network of start-up accelerators operating globally with one of its key locations being in Amsterdam.

- Nine of the top 10 investors are based in The Netherlands with only one, Startupbootcamp, being headquartered in London with a key location in The Netherlands.

- Accelerators lead the way for investment in The Netherlands with the top two most active investors falling into this category. Outside of the top two there was one more accelerator in the top 10 with the rest of the pack comprising of venture capital firms.