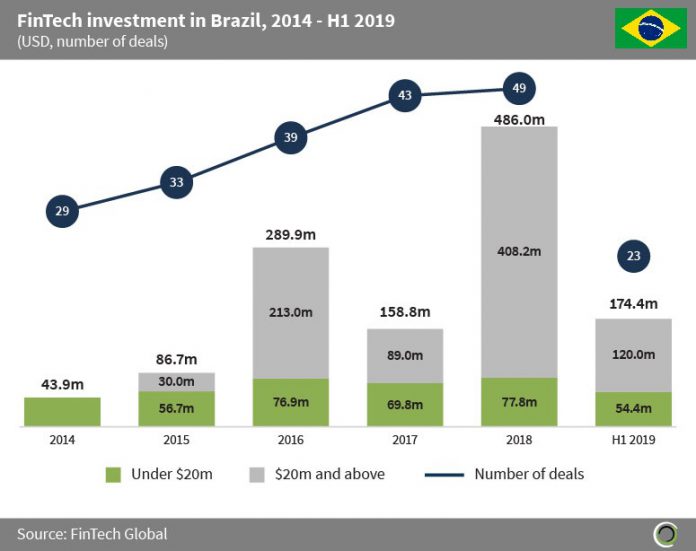

Over $1.3bn was raised by FinTech companies in Brazil, across 208 deals, between 2014 and H1 2019.

Investment grew at a CAGR of 82.4% between 2014 and 2018, with the growth being driven by large deals over $20m. Although funding in H1 2019 was equal to just 58% of the capital raised in the corresponding period last year, there were still three transactions valued above $20m completed in the first six months of 2019, with $120m invested across these deals.

PropTech startup Loft, a real estate buying and selling platform based in Sao Paulo, raised $70m in a Series B round led by Fifth Wall and Andreessen Horowitz in March 2019, in what was the largest FinTech deal in Brazil in H1.

However, the FinTech sector in Brazil is still in its infancy, with the amount of capital invested in deals valued below $20m remaining relatively stable since 2016, as investors continue to look for early stage opportunities in the country. In H1 2019, investment in this deal size bracket appears to be on track to reach record levels as it makes up 69.9% of 2018’s total, indicating the increasing number of FinTech start-ups in Brazil.

WealthTech companies have dominated in terms of investment in the region, with investment in challenger banks Neon and Nubank alone making up 40.2% of total FinTech investment since 2014. This is to be expected with nearly 40% of all Brazilian adults remaining unbanked according to the World Bank, leaving a large market of consumers to skip traditional banking systems and access financial services digitally.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global