More than $4.2bn was raised by Marketplace Lending companies in Europe between 2014 and H1 2019, with investors participating in 367 transactions during the period.

The Marketplace Lending subsector has gone through significant growth following the great financial crisis, as banks have retreated from the space due to tighter regulations around lending standards and capital adequacy ratios.

The regulatory environment, quantitative easing and negative interest rates imposed by central banks like the ECB over the past decade have been particularly problematic for the profitability of European banks, which have taken a lot longer than their US counterparts to recover from the financial crisis of 2008, limiting their ability to engage in small business lending.

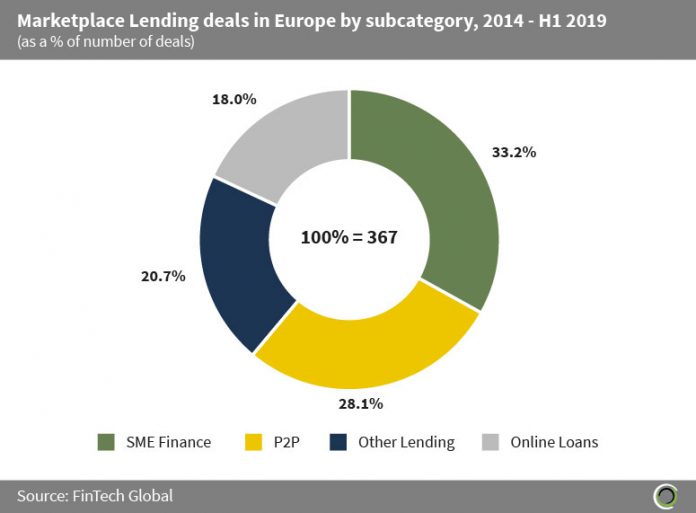

This dynamic has resulted in growth in non-bank SME Finance companies. Which provide working capital and asset based finance to businesses, capturing a third of all Marketplace Lending deals in Europe between 2014 and H1 2019.

P2P lending companies captured 28.1% of Marketplace Lending deals in Europe between 2014 and H1 2019, with 44.7% of these transactions involving P2P Lenders based in the UK. Zopa, a P2P loans provider based in London, raised $78.4m in a Series G round in Q4 2018, from investors including Bessemer Venture Partners and Augmentum FinTech, and was the largest P2P Lending deal in the UK during the five-and-a-half-year period. Zopa raised this capital to launch its very own challenger bank and received a UK banking license in December 2018.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global