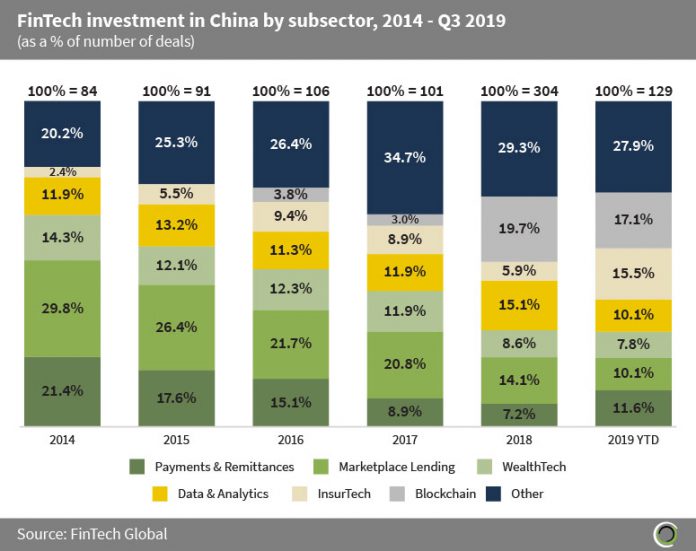

The proportion of deals involving InsurTech companies is up six-fold since 2014

- There have been 815 deals completed across China since 2014, with investors spreading capital widely across all areas of the FinTech value chain.

- In 2014, Payments & Remittances and Marketplace Lending companies dominated in terms of deal share with 21.4% and 29.8% deal share respectively. However, both subsectors have decreased their share of deals, with Payments & Remittances companies accounting for only 11.6% of deals so far this year, and Marketplace Lending companies now accounting for just 10.1%. This comes as investors look to diversify their investment portfolio in the region after tighter Marketplace Lending regulations caused the close of many P2P lending platforms.

- InsurTech and Blockchain companies have shown the greatest increase in terms of deal share over the period accounting for 2.4% in 2014, with no Blockchain deals, to now collectively accounting for 32.6% of deals in the region.

- The increase in InsurTech deals is driven by the fact that according to Swiss Re, more than 90% of the Asian population does not have any form of insurance. Asian insurance distribution is often carried out by agents who are disproportionately driven by commission; hence they aren’t interested in serving mass markets but often just high net worth individuals. Coupled with increasing awareness of insurance products and rising incomes, this leaves room for the disruption of the traditional insurance market by InsurTech companies.

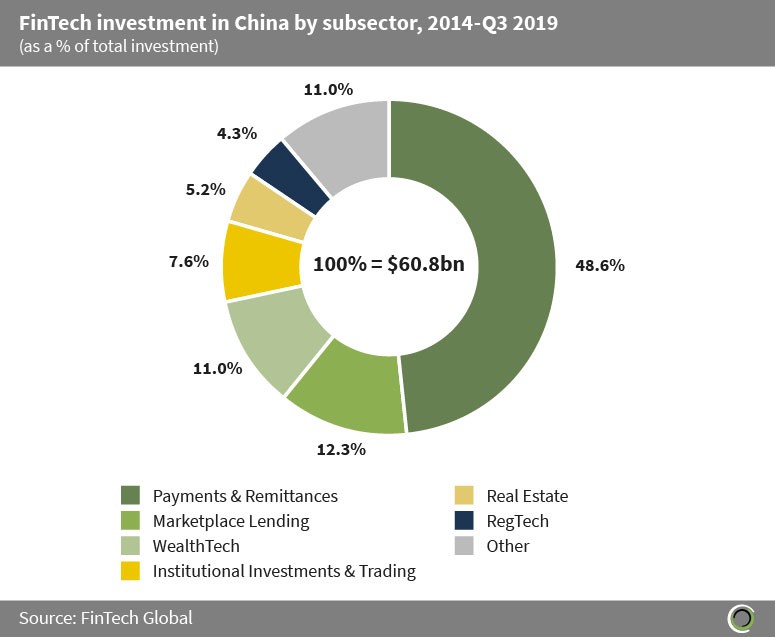

Despite a drop in deal activity, Payments & Remittances companies capture the lion share of FinTech funding in China since 2014

- FinTech investors have invested $29.5bn in Payments & Remittances companies across 96 transactions since 2014. As China races to become the first cashless society, it is unsurprising that investors see companies within the Payments & Remittances subsector as attractive, hence investing heavily in this area.

- Marketplace lending and WealthTech companies also attracted a healthy share of investment with 12.3% and 11.0% respectively. Since the global financial crisis of 2008, Marketplace Lending companies have looked to disrupt the traditional loans market by capitalising on the distrust of mainstream banks and offering financial products with more competitive interest rates, offering an attractive investment opportunity.

- The other category includes companies in Data & Analytics, InsurTech, Infrastructure & Enterprise Software, Blockchain, Cryptocurrencies and Funding Platforms subsectors, capturing a total of 11.0% of investment since 2014.

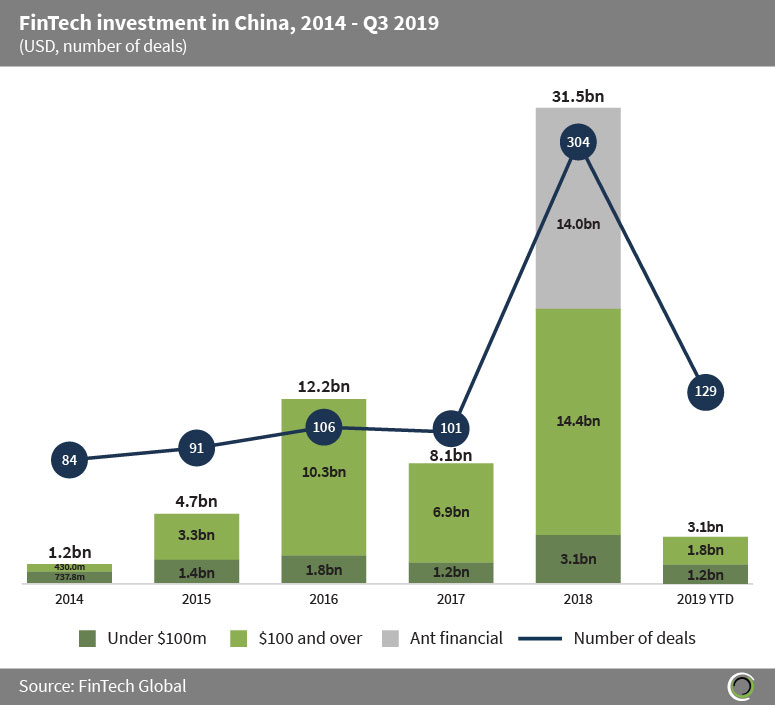

Ant Financial’s Series C deal pushed FinTech investment in China above $30bn last year

- $60.8bn has been invested in FinTech companies in China across 815 transactions since 2014.

- Total investment grew at a CAGR of 126.4% between 2014 and 2018, with this growth driven by Ant Financial’s $14bn Series C round in Q2 2018. Even upon exclusion of this mega-deal, 2018 still raised a record $17.5bn driven mainly by large deals of $100m and above, however 2018 also saw deals below this size approximately doubling compared to historical levels.

- So far this year, FinTech investment in China has experienced a significant drop with only $3.1bn raised in the first three quarters of the year, compared to $26.7bn in the same period of 2018. Hence, FinTech investment in China is predicted to drop significantly by the end of the year, a result of continued trade tensions with the US across the region.

- Deal activity has also dropped with only 129 deals completed so far this year compared to 257 in the first three quarters of last year.

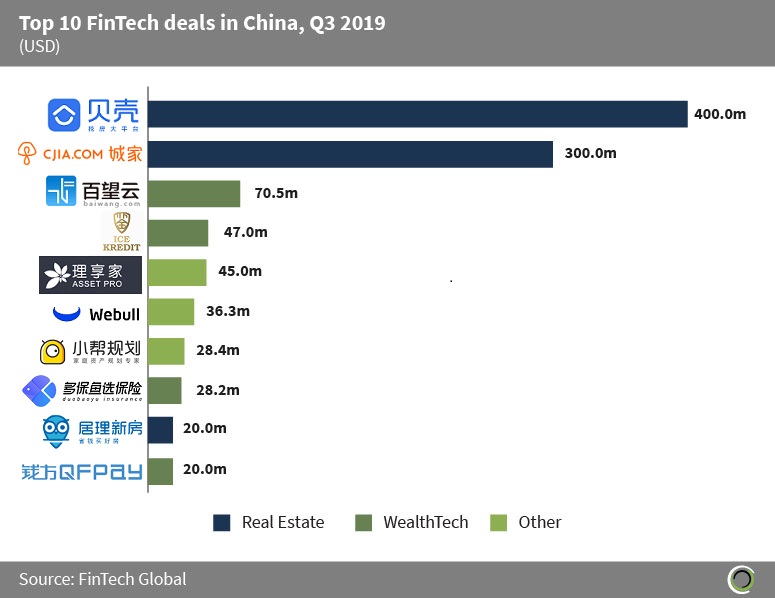

The top 10 deals in China in Q3 2019 raised nearly $1bn

- Almost $1bn was raised in the top 10 FinTech deals in China in Q3 2019, with companies in the Real Estate and WealthTech sectors leading the way in terms of investment.

- The largest round of the period went to Beike, a housing rental transaction service platform enabling agents to list new, second-hand and rental property. They raised $400m in a second Series D round, following the previous $800m Series D round in Q1 2019 led by Tencent Holdings, pushing the company to unicorn status.

- The second largest deal of the period came from Chengjia Apartment which raised $300m in a Series A round led by Boyu Capital to increase their inventory of rental properties across China.

- The two largest deals in China were raised by Real Estate companies. According to research by JLL, the PropTech space in Asia, driven primarily by China, has significant barriers to entry, which has required companies to raise huge amounts of capital in order to penetrate the market.

- The other category includes Data & Analytics, Infrastructure & Enterprise Software, InsurTech and Payments & Remittances.