Plug and Play has unveiled the 14 startups picked for its European winter accelerator programme InsurTech Europe.

The programme was first set up in 2016 with the aim to make it easier to form relationships between promising startups and Plug and Play’s global ecosystem. Some of the partners it work with in the industry includes Munich Re, Generali, Versicherungskammer Bayern, Talanx, Irish Life, Willis Towers Watson, Swiss Re, Covea and Baloise.

Robert Pechholz, Munich lead and corporate partnerships manager for Insurtech Europe at Plug and Play, said, “We are truly honored to work with so many major European Insurance players, and believe we offer our batch startups an incredibly unique opportunity. We look forward to seeing what we can accomplish on this program with the energy levels so high.”

The selected startups are not forced to give away equity or pay as a prerequisite to joining the programme.

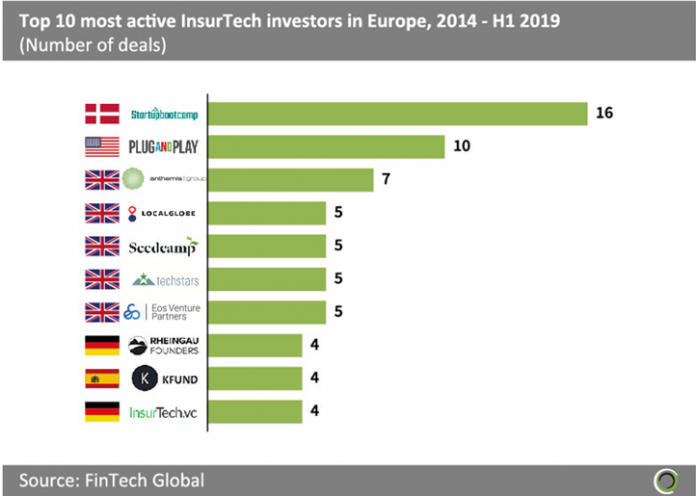

That does not mean Plug and Play is no stranger to investing in InsurTech startups. In fact, according to FinTech Global’s research, the accelerator is the second most active investor in European InsurTech companies, having injected money into ten deals between 2014 and the first half of 2019. The Danish accelerator Startupbootcamp was the most active European InsurTech investor, having invested in 16 deals during that period.

While Plug and Play will not force any company taking part of the winter programme to give up equity, it is looking to invest separately from the activities of the programme and is ranked as one of Silicon Valley’s most active early stage investors. The startups will remain part of the ecosystem even after the programme’s EXPO Day on February 5.

So let’s take a closer look at the 14 InsurTech startups selected to take part of the winter 2019 batch.

The first InsurTech company taking part of the accelerator programme is Curiosity. The startup’s Mosaik software helps companies build AI-solutions for their unstructured text data. It offers easy customisation while performing at enterprise scale and security. Among other things, Curiosity’s customers use Mosaik-based solutions for document similarity, classification and semantic search.

Aktivo seamlessly captures real-time health and lifestyle data from a smartphone and generates a digital biomarker that predicts health and longevity. Insurers utilise Aktivo to acquire, engage and retain high-value customers as well as to price and manage risk at scale.

DreamQuark is the second startup selected for the programme. By using DreamQuark’s AI solutions, financial services can solve daily business challenges with more transparency of how decisions are made and being able to do more businesses by leveraging the scores made from the software.

EasySend enables companies to quickly turn paper forms to smart e-forms. This process can traditionally take months, but EasySend’s technology slashes this period into days. EasySend has already been adopted by over 90% of the Israeli financial and insurance market and tier-1 US and German financial institutions.

Glassbox asks companies to ask themselves what it would be like if their websites had a brain. While that notion might sound odd, Glassbox empowers insurance enterprises to see how customers experience their websites and mobile apps as well as understanding why they do it in that specific way.

SlidePiper has created an AI-solution that automates customer onboarding, know-your-customer and compliance for the financial services, eliminating the risk for human error in the process.

Vizru delivers business AI process automation, data visualization and collaboration in real-time across cloud and on-premise systems.

Voiceitt’s automatic speech recognition technology uses AI to help the 100 million people around the world struggling with vocal communication to make themselves understood.

YUKKA Lab uses augmented language intelligence to sieve through and analyse news in real-time, enabling stakeholders in any topic, company or industry to know how people are talking about right now.

Cobee is a one-stop SaaS solution for companies to manage all their employee benefits by providing them with a simple app and a Visa card to consume their products in a flexible manner.

Cytegic’s solutions automate cyber risk quantification and management across the entire insurance and risk value chain. The company launched its insurance unit in September.

Knexus AI platform enables brands to deliver relevant content across social media or via email, which drive customer decisions across owned digital channels. By using the solution, Knexus claims customers can see a 318% increase in e-commerce sales and see a 21% customer increase.

Fixico has set out to digitalize how insurers and fleet companies can handle car damage.

Previsico enables real time actionable flood warnings using the latest weather predictions to make street-level flood nowcasts and forecasts.

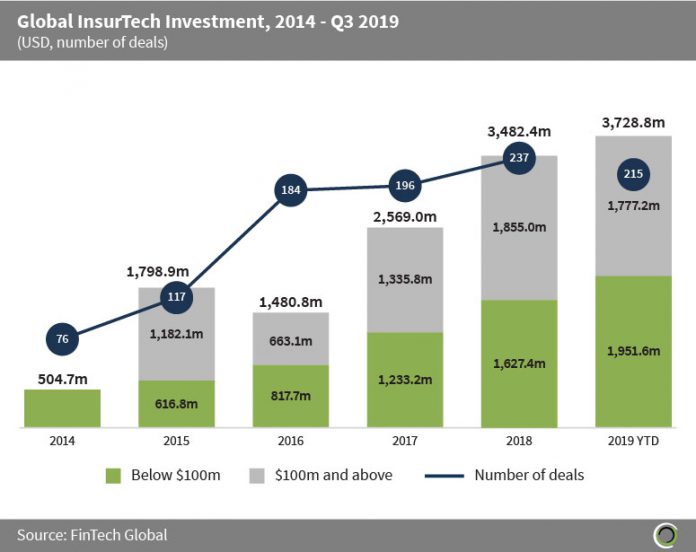

InsurTech is a booming industry. Since 2014, the sector has attracted over $13.5bn in investment, according to FinTech Global’s research. And the amount invested has increased considerably over the past six years. In 2014, $504.7m was invested in InsurTech globally around the world. That figure skyrocketed in the following year to reach $3.48bn in 2018 and then reaching $3.72bn in the first three quarters of 2019.

Of course, Plug and Play is not just not investing in InsurTech companies. For instance, it picked 24 FinTech and 15 cybersecurity startups for its fall accelerator a few months ago.

Copyright © 2019 FinTech Global