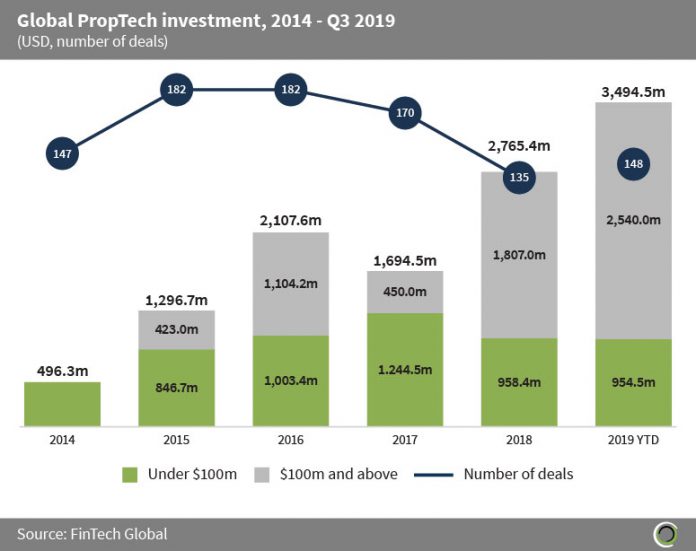

Just under $3.5bn was raised by PropTech companies in Q3 2019

- PropTech companies globally raised over $11.8bn between 2014 and Q3 2019, across 964 transactions, with funding increasing at a CAGR of 47.8% during the period.

- These growth figures underpin investor appetite for new technologies that deliver value and transformation to the world largest asset class, real estate.

- The year 2015, saw the introduction of the first PropTech deals valued at $100m and above, with more than $6.3bn invested in transactions in this deal size range between 2015 and Q3 2019.

- Funding in the first nine months of 2019, set a record with almost $3.5bn invested across, 148 deals, with 72.7% of the capital invested in deals valued at $100m and above, setting strong expectations for the remainder of the year.

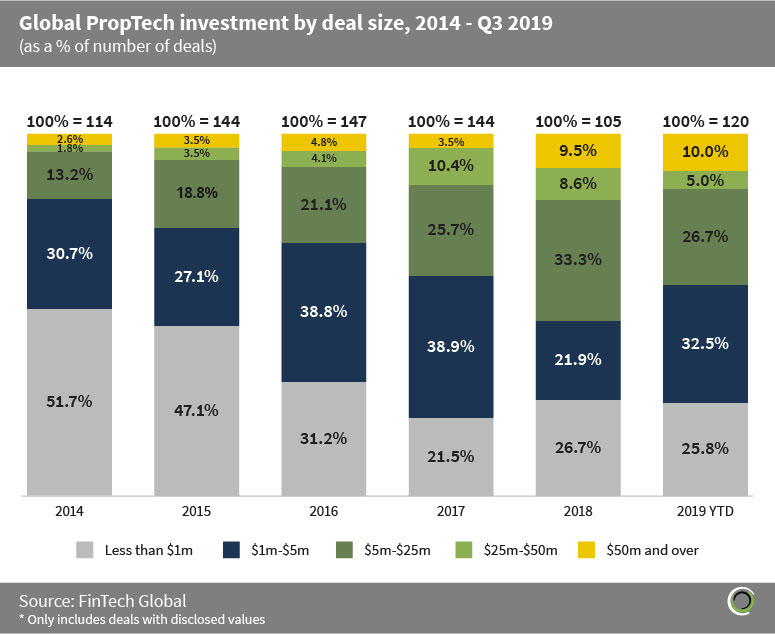

Average deal sizes in the PropTech sector have been accelerating over the past few years

- The PropTech sector has shown continued signs of maturity globally, with the share of deals valued below $1m falling from just over half in 2014, to slightly more than a quarter in the first three quarters of 2019.

- The average PropTech transaction size increased at a CAGR of 47.5% between 2014 and Q3 2019, growing from $3.4m in 2014 to $23.6m during the first nine months of the year.

- The growing maturity in the space has led to a shift in the composition of deals away from early-stage transactions to larger deals, with the proportion of transactions valued at $50m+ quadrupling from 2.6% in 2014 to 10% this year.

- McMakler, a fixed price digital real estate agency based in Berlin, raised $56.5m in a Series C round in Q2 2019. This funding, led by Target Global and Israel Growth Partners, was the largest PropTech deal in Europe this year to date.

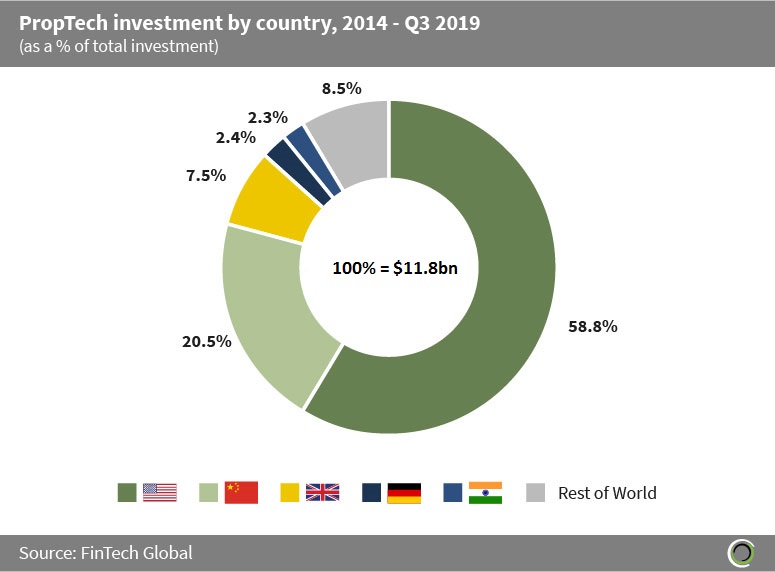

Almost 80% of the capital raised in the sector globally has gone to companies based in the US or China

- PropTech companies in the US and China have captured 79.3% of the total capital raised in the sector between 2014 and Q3 2019, with US companies raising almost $7bn during the period.

- Innvestors such as Softbank have a positive outlook on the PropTech landscape in the US, given that real estate is the biggest asset class in the country and digital transformation is still in its relative infancy.

- Despite maturity in the sector, headwinds such as high entry barriers in China persist, which has required large funding rounds to overcome. Consequently, the average PropTech deal size in China since 2014 is $75.9m, more than six times the global PropTech average of $12.3m.

- Companies in India captured the second largest share of investment in Asia, after China, with PropTech companies in the country raising $268.4m between 2014 and Q3 2019. NestAway, a home rental network based in Bangalore, raised a $50m Series D round at a $200m valuation led by Goldman Sachs in Q1 2018, which is the largest PropTech deal in India to date.

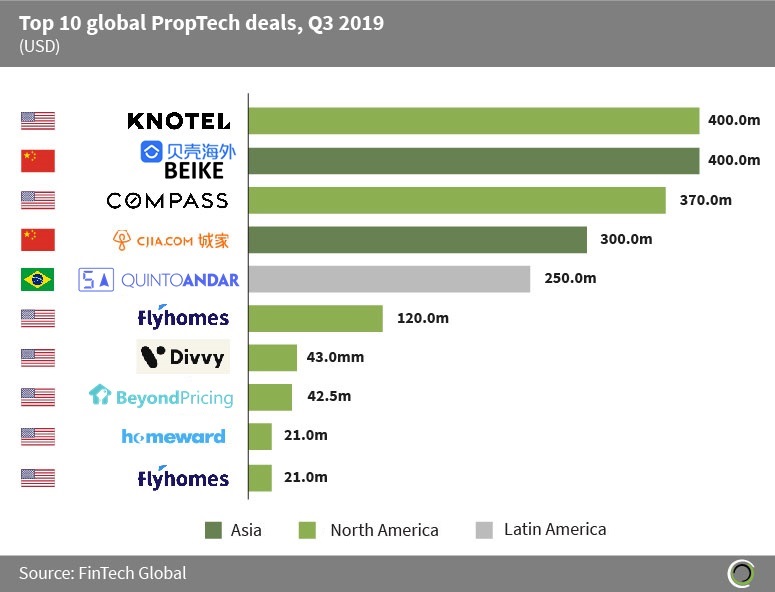

Investors poured nearly $2bn into the 10 largest PropTech deals globally last quarter

- Almost $2bn was raised in top 10 PropTech deals globally in Q3 2019, which is equal to 85.4% of the total capital raised in the sector last quarter.

- Knotel, a New York-based provider of furnished co working spaces using a similar model to WeWork, raised $400m at a $1bn valuation led by Wafra Partners. This Series C funding will be used to grow the company’s footprint in existing markets and deepen its engagement with global enterprise accounts.

- QuintoAndar is a PropTech platform that simplifies the rental process of residential property for both landlords and tenants. The Brazilian PropTech company raised $250m in a Series D round from investors including SoftBank, Kaszek Ventures, General Atlantic and Dragoneer Investment Group, valuing QuintoAndar at $1bn. This is the largest PropTech deal in Latin America to date and the funding will be used for geographic expansion and to accelerate growth through partnerships with real estate agencies.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global