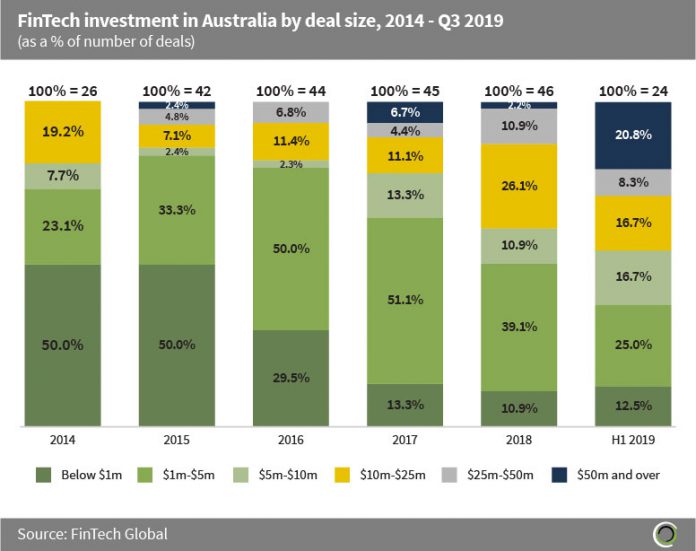

The proportion of deals valued over $50m has increased by 20.8 percentage points (pp) since 2014

- The Australian FinTech landscape has witnessed a shift since 2014 from investors predominantly backing smaller deals, towards backing more later-stage deals.

- Back in 2014, deals valued below $1m accounted for 50.0% of all deals across the region, however this has dropped significantly and in the first three quarters of this year, deals in this size bracket account for only 12.5% of deals.

- The share of deals valued at $50m or above has increased by 20.8 pp from no deals of this magnitude in 2014 to 20.8% of deals in the first nine months of 2019 being in this size range.

- Average deal size has increased more than 13-fold from $4.2m in 2014 to $54.7m during the first nine months of this year as we see annual investment in Australian FinTech increase at a higher rate than the volume of deals.

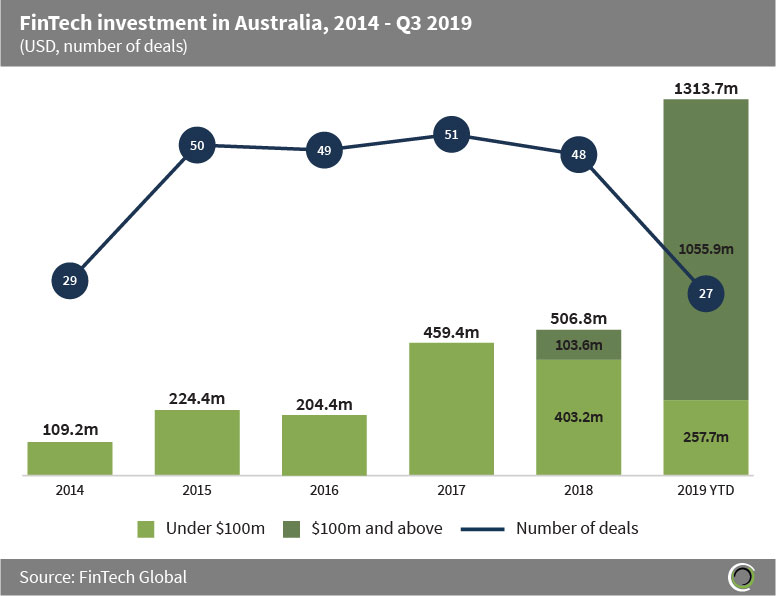

Over $1.3bn has been raised in the first three quarters of the year so far

- FinTech companies in Australia have raised over $2.8bn across 254 transactions since 2014, with investment growing at a CAGR of 46.8% between 2014 and 2018.

- Funding raised so far in 2019 has reached a new record and is already 2.5x greater than the record funding raised last year. The record funding is driven by large deals over $100m, as 2018 saw the introduction of the first deal in this size bracket, while funding raised by deals below this size remains similar to historic levels.

- Funding raised in the first nine months of the year set a record with over $1.3bn invested across 27 deals. 80.4% of this capital was invested in deals valued at $100m or above, setting strong expectations for the remained of the year. Capital raised in deals under $100m has been on the decline since 2017 as investors rotate out of smaller deals towards later stage transactions, a sign of Australia’s maturing FinTech landscape.

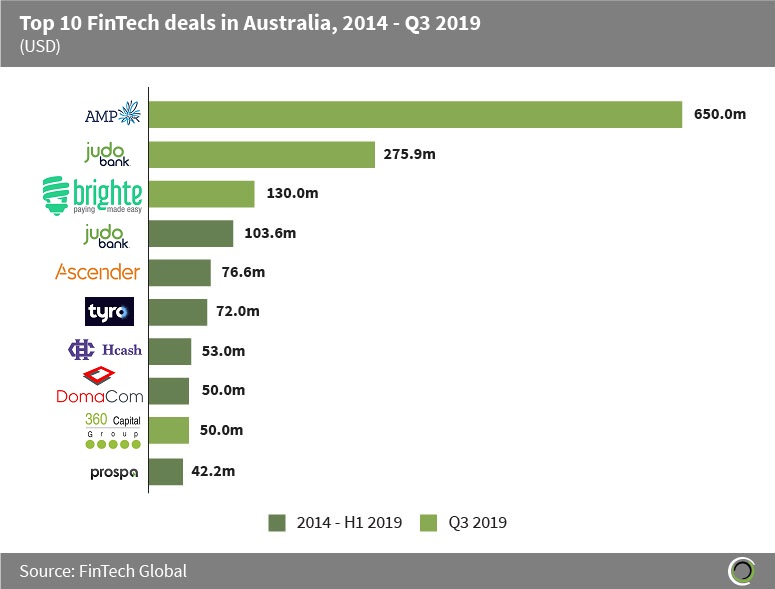

Four of the top 10 deals in Australia since 2014 have been raised in Q3 2019

- Over $1.5bn has been raised in the top 10 FinTech transactions in Australia between 2014 and Q3 2019, accounting for 54.6% of total capital raised in the region during the period. Of the top 10 deals, four were raised in Q3 2019 alone, with three of them taking the to spots on the list.

- The largest deal since 2014 was raised by AMP, a wealth management company serving Australia and New Zealand. The company raised $650m in a Post-IPO-equity round in August 2019.

- The largest deal raised before Q3 2019 came from Judo Bank, a small-business challenger bank, who raised $103.6m in a Series A round in Q3 2018. The round’s investors include Credit Suisse Asset Management, Abu Dhabi Capital Group, Ontario Pension Trust and Myer Family Investments. The capital will be used to tap into the shortfall in small and medium-sized business lending.

- Capital allocation in the top 10 deals was widely distributed across subsectors with Infrastructure & Enterprise Software, Marketplace Lending and Cryptocurrency companies accounting for one deal each, Payments & Remittances and Real Estate companies accounting for two deals each and WealthTech companies making up the remaining three deals.

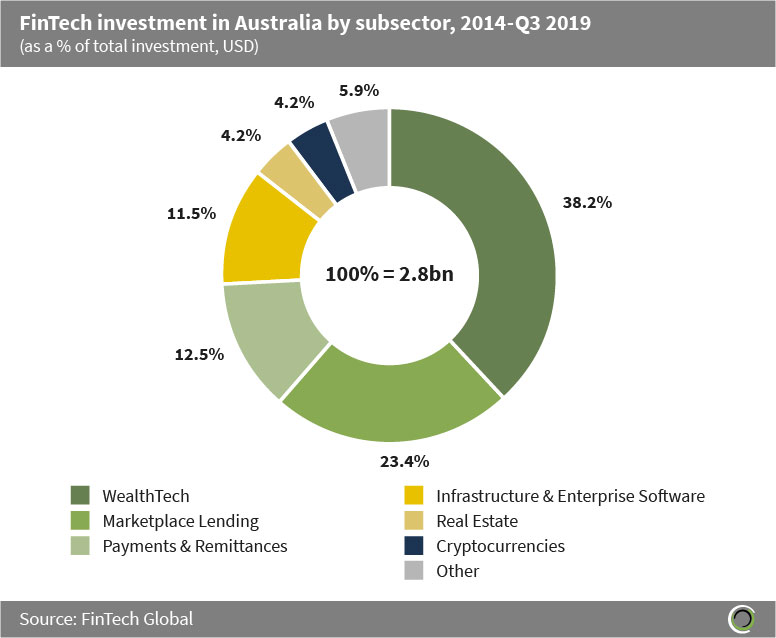

WealthTech and Marketplace Lending companies account for over half of all FinTech investment in Australia since 2014

- The Australian FinTech space has experienced a concentration of capital investment primarily in two subsectors, WealthTech and Marketplace Lending, collectively capturing over half of all investment in the region since 2014.

- WealthTech companies are responsible for 38.2% of Australia’s FinTech investment between 2014 and Q3 2019. This is unsurprising as challenger banks in the sector aim to disrupt traditional legacy banking and attract a growing millennial customer base.

- Companies offering Marketplace Lending solutions in Australia account for a healthy 23.4% of investment in the country since 2014. This comes after the financial crash of 2008 with new lenders looking to capitalise on the distrust of mainstream banks who are retreating from the space, using technology to offer more competitive interest rates, reach underserved markets and improve borrower experiences. Marketplace Lending subsectors such as P2P lending are well established in the UK and US but are still in their relative infancy in Australia and therefore offer an attractive investment opportunity for investors in the region.

- The other category consists of companies in the RegTech, Data & Analytics, Funding Platforms, InsurTech, Blockchain and Institutional Investments & Trading subsectors, collectively accounting for only 5.9% of total investment in Australia since 2014.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global