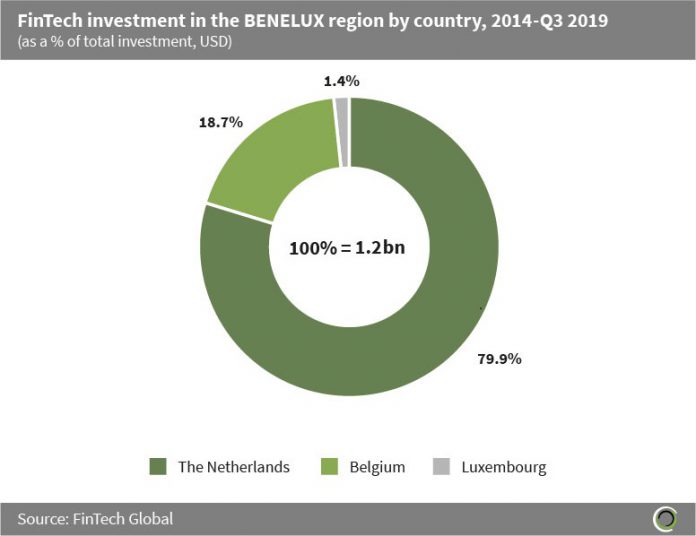

Over 75% of investment in the BENELUX region has been raised by Dutch companies

- Companies based in The Netherlands captured 79.9% of total FinTech investment in the BENELUX region between 2014 and Q3 2019. Companies in Amsterdam have been the driving force for this investment with 69.3% of deals in The Netherlands since 2014 being raised by companies based in the capital. Netherlands presents an attractive environment for FinTech investment due to its competitive fiscal climate and welcoming culture which is open to innovation. This is coupled with Holland FinTech, a financial technology hub based in Amsterdam, which is very active in the space.

- Belgium captured 18.7% of investment in the region since 2014 with companies in Brussels being the driving force for the country accounting for over 25% of deals in the country over that period. Belgium’s FinTech success can be put down to the government policy named The Digital Belgium Policy, which creates a tax shelter for tech companies in order to boost the digital and FinTech sectors.

- Luxembourg accounted for only 1.4% of FinTech investment in the BENELUX region since 2014. This is surprising since Luxembourg was ranked as the third most competitive financial centre in Europe in the 2017 Global Financial Centres Index, behind only London and Zurich.

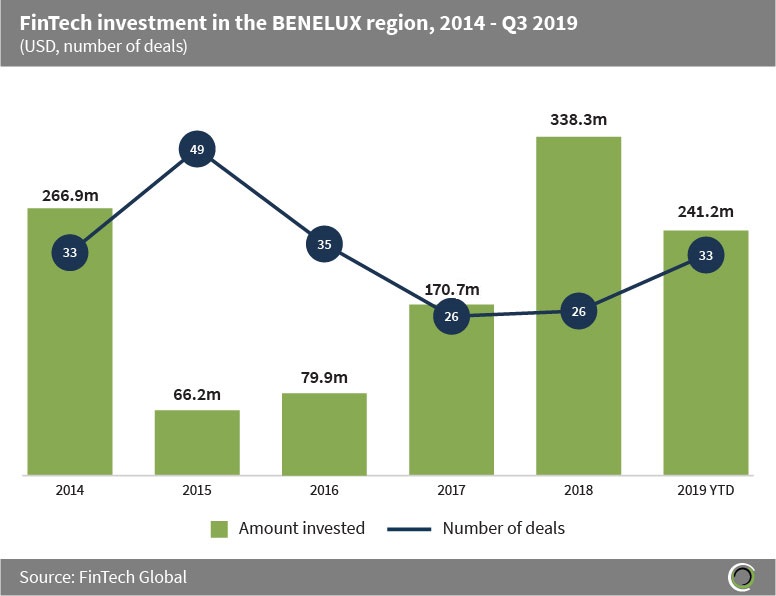

Over $241m has been raised in the first nine months of 2019

- Just under $1.2bn has been raised by FinTech companies in the BENELUX region between 2014 and Q3 2019, across 202 deals, with 62.9% of transactions being raised by Dutch companies. Funding grew at a CAGR of 72.3% between 2015 and 2018 with average deal size increasing over nine-fold from $1.4m to $13m.

- Funding so far in 2019 has reached $241.2m, equating to 108.4% of funding in the first nine months of last year, setting investment on track to reach record levels by the end of 2019.

- In terms of deal activity, 33 deals were completed in the first nine months of this year, already surpassing the 26 transactions completed last year. However, last year deals in general were larger with an average deal size of $13.0m compared to an average deal size of only $7.3m this year so far.

- Funding reached $266.9m in 2014 driven by a large deal from Adyen, a payments platform delivering frictionless payments across online, mobile and in-store channels. They raised a $250m Series B round in Q4 2014 which valued the company at $1.5bn.

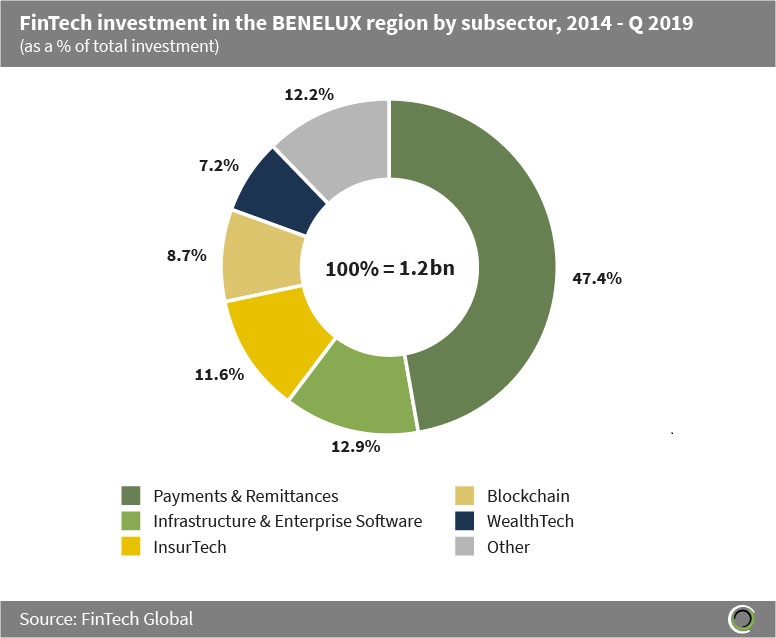

Payments & Remittances companies captured nearly 50% of FinTech investment in the BENELUX region since 2014

- Investors in the BENELUX region have been deploying capital across a variety of the FinTech value chain, with large investment concentrated in the Payments & Remittances subsector which accounts for 47.4% of total capital raised in the region since 2014. Since there is a global push towards becoming cashless, Payments & Remittances companies offer an attractive investment opportunity, with businesses competing to keep up with the rapidly changing landscape by creating innovative payments solutions.

- Infrastructure & Enterprise software companies in the region have also attracted a healthy share of investment with 12.9% of total capital raised. This comes as investors, who predominantly looked for Infrastructure & Enterprise Software investment opportunities in North America, shift away from the US and seek growth opportunities in other markets such as Europe.

- The other category consists of companies in the Cryptocurrencies, Data & Analytics, Funding Platforms, Institutional Investments & Trading, Marketplace Lending, Real Estate and RegTech subsectors, collectively accounting for 12.2% of funding in the region since 2014.

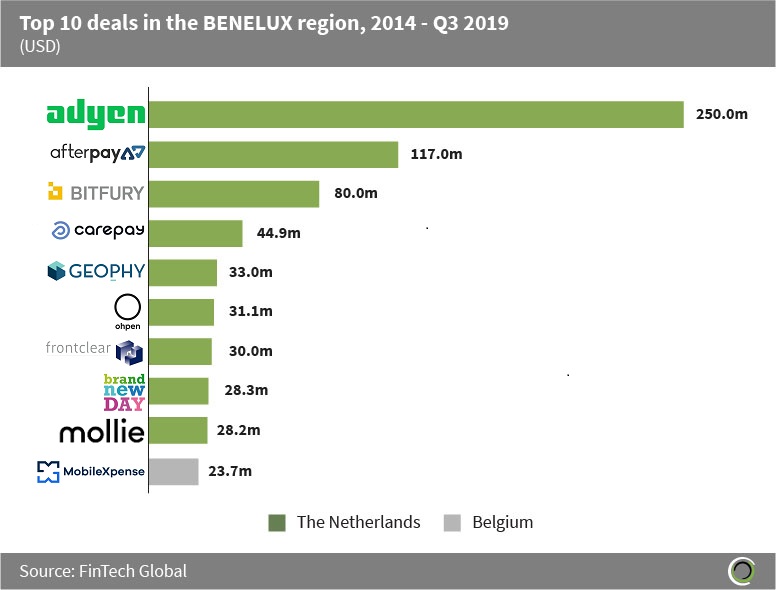

Nine of the top 10 FinTech deals in the BENELUX region were raised by companies in the Netherlands

- Just over $660m was raised in the top 10 FinTech transactions in the BENELUX region between 2014 and Q3 2019, which is equal to 57.3% of total capital raised in the region during the period.

- Companies in The Netherlands dominate the list with nine of the top 10 transactions in the region coming from Dutch companies. Only one Belgian company made it into the top 10, with no companies from Luxembourg making the list.

- The largest deal of the period came from the previously mentioned Series B round raised by Adyen. This capital was used to continue Ayden’s international expansion, with a particular focus on the Asian market.

- The only deal to make the top 10 from Belgium came from MobileXpense in a $23.7m round in Q4 2017 led by Fortino Capital, who took a majority stake in the company. MobileXpense builds travel and expense management software which integrates with ERP systems. The company used the capital raised to fuel their international expansion and accelerate product development.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global