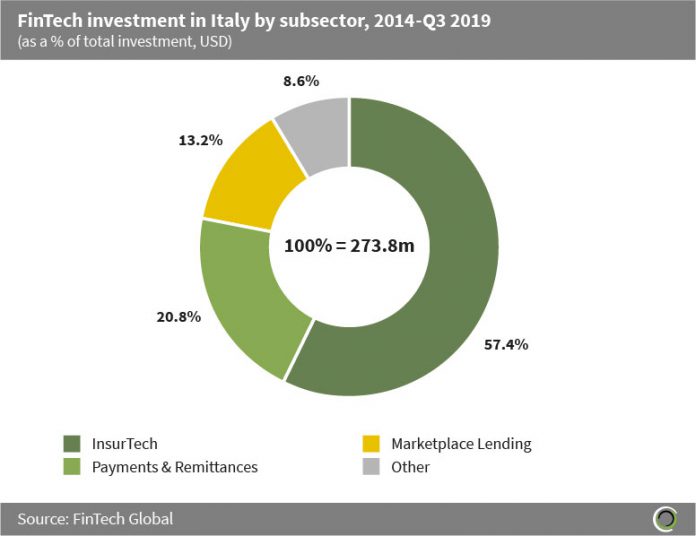

Italian FinTech companies raised $273.8m worth of capital between 2014 and Q3 2019, with investors participating in 72 deals during the period.

InsurTech companies in the country captured the lion share of investment with 57.4% of funding between 2014 and the first nine months of the year. The InsurTech landscape in Europe has been growing in recent years as investors respond to the global consumer appetite for digital innovation. Italy is particularly open to the innovation with less than half of customers in a recent survey by Oliver Wyman stating that they would choose traditional insurers over FinTech rivals.

Payments & Remittances companies also captured a healthy share of investment during the period, accounting for 20.8% of investment. This is unsurprising given that Italy is one of the largest economies in Europe and has made significant progress in electronic payments in the past ten years and was one of the first countries to adhere to the Single Euro Payments Area Instant Credit Transfer scheme in 2017.

The other category includes companies in the Blockchain, Data & Analytics, Infrastructure & Enterprise Software, Funding Platforms, WealthTech, RegTech, Real Estate and Cryptocurrencies subsectors who collectively raised only 8.6% of total funding since 2014.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global