Insuritas has been at the forefront of the InsurTech revolution for two decades. While its leadership sees some challenges on the horizon, they believe they are well positioned to transform them into opportunities for growth.

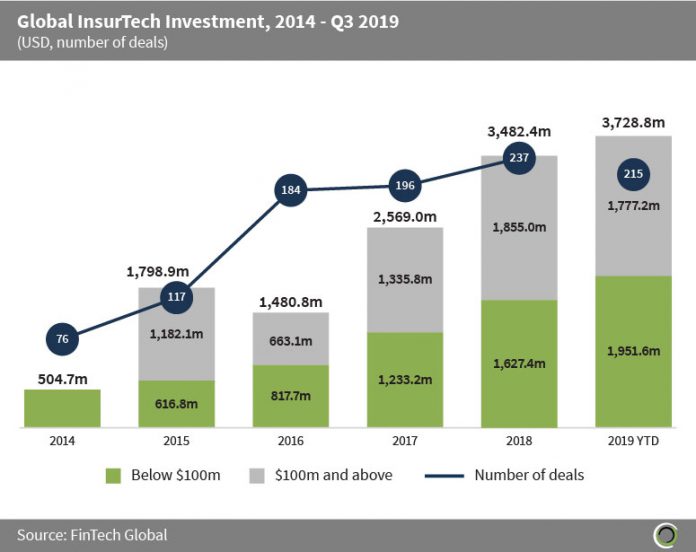

The InsurTech space is going from strength to strength. This is evident given how the investment figures into the sector are growing every year.

Back in 2014, $504.7m were invested into the global sector. That number jumped to a massive $3.48bn in 2018 only to skyrocket to $3.72bn in the first nine months of 2019, according to FinTech Global’s data. With over 1,000 deals having been signed off in the sector to date and this already looking to be another record year, it’s safe to say that the opportunities for tech solutions in the insurance space are only multiplying.

Matt Chesky (pictured) is one of the people who has witnessed the proliferation of these opportunities over the years. He is the President of Insuritas, the U.S. leader in insurance agency solutions for financial institutions. He is also the son of the company’s founder, chairman and CEO, Jeffrey Chesky.

As such, he has been able to see the growth of the sector first-hand, both by talking about it with his father across the dinner table growing up, and eventually joining the company after graduating from college in 2012. Having helped the company grow to its market-leader position in the U.S. today, Matt Chesky believes there are still plenty of opportunities for entrepreneurs who know where to look.

“One of the widest gaps between consumer expectations and reality today in the InsurTech space is in the insurance shopping experience,” he says. “Many of the newer innovations in the distribution side of InsurTech are focused exclusively on digitizing a traditionally analog shopping experience, but don’t necessarily solve for some of the other frictions inherent in that process.

“We think that building an omni-channel insurance ecosystem, that incorporates world-class InsurTech to reduce those frictions, or even eliminate the need for users to shop for insurance, represents one of the most scalable opportunities in the space.”

And that is exactly what Insuritas does. Founded and launched in 1999 as Banc Insurance Services, the company pioneered the idea of conceptualising, designing, installing and outsourcing management of insurance agencies for financial institutions across the country, enabling banks and credit unions to offer the auto, home and business insurance products their depositors purchase every year.

These features formed the core model of the company when Banc Insurance Services was acquired by Jack Henry & Associates, a leading bank core processing company, in 2004. And they were still enterprise’s key features four years later when Jeffrey Chesky bought back the company and renamed it Insuritas. Since then, Chesky senior has been pivotal in propelling the company to the heights it has today, often hitting the road to spread the gospel of its solutions at conventions across the US.

Through his and his team’s hard work, Insuritas has become the leading InsurTech company in the U.S., connecting people with the insurance products that they need through a seamless and transparent shopping experience. Today, its fast growing partner network of 200 banks and credit unions is serving over ten million customers across the USA.

Moreover, today Insuritas maintains relationships with over 75 insurance carriers to ensure its end users have access to competitive pricing and a comprehensive array of products available.

Through its platforms, Insuritas is empowering financial institutions to leverage proprietary data-mining techniques and integrations with a broad array of insurance carriers to make highly personalized, digitally optimized insurance offers to their depositors, all within their brand. These strategies help further their commitment to the financial well-being of their customers, while driving a critical source of non-interest income for their institution.

This model of building an insurance ecosystem where carriers, customers and Insuritas’ financial institutions partners come together to drive mutual value is purposeful . “The insurance agency distribution model evolved to meet users’ preference for a trusted, objective advisor to assess their risk management needs and connect them to a carrier who could offer them the right coverage at the right price,” Matthew Chesky says.

“As the independent agency system in the US continues to consolidate, we believe that financial institutions will continue to see this opportunity to step in and serve as this trusted advisor to their depositors as a logical extension of their core business, as well as a tremendous opportunity to drive customer wallet share, retention and recurring non-interest income.”

A testament to this fact is that Insuritas – two decades after it was launched – is still finding new customers and partners to join forces with.

In 2019 alone, Insuritas has launched partnerships with banks and credit unions in eight states across the US and has expanded its addressable market by nearly a million households.

Most recently, Insuritas launched Marquette Insurance Services for Marquette Bank, a full-service insurance agency for one of the largest privately held banks in the Chicago market with 24 offices throughout the region, empowering its retail and commercial customers with the ability they need to find the coverage they need from a massive group of insurance carriers.

Through the years, Insuritas has developed several high-tech solutions for its clients, including its E-InsuranceAISLE, LoanINSURNACE, InsureNOW and AgentFORCE platforms.

Rather than taking its foot off the metal any time soon when it comes to innovation, Insuritascontinues to roll out new solutions for the market.

In September 2019, it unveiled its latest addition to its already bursting portfolio of products: iInsure, a first of its kind technology that enables banks and credit unions to fully integrate insurance quote and buy capabilities into their high-usage digital banking platforms.

The company also recognises that the InsurTech industry will have several hurdles to overcome in the near future. Indeed, the industry has to evolve with the ever-changing regulatory landscape and remain conscious of new technological innovations.

Nevertheless, Matt Chesky believes one obstacle will be harder to tackle than any other. “The biggest challenge in the InsurTech space today is customer acquisition,” he says. “Our industry has seen an accelerated influx of new entrants and capital over the last several years, that, with the continued expansion of the direct writers in the US, have significantly driven up the cost of customer acquisition. Any scalable insurance platform in the US will need to solve for that challenge.“

Copyright © 2019 FinTech Global