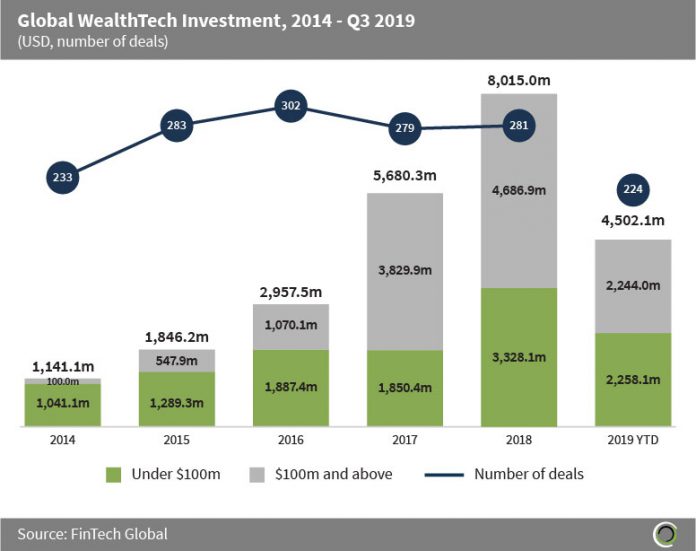

Over $4.5bn was invested in WealthTech companies during the first nine months of the year

- Investors poured $24.1bn into WealthTech companies around the world between 2014 and Q3 2019, completing over 1,600 transactions during the period, yielding an average deal size of $15.1m.

- The WealthTech ecosystem comprises of companies looking to provide digital transformation solutions to tech-savvy wealth managers and digital tools to assist a new cohort of millennial consumers with digital banking and personal financial management.

- Funding increased year on year from almost $1.2bn in 2014 to over $8.0bn last year, at a CAGR of 62.8% during the period.

- As of the first nine months of 2019, WealthTech deal activity stood above 220 transactions and more than $4.5bn has been raised, with an even split between investment in deals valued over $100m and those valued below $100m.

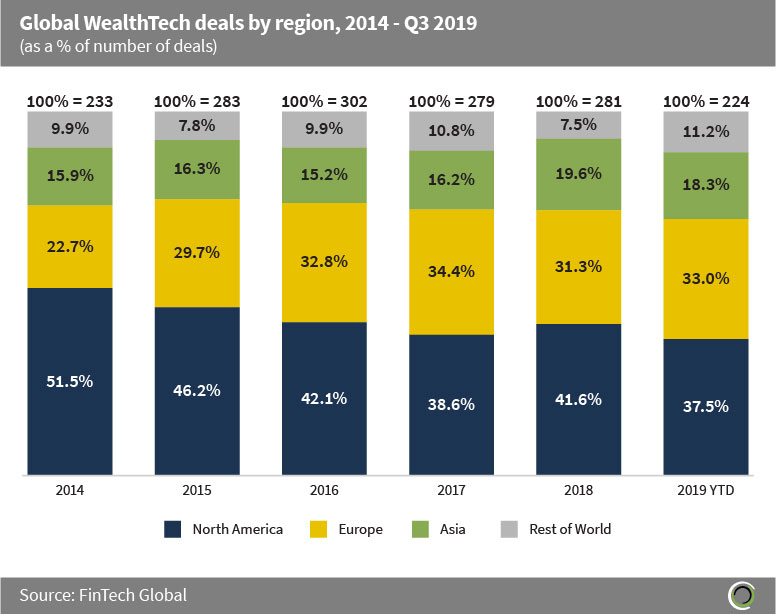

Europe’s share of WealthTech deal activity is up 50% since 2014

- Since 2014, WealthTech companies globally have raised over $24bn, with $8.7bn of this invested in North American companies and $4.8bn invested in companies based in Europe.

- Companies in North America, dominated by the US, have captured 42.9% of global WealthTech deal activity between 2014 and Q3 2019, compared to just under a third in Europe.

- However, the share of deals has been shifting from North America to Europe, with the share of deals involving European companies increasing from 22.7% in 2014 to a third of deals in the first three quarters of 2019.

- The banking industry across Europe has been under significant pressure since the great financial crisis, with negative rates and tighter regulations harming profitability, which has ushered in a new wave of digital challengers that have caught the eye of the investing community. N26 is now the leading challenger bank In Germany with 3.5m customers spread across 24 countries and is valued at $3.5bn. The company operates throughout the EU, recently started operations in the US and is also planning an expansion to Brazil.

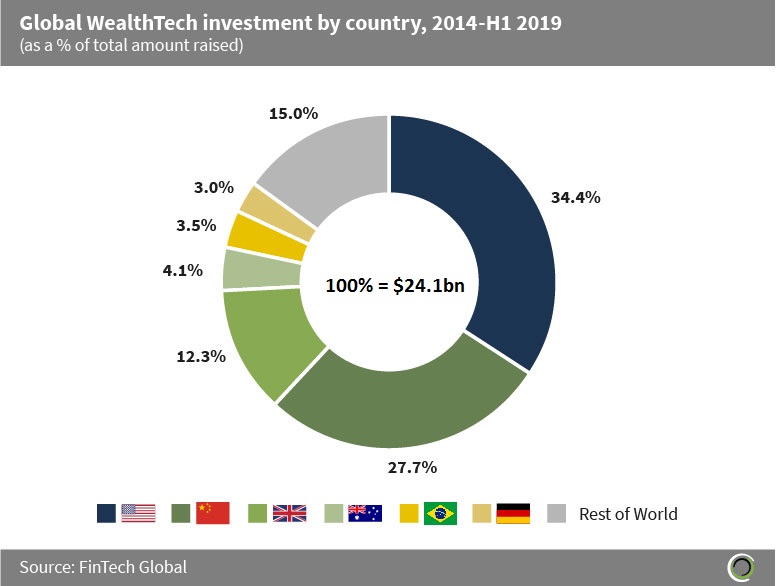

Almost 90% of the capital raised in the sector since 2014 has been captured by WealthTech companies based in just six countries

- Of the more than $24bn that was invested in the sector between 2014 and Q3 2019, 85% of this capital has been captured by WealthTech companies based in the US, China, UK, Australia, Brazil and Germany, with over 60% being raised by companies in the US and China during the period.

- According to research from the Wealth and Asset Management Consulting unit at KPMG, WealthTechs represented a catalyst for a tectonic shift to a sleepy but highly valuable subsector of financial services. Digital will likely be the key to success in the future, not only as an enabler of growth, but also to reduce costs, improve performance and better manage risks.

- The global landscape is now peppered with major well-capitalised challengers such as Chime in the US, WeBank in China, Monzo in the UK, Xinja in Australia, Nubank in Brazil, and N26 in Germany.

- However, the large capital requirements to support significant digital transformation in the space has forced investors to concentrate on later-stage transactions, which has seen average deal sizes increase from $4.9m in 2014 to $28.5m last year.

- JD Digits (formerly JD Finance) is a Chinese FinTech conglomerate offering services that span asset management, banking, lending and payments solutions. The company raised $2.1bn in a Series A round led by China Creation Ventures in Q2 2017, which is the largest WealthTech deal to date globally.

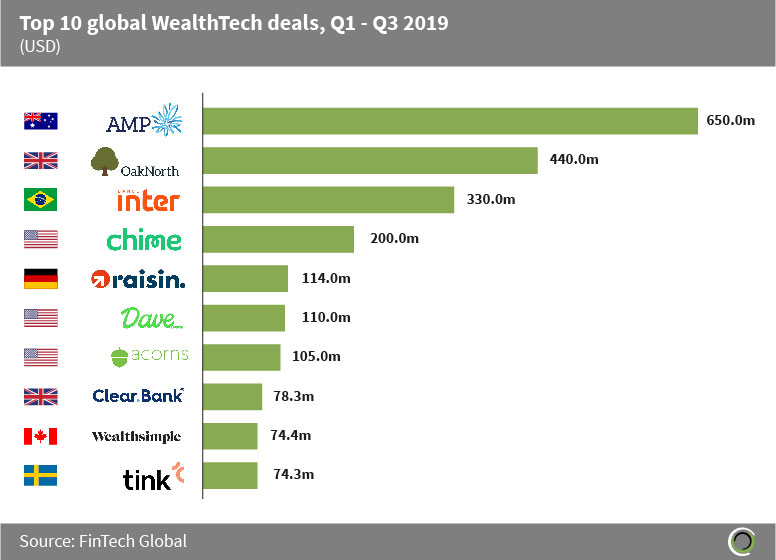

Almost $2.2bn was raised in the ten largest WealthTech deals globally this year

- Just under $2.2bn was invested in the 10 largest WealthTech deals globally between Q1 and Q3 2019, which is equal to almost half of the capital raised in the sector during the period.

- There was also significant geographic diversity in the list with companies from four continents; North America, Europe, South America and Australasia represented, and five digital/challenger banks (OakNorth, Banco Inter, Chime, Dave.com, ClearBank) listed.

- AMP, a quantitative and qualitative wealth manager based in Sydney with over $90m of AUM, raised $650m of Post-IPO equity in August, which is the largest WealthTech deal of the year to date.

- Brazilian digital banking giant Banco Inter also received Post-IPO equity, raising $330m in July 2019. SoftBank invested in the deal and Banco Inter has grown to 2.5m customers, up from the roughly 500,000 it had at its IPO in March 2018. This is the second largest challenger bank deal of the year, after the $440m raised by OakNorth in Q1, and is the largest WealthTech deal in Latin America to date.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global