Over $3.3bn was raised by FinTech companies in Europe in Q3 2019

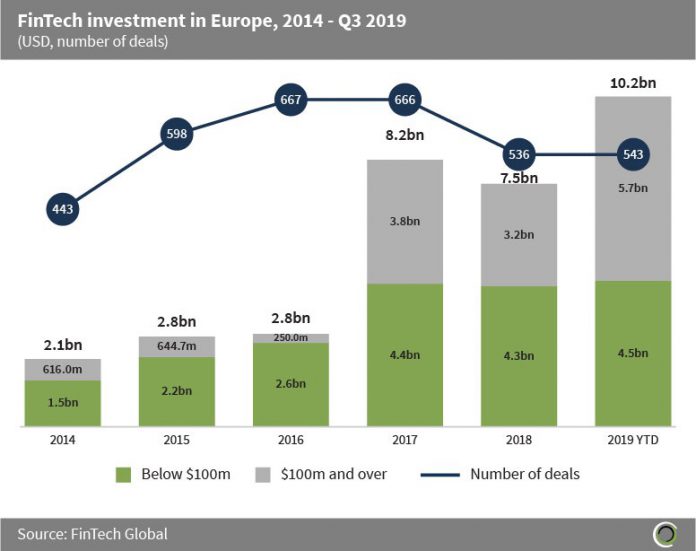

- FinTech companies in Europe have raised over $33.6bn between 2014 and Q3 2019, across 3,453 transactions.

- Funding increased at a CAGR of 57.5% between 2014 and 2017, reaching a record of $8.2bn invested in 2017 across 666 transactions. Investment dropped slightly last year reaching only $7.5bn across 536 transactions, but investment is on the rise again this year reaching a new record level of $11.4bn across 544 transactions in the first nine months of the year alone, setting strong expectations for the rest of the year.

- Average deal size has increased nearly four-fold from just $4.7m in 2014 to $18.8m in the first three quarters of the year so far, as FinTech investors in the region look to back more later-stage deals as FinTech innovation spreads across Europe.

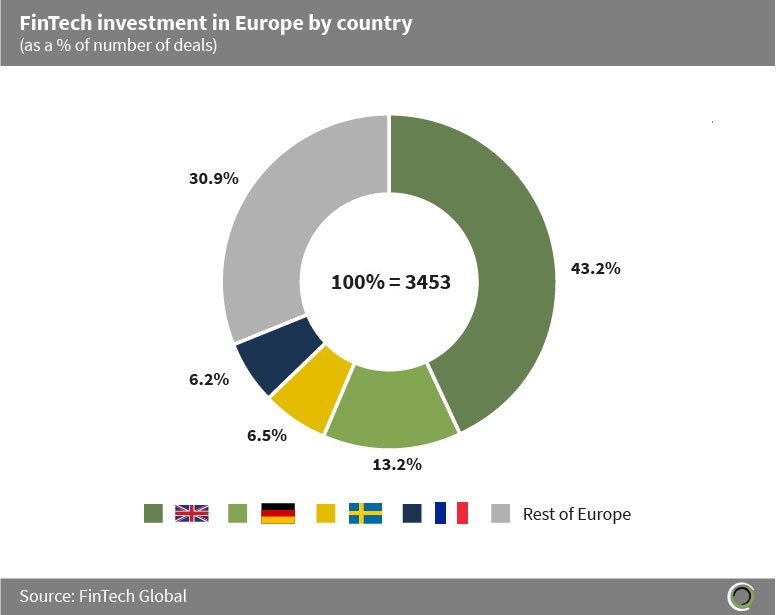

More than half of all deals in the region were raised by companies in the United Kingdom or Germany

- There have been over 3,400 FinTech deals completed across Europe since 2014, with companies in the UK and Germany dominating deal activity in the region during the period.

- FinTech companies based in the UK captured 43.2% of deals in the region and more than half of total capital invested went to UK companies. This is unsurprising as the UK is one of the largest economies in Europe with London being considered the FinTech capital of Europe.

- Germany has captured 13.2% of FinTech deals across Europe since 2014. Berlin is an attractive environment for FinTech businesses to develop due to its wide tech-related talent pool, relatively low cost of living and large millennial population.

- Sweden has also been a major player in the FinTech landscape in Europe since 2014 capturing 6.5% of deals. Although not the largest economy or population, Sweden is home to the buy now pay later platform Klarna, who is the third most valuable FinTech in Europe to date.

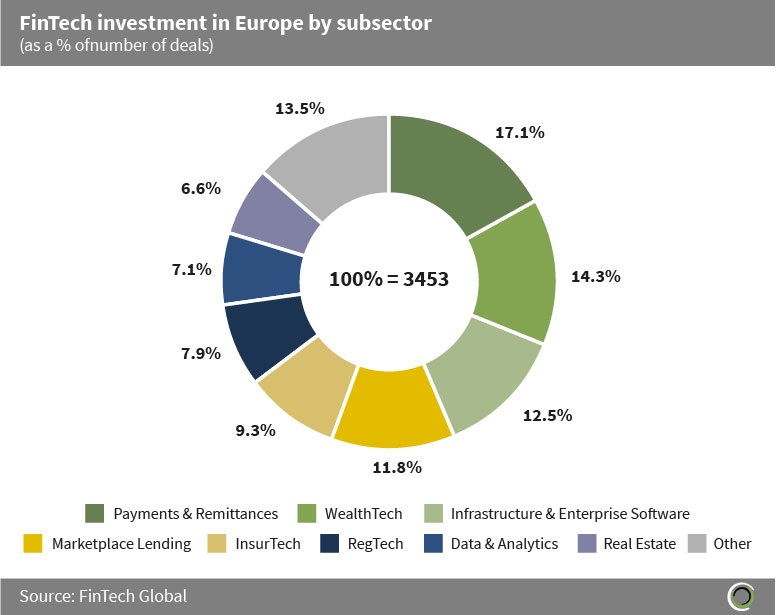

Investors in Europe have deployed capital across a wide variety of FinTech subsectors since 2014

- Investors in Europe have been active across all subsectors of the FinTech value chain since 2014, with no real dominant subsector in regards to deal activity emerging during the period.

- The Payments & Remittances and WealthTech subsectors have taken a minor lead over the other subsectors, capturing 17.1% and 14.3% of total deals in Europe respectively between 2014 and Q3 2019.

- The Payments & Remittances subsector has been growing in recent years as technology-driven payments processes are more often chosen over traditional institutions as Europe looks to keep up with the global trend towards becoming cashless.

- The WealthTech subsector in Europe has been greatly driven by the introduction of digital banks who cater for the millennial population in the region who tend to be tech savvy and seeking innovation in their everyday lives.

- The other category includes companies in the Cryptocurrencies, Funding Platforms, Blockchain and Institutional Investments & Trading subsectors, accounting for nearly one in seven FinTech transactions in the region since 2014.

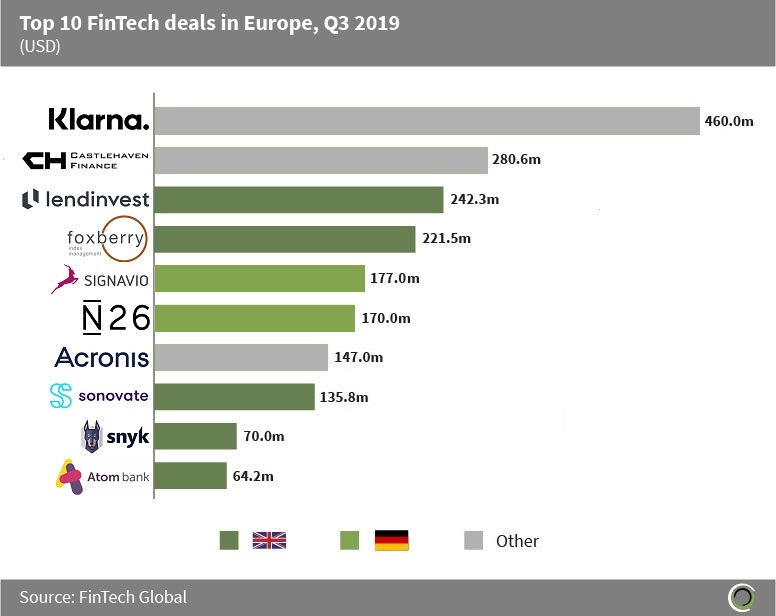

Over $1.9bn was raised in the top 10 FinTech transactions in Europe in Q3 2019

- Over $1.9bn was raised in the top ten FinTech deals in Europe in Q3 2019, with companies in the UK accounting for half of the deals on the list.

- The list contains companies from across the FinTech value chain including RegTech (Snyk, Acronis and Signavio), WealthTech (Atom Bank & N26), Cryptocurrencies (Foxberry), Marketplace Lending (Lendinvest & Castlehaven Finance), InsurTech (Sonovate) and Payments & Remittances (Klarna).

- The largest deal of the period went to Klarna, a buy now pay later platform for online retailers allowing the purchase of goods later with no interest or fees. The Swedish company raised $460m in equity funding led by Dragoneer Investment Group. The capital raised values the company at $5.5bn and they plan to use the investment to further their international expansion to the US.

- The largest deal raised by a company in Germany came from Signavio in their Series C round led by Apax Digital. The company raised $177m, valuing the company at $400m and plans to use the capital to continue its international expansion by leveraging Apax Digital’s operating capabilities and global platforms.