China and India have led the Asian FinTech investment league until the first six months of 2019 when Singaporean businesses toppled them both by raising a massive $1.62bn.

The win might be more due to the incidental $1.4bn post-IPO equity round from Sea Limited, the e-commerce company, than the Singaporean scene actually being bigger than the ones in India or China.

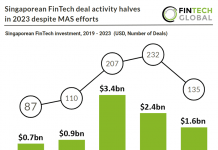

Nevertheless, Singapore is adamant in its efforts to not just remain a FinTech hotbed, but to actually be a leader in this space in Asia.

The latest step in this effort is that country is rolling out the welcome mat to virtual banks from other countries.

Ravi Menon, managing director at the Monetary Authority of Singapore (MAS), recently said that the reason why three out of the five new digital banking licences that are up for grabs are open to foreign companies is to ensure they pick Singapore as their headquarters as they scale in the region.

MAS also made unveiled a new sandbox option to boost innovation in the industry in August. having unveiled its original regulatory sandbox back in 2016.

Copyright © 2019 FinTech Global