The UK challenger banking sector is about to get even more crowded with Cato Banking gearing up to launch next year.

For the past six years, the British challenger banking sector has gone from strength to strength, with new digital banks like Revolut, Atom bank and Monzo competing for the big bucks whilst trying to disrupt the incumbents’ old business models.

However, in 2020 they are set to face competition from another new player in the industry: Cato Banking.

The startup is set to officially launch early next year and has already opened up its waiting list. It will offer features like automatic bill payments, saving pots as well as rewards and discounts.

Co-founder and CEO Simon Phillips has said that launching Cato Banking will enable their customers to tap into technology that tackle financial issues that negatively affect individuals and communities.

Cato Banking was founded in 2018 and currently has two to ten employees, according to LinkedIn.

The new challenger bank will face a lot of pressure from both traditional institutions and other digital banks.

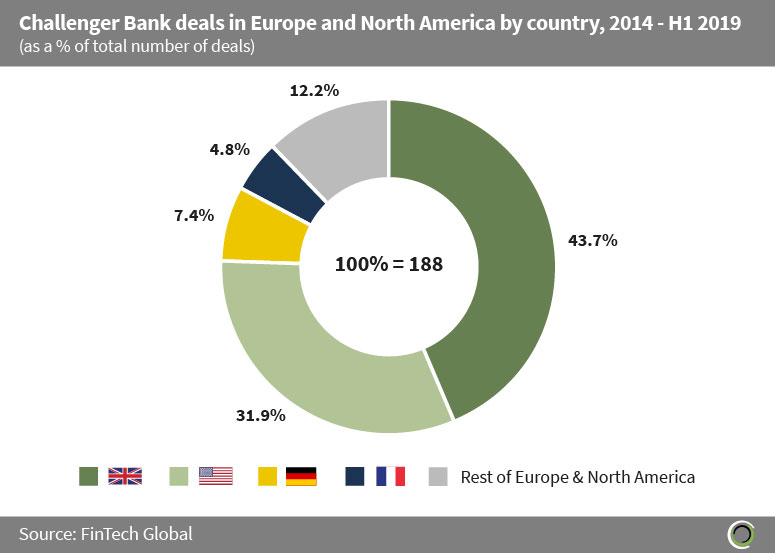

Is no secret that the UK has one of the most thriving challenger bank industries in the world. Since 2014, companies like Atom bank, Monzo and Revolut has raked in hundreds of millions of investments. The country received 43.7% of the total challenger bank deals in Europe and North America between 2014 and the first six months of this year, according to FinTech Global’s data.

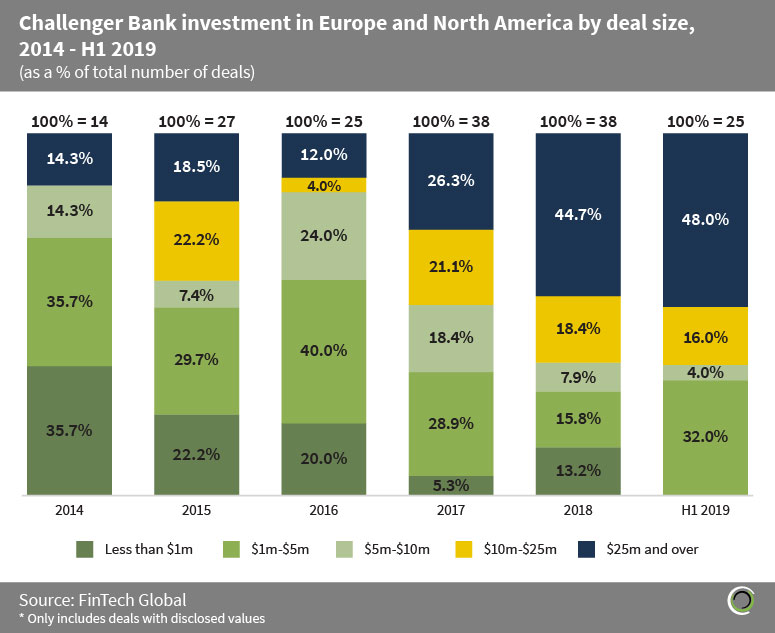

The sector is growing overall, with deals in North America and in Europe increasing in size every year. Whereas only 14.3% of all deals were involved investments of $25m or over in 2014, that number jumped to 44.7% in 2018. In the first half of 2019, 48% of all deals were worth $25m or over.

Or to put it this way, six out of the top ten biggest challenger bank deals in that period happened between January and July this year.

Copyright © 2019 FinTech Global