Real estate technology company Juniper Square has collected $75m in its Series C round led by Redpoint Ventures.

Additional contributions came from Ribbit Capital, Felicis Ventures and Zigg Capital.

The company automates investment workflows and centralizes information surrounding transactions, investments and investors. Roughly $800bn of real estate is managed through the platform.

Founded in 2014, the company was designed for the real estate industry and helps improve the collection of data so a company can improve their operations, accounting and investing.

Juniper Square co-founder and CEO Alex Robinson said, “With this latest round, Juniper Square is better able to seize the opportunity to change the status quo in a way that benefits both GPs and LPs in the commercial real estate ecosystem. Our vision is that one day, an institution or individual could invest in a share of a commercial building just like they would in a share of stock on the NYSE.”

Last year, the company collected $25m in a Series B round and $6m in its Series A.

Redpoint Ventures recently participated in the $40m funding round of data preparation and exploration solution Datameer.

Other FinTech investments from Redpoint this year include a contribution to the $523m round of Root Insurance and an investment into AppZen, which builds software to help financial teams.

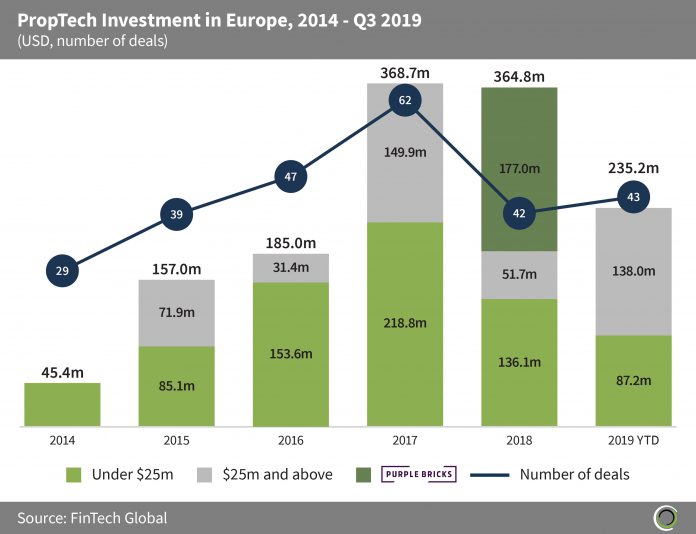

Europe’s PropTech sector has been growing at a steady rate since 2014. Last year a total of $364.8m was raised by startups in the space.

Copyright © 2019 FinTech Global

Copyright © 2019 FinTech Global