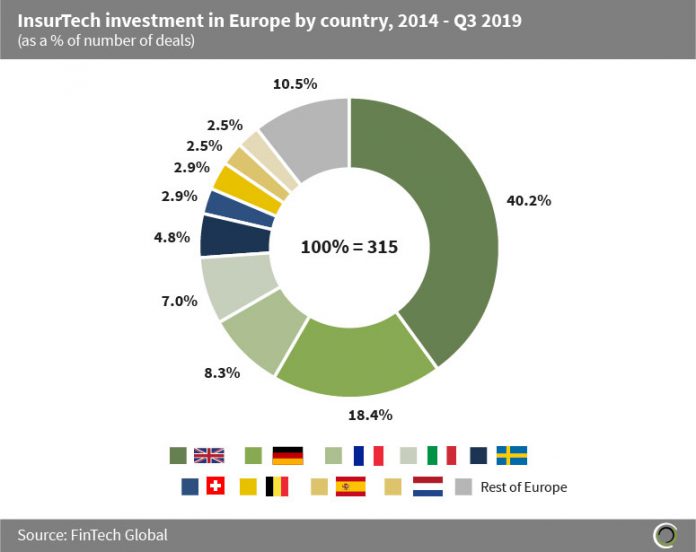

More than two fifths of InsurTech deals in Europe between 2014 and Q3 2019 involved companies based in the UK

- The InsurTech landscape in Europe has been growing over the past five years as many InsurTech startups continue to support incumbent insurance companies in their digital transformation efforts.

- The top nine countries in Europe with respect to the number of InsurTech transactions completed between 2014 and the first three quarters of 2019, captured more than 90% of the total deal activity in the region during the period.

- More than 40% of the InsurTech deals that occurred between 2014 and Q3 2019 involved companies based in the UK, which has led the way for InsurTech innovation across Europe. Germany is in second place with InsurTechs in the country capturing almost a fifth of deal activity, however, insights from Oliver Wyman show that although the number of InsurTechs in Germany continues to grow, the start-up boom is starting to level off, due to exits, market withdrawals, and pivots.

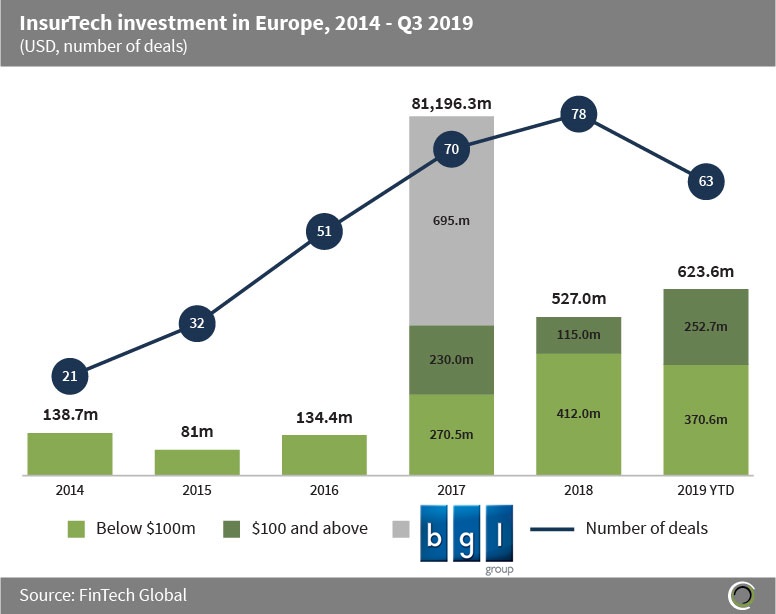

InsurTech investment in the UK between 2014 and Q3 2019 leads funding in the sector to more than $2.7bn during the period

- More than $2.7bn was invested in InsurTech companies in Europe between 2014 and Q3 2019, with 315 transactions completed during the period. This funding has been predominantly driven by investments in the UK and Germany with $1.4bn and $610m invested in InsurTechs in these countries, respectively.

- When analysing the composition of deal sizes, 2017 marked the introduction of the first $100m+ deal, and almost $1.3bn of the $2.7bn of funding raised in the European InsurTech sector has been invested in transactions valued at $100m and above. More than 90% of the capital invested in this deal size range has been raised by InsurTech companies based in the UK and Germany.

- Peterborough-based BGL Group, a digital distributor of insurance products which owns brands such as comparethemarket.com, raised $695.8m from Canada Pension Plan Investment Board in November 2017, which is the largest InsurTech transaction in Europe to date.

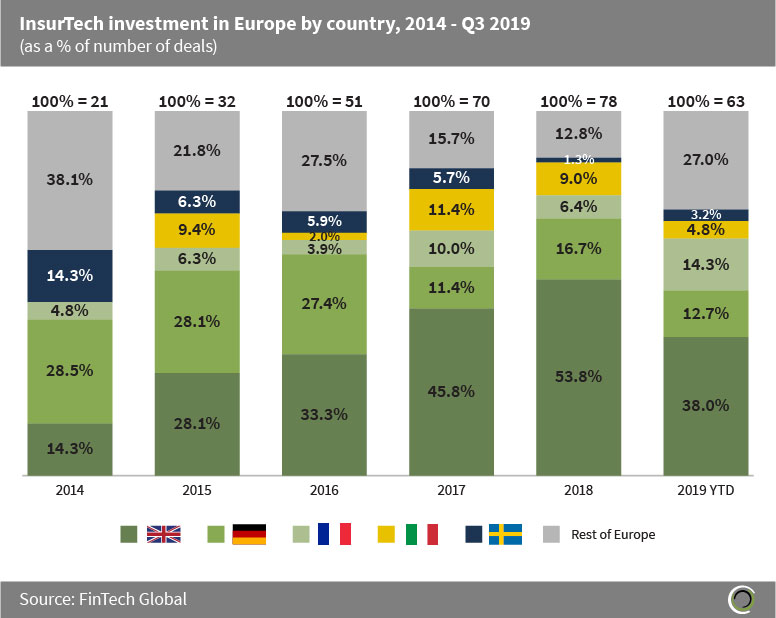

Companies in the UK, Germany, France, Italy and Sweden captured almost 80% of InsurTech deals activity in Europe between 2014 and Q3 2019

- The UK has been the leading destination for InsurTech investments across Europe since 2014, in terms of both deal activity and funding, and the country’s share of transactions in the region grew from 14.3% in 2014 to 53.8% last year.

- Companies in countries outside of the top five for deal activity; UK, Germany, France, Italy and Sweden, have also be raising capital and captured more than a fifth of the InsurTech deals that took place in Europe between 2014 and Q3 2019.

- CarePay International is an Amsterdam-based health data & payment distribution platform that has connected over 4.5m users to more than 1,200 healthcare facilities. The company raised a $44.9m Series A round from the Dutch Ministry of Foreign Affairs and Investment Funds for Health in Africa, to expand operations from Kenya to Nigeria and Tanzania. This funding was the largest InsurTech deal in Europe in Q2 2019 and is the largest InsurTech investment in Europe raised by a company outside of the UK, Germany, France, Italy and Sweden to date.

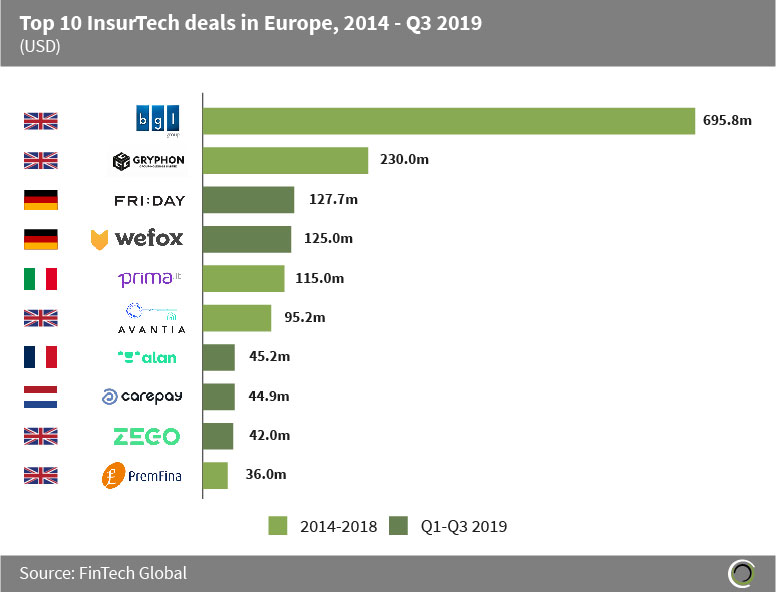

Almost $1.6bn was raised in the largest ten InsurTech deals in Europe between 2014 and Q3 2019

- Investors poured almost $1.6bn into the largest InsurTech deals in Europe between 2014 and Q3 2019, with half of these deals taking place in the first nine months of the year.

- All of the top 10 transactions involved companies based in the top four countries for InsurTech deal activity across Europe between 2014 and Q3 2019; UK, Germany, France and Italy. Previously mentioned BGL Group raised $695.8m in Q4 2017 and is now one of the few FinTech unicorns in the UK.

- FRIDAY is a leading digital insurer based in Berlin which offers innovative car insurance with completely paperless administration and kilometre accurate billing. The InsurTech raised $127.7m from SevenVentures, German Media Pool and Baloise Strategic Ventures in March 2019. This is the largest InsurTech deal in Europe this year and will allow FRIDAY to fund its ambitions of becoming Germany’s most popular digital insurer by 2021.

- Prima Assicurazioni, a Milan-based online insurance provider, raised $115m in a Series A round from Blackstone and Goldman Sachs in Q4 2018. This is the largest FinTech deal in Italy to date and the company siloed the funds for new technologies and to expand its marketing and sales teams.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global