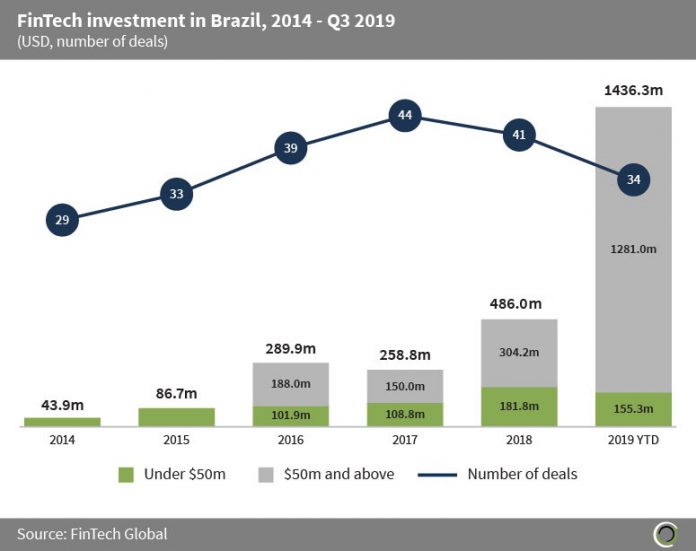

Over $1.4bn has been raised by Brazilian FinTech companies this year alone

- FinTech companies in Brazil have raised over $2.6bn across 220 transactions between 2014 and Q3 2019, with 73.9% of this invested in transactions valued above $50m.

- Investment grew at a CAGR of 82.4% between 2014 and 2018, and this growth has continued into 2019 with funding hitting a record of over $1.4bn raised in the first three quarters.

- The record investment so far this year has been driven by five deals valued above $50m, compared to only seven deals in this size bracket between 2014 and 2018, setting strong expectations for the rest of the year.

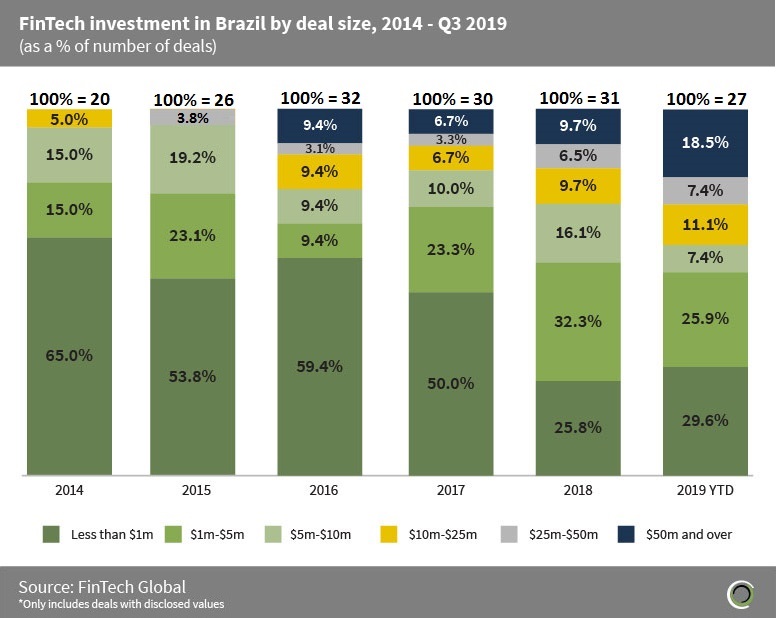

Nearly one in five FinTech deals so far this year were valued at $50m or more

- The FinTech landscape in Brazil has undergone a shift in recent years from investors predominantly backing smaller deals, towards participating in later-stage transactions.

- In 2014, there were no deals in Brazil valued above $25m, and 65% of deals in the country were valued below $1m. However, this has dropped significantly with deals valued below $1m accounting for only 29.6% in the first three quarters of 2019.

- The proportion of FinTech deals in Brazil valued above $50m has shown significant growth, from no deals in 2014, to 18.5% of deals in 2019 so far being of this magnitude.

- Average deal size has increased nearly 28-fold between 2014 and the first three quarters of 2019, from just $1.5m back in 2014, to $42.2m so far this year, as we see investment in Brazilian companies increase at a greater rate than the volume of deals closed.

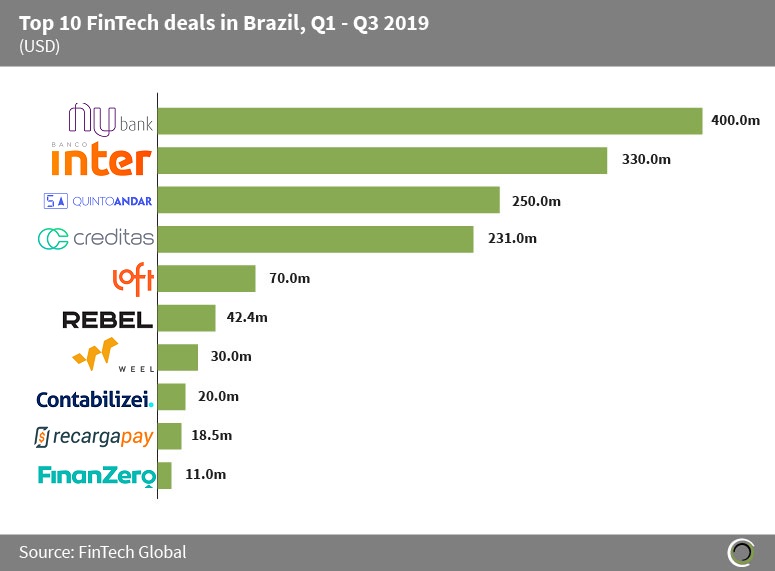

Over $1.4bn has been raised in the top 10 FinTech transactions in Brazil this year so far

- The top 10 FinTech deals in Brazil in 2019 so far have collectively raised over $1.4bn, which is equal to 53.9% of the total capital raised in the country since 2014, and 97.7% of capital raised in the first nine months of 2019. Five of the top 10 deals were raised in Q3 2019, with four of these taking the top spots on the list.

- The largest round of the period went to Nubank, a challenger bank which serves 12m customers and has recently expanded its product offering to include cash withdrawal options and personal loans. The company raised $400m in a Series F round led by TCV, which values the company at over $10bn meaning it has joined the coveted decacorn club.

- The largest deal outside of Q3 2019 went to Loft, a real estate buying and selling platform, which raised $70m in a Series B round in Q1 2019, led by Fifth Wall and Andreessen Horowitz.

- Of the top 10 deals, Payments & Remittances and Marketplace Lending companies dominated with three deals each. The rest of the capital was spread across Blockchain, Infrastructure & Enterprise Software, RegTech and WealthTech companies, with one deal each.

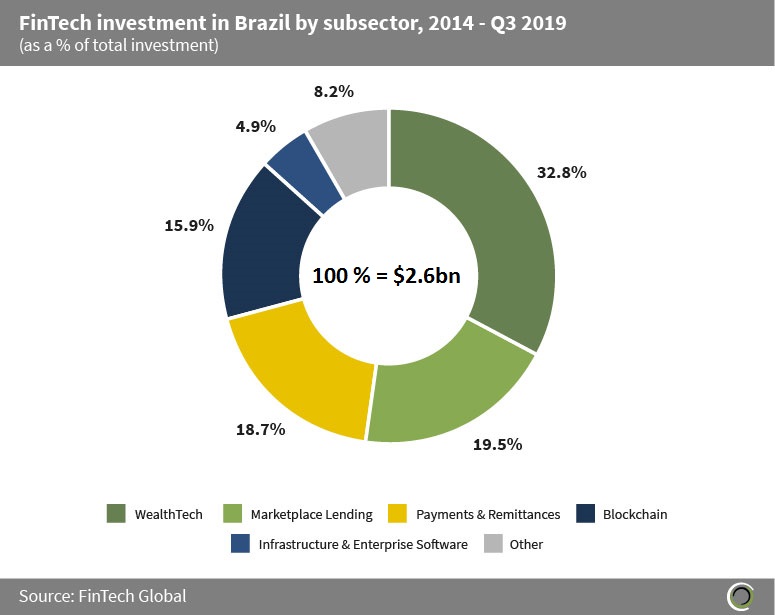

WealthTech companies in Brazil account for nearly one third of total investment in the country since 2014

- There has been a concentration of capital investment in Brazil within WealthTech and Marketplace Lending subsectors since 2014, with over 50% of total capital raised being invested in one of these subsectors.

- WealthTech companies in the country account for 32.8% of total capital raised since 2014, with investment in challenger banks Nubank and Neon alone making up 10.1% of total investment since 2014. According to the World Bank, nearly 40% of Brazilian adults remain unbanked, presenting an attractive investment opportunity for investors as there is a large market of customers to skip traditional banking systems and access digital financial services provided by WealthTech companies.

- Marketplace Lending companies also attracted a healthy proportion of investment with 19.5% of capital being raised by companies in this subsector. This is again unsurprising as with such a large unbanked population there is a large market to offer financial products such as loans to, offering more competitive interest rates and improved borrower experiences to those who would not usually be able to reach such services through mainstream banks.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global