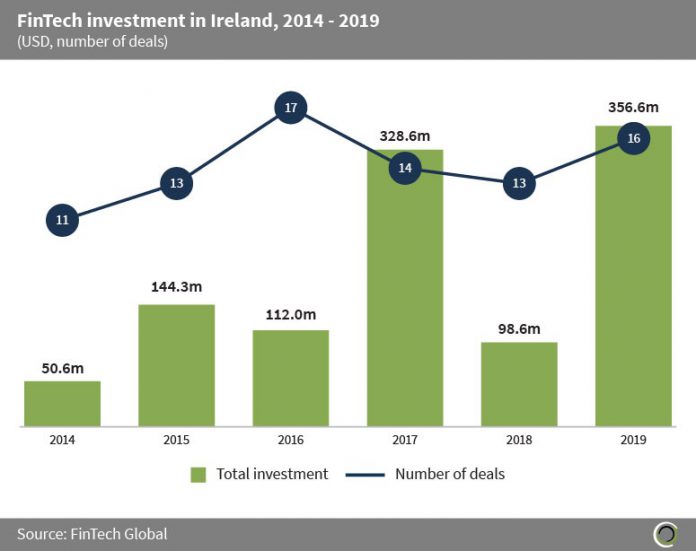

FinTech companies in Ireland have raised over $1bn between 2014 and 2019 across 84 transactions. Funding increased at a CAGR of 86.6% between 2014 and 2017, when funding reached $328.6m. Funding dropped in 2018 to only $98.6m but has since recovered to reach a new record of $356.6m across 16 deals in 2019.

The record funding raised in 2019 was driven by Castlehaven Finance’s private equity deal in Q3 2019, which alone accounted for 78.7% of the total funding raised in 2019. The company, which offers alternative lending solutions for property development in Ireland, raised $280.6m from Avenue Capital Group which will acquire the existing Castlehaven Finance Portfolio from Pollen Street Capital and provide future funding lines to further grow the Castlehaven platform.

Ireland offers an attractive environment for FinTech investors particularly in the Marketplace Lending sector. Since the financial crash of 2008, mainstream banks have retreated from the space due to tighter lending standard regulations and FinTech companies offer an alternative which often falls outside of this regulatory ambit, hence not requiring authorisation from the Central Bank of Ireland. Further to this, Brexit uncertainty has caused the relocation of several firms to Ireland, increasing FinTech investment in the country.

Copyright © 2020 FinTech Global