Brexit has caused a lot of uncertainty for FinTech firms. However, those worries have not stopped Getsafe from?venturing into Britain.

The German InsurTech startup has dared to open its British operations ahead of the UK divorce from the EU on January 31 by?launching an independent subsidiary in London.

Doing so has supposedly enabled it to operate despite the political uncertainties caused by the British exodus from the neighbouring trading bloc.

Getsafe has also partnered with domestic insurer Hiscox to further secure its position. ?Getsafe acts as a platform with multiple carriers, including Munich Re and AXA, providing the capacity in the background,said Christian Wiens, CEO and founder of Getsafe. ?With Hiscox, we have a renowned carrier for our UK contents product at our side and are pleased to be working with them.”

He is making no secret about why Getsafe wanted to tap into the UK market, citing the huge opportunities for e-commerce, mobile payments and other innovative FinTech solutions.

Although, while Wiens noted that the UK is swarming with challenger banks like Monzo, Revolut, Starling and German N26, he believed there is no comparable insurance solution in the country yet. “With our smartphone app, Getsafe will close this gap in the market,” boasted Wiens.

Getsafe has created a machine learning-powered solution aimed at making it easier to control how to pick and change insurance. “At Getsafe we live the philosophy that insurance does not have to be complicated,said Wiens. ?That is why we offer our customers a simple and transparent solution at fair prices.”

The news about the UK expansion comes on the back of Getsafe success in its native location, funded partly by the startup $17m Series A round from June 2019. “Over the last two years, we have shown that our product meets a core need for the young, tech-savvy generation,said Wiens. ?With our insurance delivered through your smartphone, we are developing a product that fits perfectly with the living and communication habits of this generation.p>

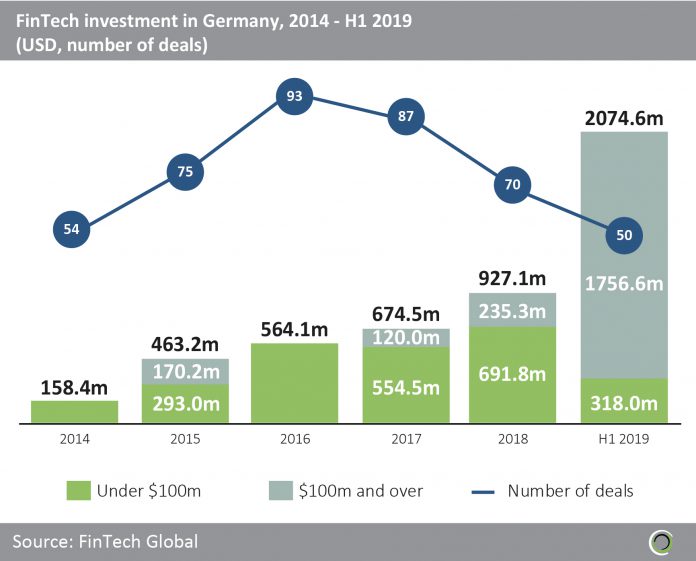

The German FinTech sector has gone from strength to strength over the past six years. Having played second fiddle to the UK FinTech scene for years, there are signs that suggest that things may be about to change.

For instance, while only $158.4m were injected into the nation FinTech industry in 2014, that figure shot up to massive $927.1m in 2018 to then skyrocket to $2.07bn in the first six months of 2019, according to FinTech Global data.

The growth has caused some speculation that Germany might overtake the UK as the European FinTech destination of choice?after Brexit.

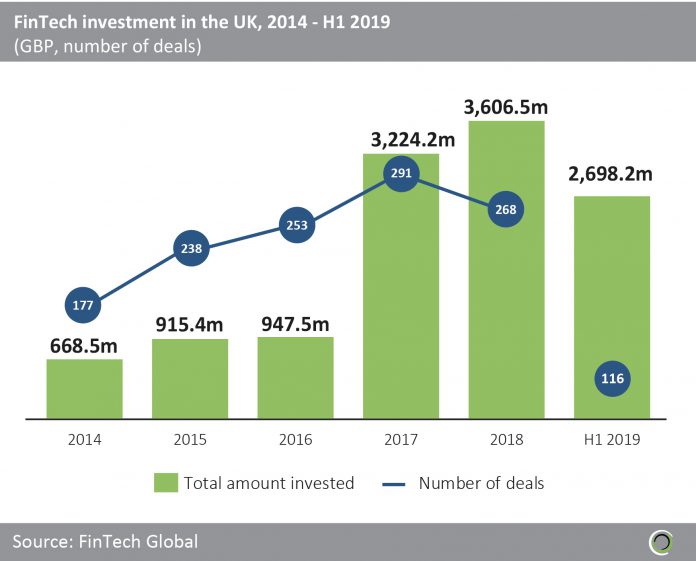

Although, FinTech Global data suggest that the country may still have some miles to go before catching up with Blighty.

In 2014, the British FinTech sector attracted ?668.5m in investment. That number grew to ?3.6bn in 2018. Moreover, it had already attracted ?2.69bn at the end of the the first six months of 2019.

Nevertheless, Brexit has caused some concerns for British businesses. Banks, the Financial Conduct Authority, the European Securities and Markets Authority and RegTech companies have all warned that there are still regulatory hurdles for the UK to overcome in order to insure uninterrupted trade with the European market.

Yet, businesses are trying to prevent huge losses as best they can. For instance, over 100 London-based finance firms have done the reverse of what Getsafe did and opened offices across the EU to ensure they have access to the trading bloc market after Brexit.

The trend seems to be ongoing, with challenger bank Starling Bank has announced plans to set up shop in Ireland.

Copyright ? 2020 FinTech Global