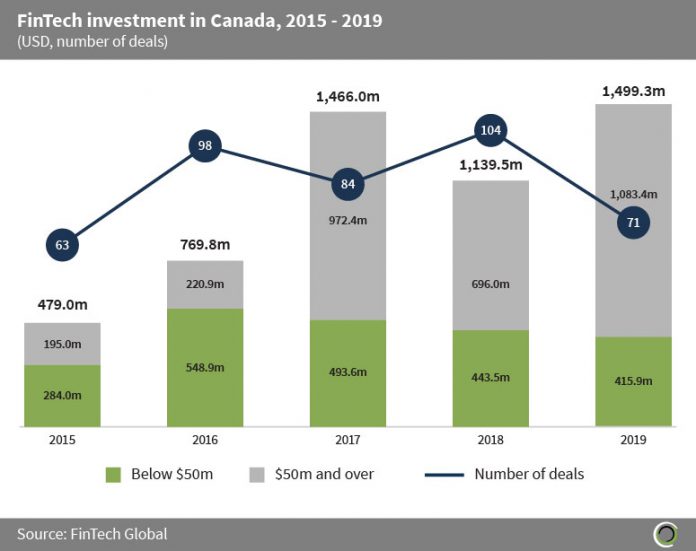

Investment in 2019 set a new high surpassing 2017’s record by $33.3m

- FinTech companies in Canada raised over $5.2bn between 2015 and 2019 across 420 deals.

- There was a slight drop in FinTech investment in 2018 compared to the previous year. Despite this, deal activity hit an all time high of 104 that year, which is an increase of 20 transactions from 2017. There were much larger deals in the $50m and over category, which cased the record funding levels in 2017. The deal sizes reverted back to the historical averages in 2018, leading to the drop in investment.

- Transaction activity has been quite consistent from 2015 to 2019 averaging at 84 deals annually. The results also suggest that the average deal size has increased from £7.6m in 2015 to $21.1m in 2019.

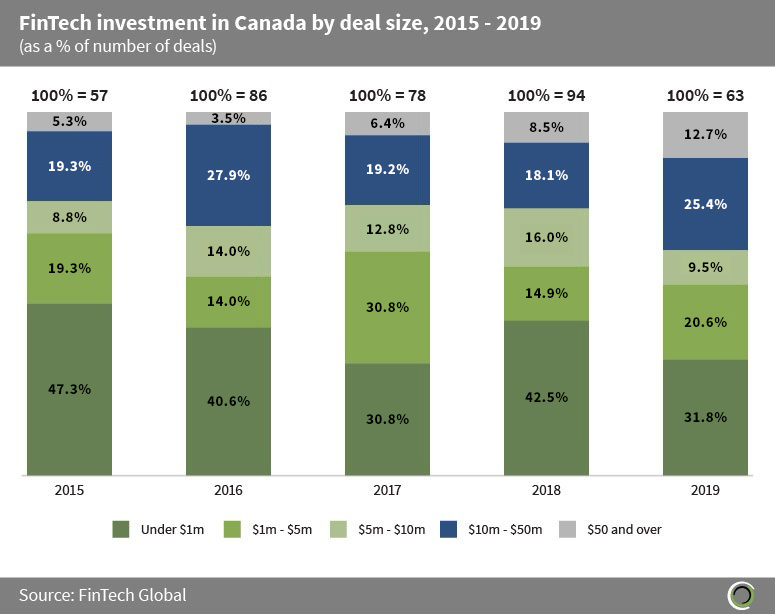

FinTech investment at $50m and above is on the rise since 2015

- Since 2015 the investors in Canada have been gradually investing less in smaller deals and funding more the larger size deals. Figure above shows that investment into $50m and over transactions increased from 5.3% in 2015 to 12.7% in 2019.

- The figure above shows that investment in deals under $1m in 2018 was over 10 percentage-points higher than the year before or after. This indicates that there was an increase number of early stage deals, which were used to fund new entrants into the market.

- Additionally, investment into deals under $1m decreased from 47.4% in 2015 to 31.7% in 2019. This shows that investors preferences are changing and moving towards larger deal sizes.

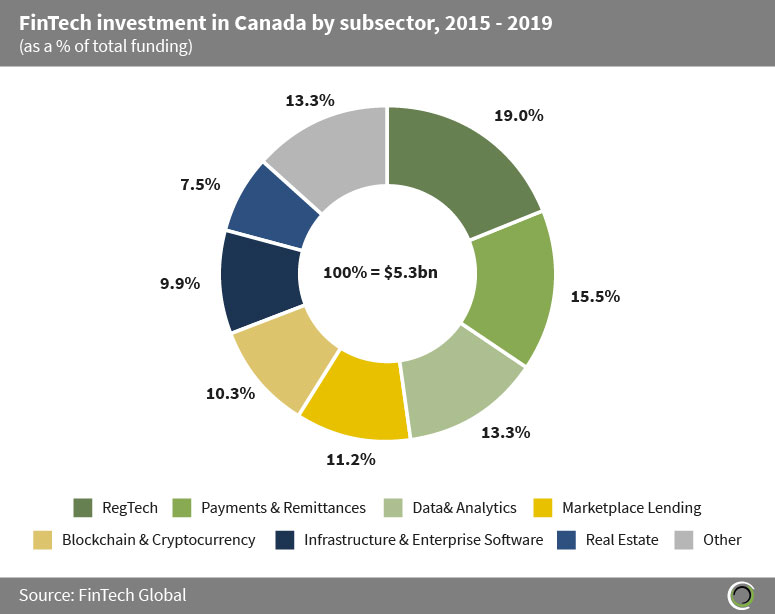

RegTech, Payments & Remittances, and Data & Analytics deals account for almost half of FinTech Investment in Canada since 2015

- Canada has experienced a concentration of funding within three subsectors; RegTech, Payments & Remittances, and Data & Analytics, accounting for 47.8% of overall FinTech investment in Canada since 2015.

- RegTech companies have received the most funding since 2015, with 19% of the total funding being raised by companies in the sector. Furthermore, RegTech has attracted 11.4% of deals between 2015 and 2019. This puts RegTech behind Infrastructure & Enterprise Software, WealthTech, and Payments & Remittances at 15.5%, 13.5%, and 13.2% of transactions, respectively.

- The Other category consists of Funding Platforms, WealthTech, Institutional Investment & Trading, and InsurTech companies, which collectively amount to 13.3% of overall FinTech funding in the country since 2015.

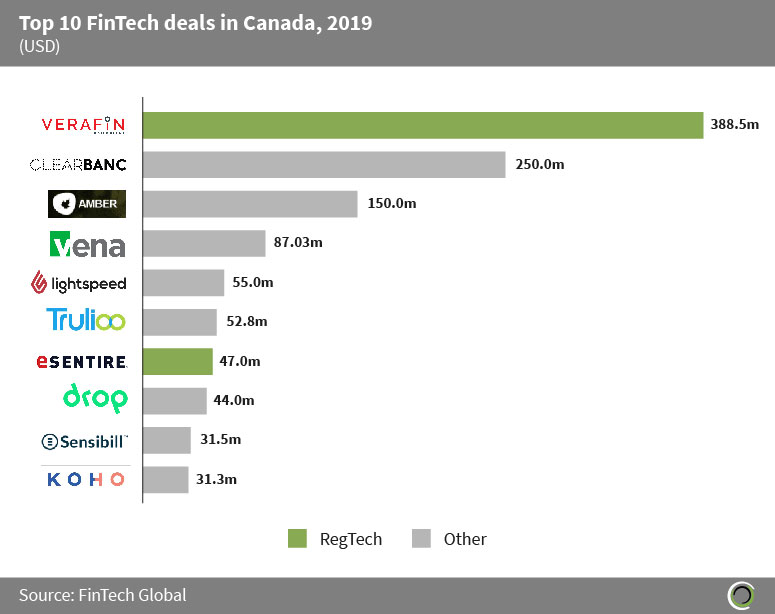

Over $1.1bn was raised in the top 10 FinTech deals in Canada last year

- The top 10 FinTech deals in Canada last year collectively raised over $1.1bn. Three of the top 10 deals were raised by companies in the RegTech subsector.

- The largest round in 2019 went to Verafin, a provider of software platforms that specialize in financial crime management solutions. The company managed to raise $388.5m (CA$515m) in one private equity round. The lead investors were Information Venture Partners and Spectrum Equity. The funding is being used toward their long-term goal of combating financial crime through collaboration and cross institutional analysis. Specifically, this capital investment will allow Verafin to aggressively proceed along with its growth plans and continue to remain an independent company.

- The funding allocation between the top 10 deals is quite widely distributed through the subsectors with three deals in RegTech. Another two deals in Payment & Remittances and Infrastructure & Enterprise Software and one deal in WealthTech, Data & Analytics, and Funding Platforms companies.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global