The Association of Southeast Asian Nations (ASEAN) was established in August 1967 with the purpose of accelerating the economic growth, social progress, and cultural development in the region. Member states include Indonesia, Thailand, Singapore, Malaysia, Philippines, Vietnam, Myanmar (Burma), Brunei, Cambodia and Laos.

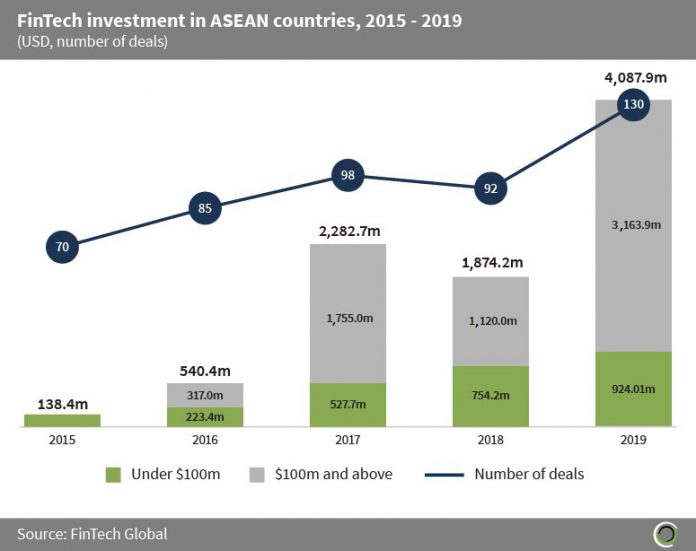

FinTech companies in the region have raised over $8.9bn across 475 deals between 2015 and 2019, with $6.4bn of this capital being raised by transactions valued at $100m or above. Investment grew at a CAGR of 133.1% between 2015 and 2019, reaching a record of nearly $4.1bn across 130 deals last year.

The amount raised by FinTech companies in the ASEAN region in 2019 equates to 45.8% of the total capital raised across the area since 2015. This significant growth can be put down to the fact that although many ASEAN countries are still emerging markets, there is insufficient financial inclusion across the region resulting in the adoption of FinTechs which can fill these gaps more easily. Average deal size has also increased nearly 16-fold from just $2.0m in 2015 to $31.4m in 2019 as the landscape matures and investors look to back later-stage funding rounds.

Sea Group is a mobile payments and e-commerce platform based in Singapore. The company raised $1.4bn of post-IPO equity from Tencent Holdings in March 2019 and used the capital to fund its fierce competition with regional e-commerce rival; Alibaba. This was the largest FinTech deal in Singapore, and also the largest FinTech deal in the ASEAN region to date.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global