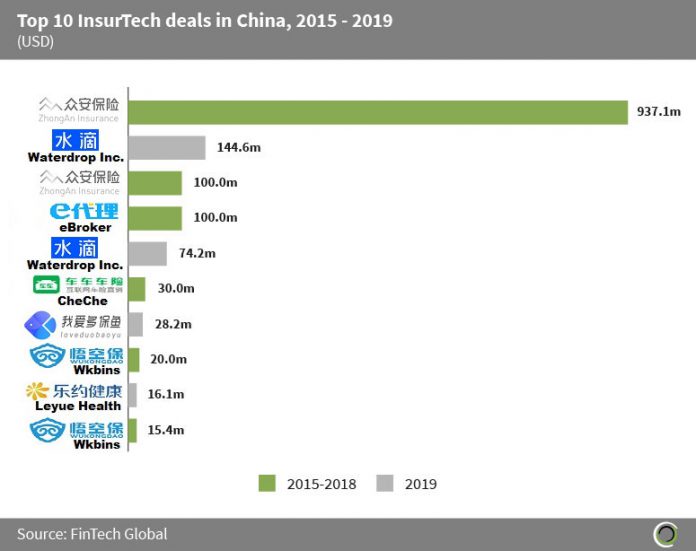

InsurTech companies in China have raised over $1.7bn between 2015 and 2019, with more than $1.4bn of this being raised in the top 10 transactions in the subsector. The amount invested in these deals equates to 84.6% of the total capital raised in the subsector during the period. Of the top 10 deals, four were raised in 2019.

According to research by Swiss Re, more than 90% of the Asian population do not own any form of insurance. Coupled with the fact that Asian insurance is often distributed by agents who are disproportionately driven by commission, hence targeted mainly at high net worth individuals rather than mass markets, InsurTech companies present an attractive investment opportunity due to their ability to disrupt the traditional market model.

The largest deal of the period went to ZhongAn Insurance, a first-of-its-kind for China, internet-based property insurance company which handles claims and distributes its products online. The company raised $937.1m in a Series A round in 2015 from investors including Morgan Stanley. Following the investment, the company’s shareholder number increased from nine to 14.

The largest deal of 2019 came from Waterdrop Inc., an insurance platform which aims to use mutual insurance, crowdfunding and commercial insurance products to solve the problem of high medical fees. The company raised $144.6m in a Series C round led by Boyu Capital. The capital will be used to explore artificial intelligence applications of healthcare insurance and to further build the team.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global