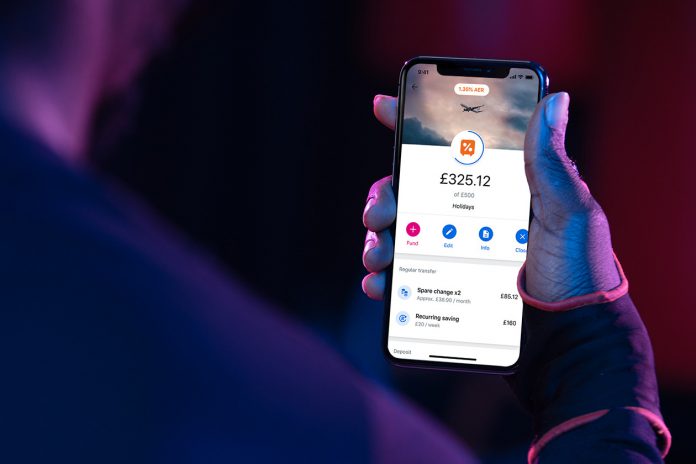

UK challenger bank Revolut has unveiled a new feature. However, its only available for its UK metal customers.

Metal card holders, who pay £116 per year for their memberships, can now earn interest of up to 1.35% on their savings through Revolut’s new Savings Vaults feature.

Although, the 1.35% annual equivalent rate of their savings is only available to a certain point. After the limit has been reached, new deposits will receive a lesser rate.

The new feature is protected up to £85,000 under the Financial Services Compensation Scheme. The protection is through Paragon Bank.

“Interest rates have been minuscule in recent years and this has directly impacted the options that people have when it comes to saving money,” said Nik Storonsky, founder and CEO of Revolut. “With the introduction of Savings Vaults, we can now offer our UK customers one of the most competitive rates in the country, with complete flexibility and protection.

“For us, this is another step towards our goal of democratising the financial services industry and providing much greater value than traditional banks. As we push into 2020, we have a host of new products and services on the way that will help our customers to spend, save and manage their money more effectively.”

Revolut partnered with WealthTech company Flagstone for the feature. Both Flagstone and Revolut featured on LinkedIn’s annual list of the top startups professionals want to work for in the UK in September.

This is only the latest feature to be added to the challenger bank’s offering. The Vault feature was launched in April 2018. Customers have since put aside over £1bn into the Vaults and 6,000 new ones are reportedly opened each day.

In December, Revolut announced that it would roll out a direct debit service in the UK.

The news about the new Savings Valuts comes as Revolut is reportedly eyeing funding that would take the unicorn’s valuation past the $5bn milestone. The close of the round is expected later in January.

Revolut announced in September 2019 that it was planning on hiring 3,500 new employees after securing a new deal with Visa. The deal would also support the company’s roll out across the Americas and Asia.

Copyright © 2020 FinTech Global