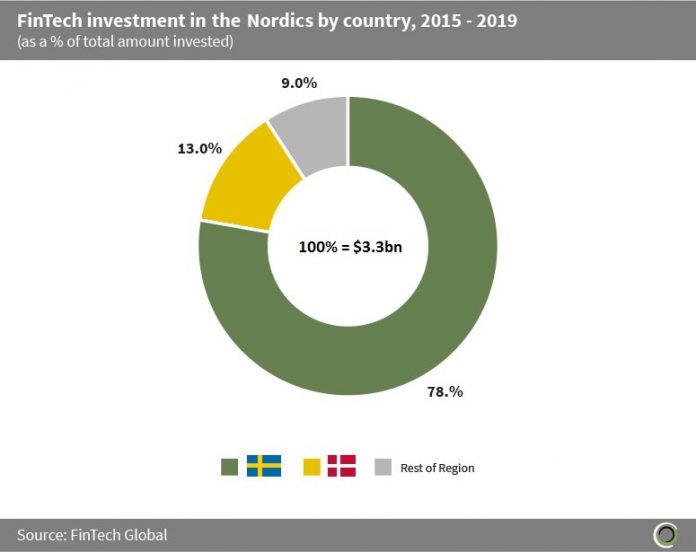

Only 9% of FinTech investment in the Nordics was raised outside of Sweden and Denmark

- Companies based in Sweden captured 78% of the nearly $3.3bn raised by FinTech companies in the Nordics between 2015 and 2019. This is unsurprising as Sweden has a population which is quick to adapt to new financial technologies and the country offers an education system that aims to combine novelty, design and engineering, making it one of the leading economies in the world for FinTech innovation.

- Companies based in Stockholm are spearheading the innovation efforts with 75.8% of total funding in the Nordics since 2015 being raised by companies in the capital. Stockholm is often referred to as a ‘unicorn-factory’ as it produces more billion-dollar companies per capita than any other region, second only to Silicon-Valley.

- The capital is also home to one of the largest privately held FinTech companies in Europe, Klarna, valued at $5.5bn as of August 2019. Funding raised by Klarna since 2015 alone accounts for 28.8% of the capital raised by companies in the Nordics during the period.

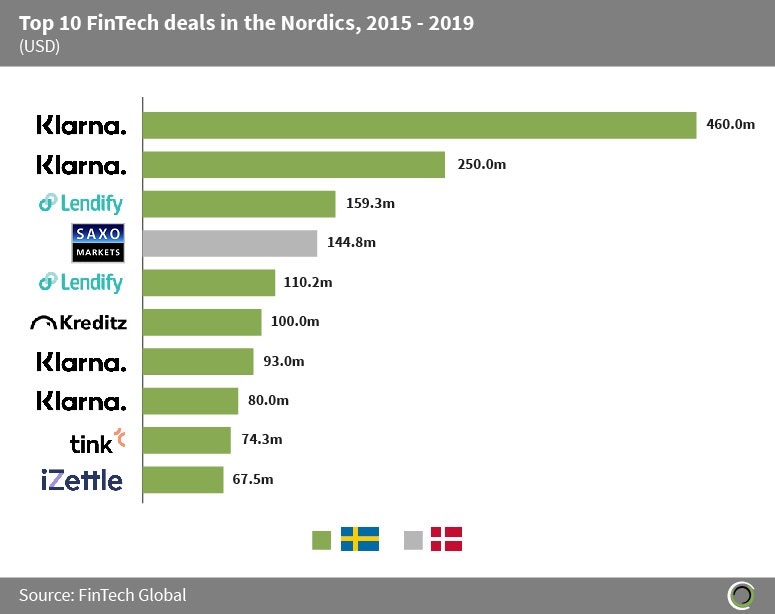

Nine of the top 10 FinTech deals in the Nordics since 2015 have been raised by Swedish companies

- Over $1.5bn has been raised in the top 10 FinTech transactions in the Nordics between 2015 and 2019, accounting for 47% of total FinTech investment in the region during the period.

- There has been little geographic diversity within the top 10, with nine transactions making the list raised by companies based in Sweden. All the Swedish deals to make the top 10 were completed by companies based in Stockholm.

- The largest round of the period went to Klarna, which took four spots on the list. The company, which provides payment solutions for online merchants enabling customers to ‘buy now pay later,’ raised $460m in Q3 2019 in a round led by Dragoneer Investment Group. Upon completion of the round, Klarna was valued at $5.5bn, making it the fourth most valuable FinTech company across North America and Europe. The new capital raised was used to continue the company’s rapid expansion in the US market following its partnership with H&M and ASOS in the region.

- The only deal to make the list raised outside of Stockholm was Saxo Market’s $145m secondary market round in Q3 2015. The company is a regulated bank which provides clients with access to multi-asset investing and trading. Sinar Mas Group led the round and acquired a 9.9% stake in the company upon completion of the round and the capital raised was used to spur Saxo Bank’s growth into the Asian markets.

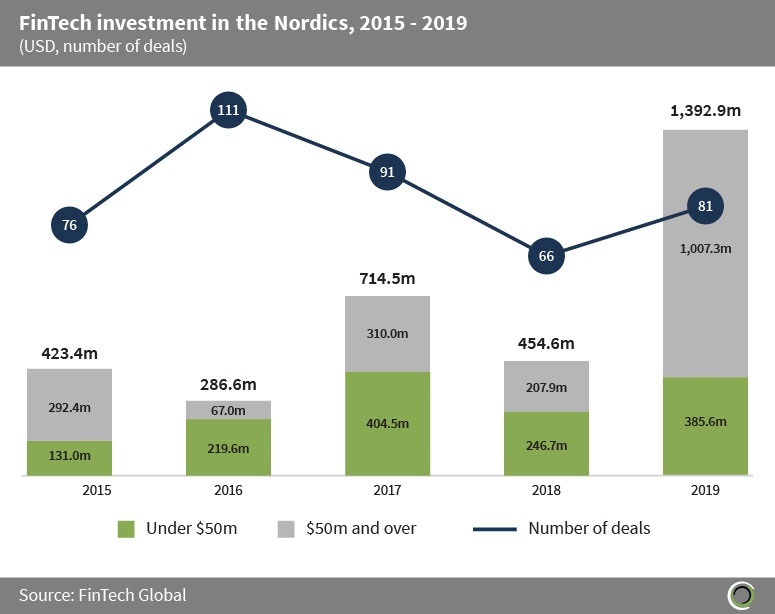

FinTech investment in the Nordics reached a new record of over $1.3bn in 2019

- FinTech companies in the Nordics have raised over $3.2bn across 425 deals between 2015 and 2019, with 42.6% of this funding being raised in 2019. Total amount invested each year has been up and down over the past five years but reached a record of over $1.3bn in 2019.

- Average deal size has increased over three-fold across the period from $5.6m in 2015 to $17.2m in 2019, as investors look to back already established players in the region looking to expand internationally.

- Deal activity was on the decline between 2016 and 2018 as the FinTech landscape in the region matures and investors back more later-stage deals rather than lots of smaller deals. However, in 2019 deal activity rebounded to a total of 81 transactions completed across the region.

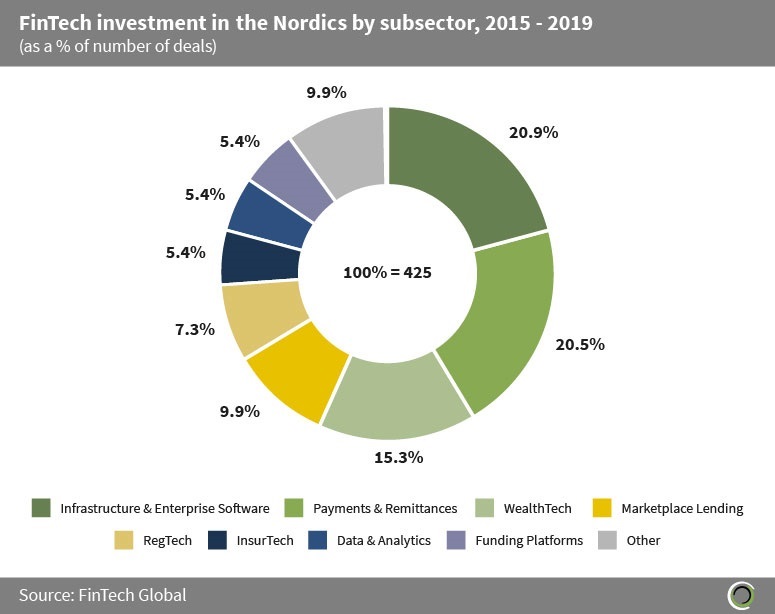

Investors in the Nordics have deployed capital across all FinTech subsectors since 2015

- FinTech deal activity in the Nordics has been widely distributed among all subsectors. With Sweden being seen as one of the most innovative countries in the world The Nordics is placed to become a global FinTech hub, hence investors are looking to diversify their portfolio of companies in the region.

- Infrastructure & Enterprise software companies attracted the largest share of deals in the region since 2015 with 20.9% of transactions raised by companies in the subsector. Tink, an open banking software platform raised four deals since 2015 with the largest being a $74.3m Series D led by Insight Partners.

- Payments & Remittances companies also captured a healthy share of deals, accounting for 20.5% of deals in the region during the period. This is unsurprising considering only 20% of payments in Sweden are made with cash and the Danish government have set a target to become cashless by 2030.

We are excited to partner with Stockholm Fintech Week to support the creation of a healthy FinTech ecosystem in Sweden. Get your tickets here and join us at the various events during the conference on 10th-14th of February 2020. Use code SFW<3FintechGlobal! for 10% off.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global