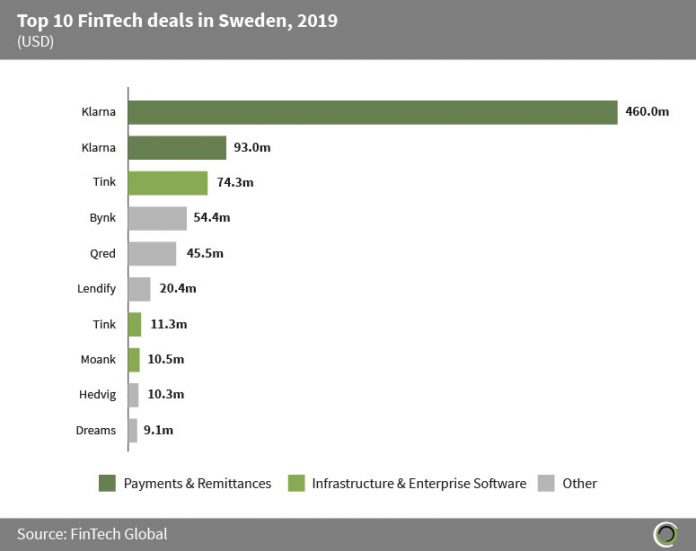

The top 10 FinTech deals in Sweden collectively raised $788.9m in funding, which accounts for 91% of total capital raised by FinTech companies in the country during 2019. According to Stockholm FinTech Guide, in the last few years Sweden has experienced its FinTech ecosystem expanding at a rapid rate. The report stated that the Swedish FinTech markets success is due to a combination of factors such as being a technology hub, having a highly educated population, supportive regulatory framework and financial system. The CEO of Instantor Simon Edstrom stated that the trust in their financial system combined with recording stable financial markets for decades has led to the demand for FinTech services in the country.

The Payments & Remittances subsector captured 70.1% of the $788.9m raised by the top 10 transactions, driven by one of Europe’s FinTech giants – Klarna. The Swedish payment provider raised $460m in a venture round led by Dragoneer Investment Group in August 2019. The company stated that the funding will be used to continue its expansion into the US, which is currently attracting 6 million new US clients annually.

Tink, a Swedish open banking platform, raised $74.3m in a series D round led by Insight Partners in February 2019. The company will use the funding to speed up its expansion in Europe and continue to invest in its data services. Tink’s series D round is the largest recorded Swedish deal in the Infrastructure & Enterprise Software subsector during this period.

Bynk, a Swedish based mobile loan company, raised $54.4m in a venture round in February 2019 from investors LMK-industri and Schibsted Growth, which is the largest Marketplace Lending company transaction during the period. The company will use the investment to expand in Europe and release new services such as peer-to-peer loans.

Of the top 10 FinTech transactions, three were raised by Infrastructure & Enterprise Software companies (Tink & Moank), two each from Payments & Remittances (Klarna), Marketplace Lending (Qred & Bynk), & WealthTech (Lendify & Dreams) companies, and one by an InsurTech (Hedvig) company.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global