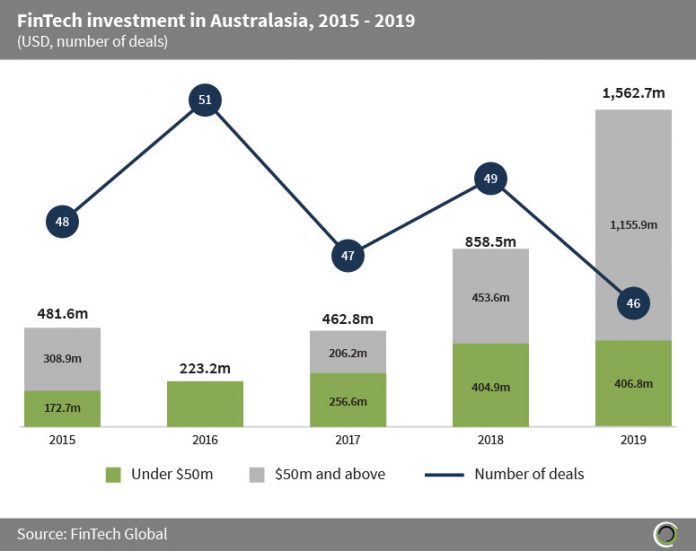

FinTech companies in Australasia raised $3.6bn across 241 transactions between 2015 and 2019, with Australian companies capturing 91.1% of the investment on the continent.

Funding in the region tripled during the period, which shows that the FinTech sector has been maturing. The development in the sector is most noticeable in the growth of capital invested in deals valued $50m and above, which increased by 3.7x since 2015. Transactions of this size are normally later stage funding rounds for FinTech companies looking to expand operations domestically, overseas, or to fund internal growth.

The Australasian FinTech market recorded no deals valued at $50m and above in 2016, which indicates that the transactions that year were all early stage deals (seed & angel rounds). Until then the Australian banking system was controled by four major banks with no competition which stifled investment into the sector. Then in 2017, the Australian regulator APRA suggested creating a “restricted bank licensing framework” to increase competition in the banking sector. The bank licensing framework was then introduced the following year and opened new market opportunities for investors, which explains the large increase in FinTech investment in 2018 onwards.

In terms of deal activity, the volmue of transactions stayed quite consistent only dropping by two deals between 2015 and 2019.