The UK is often hailed as frontrunner when it comes to challenger banks. However, only one of the leading brands has become profitable.

Rishi Khosla and Joel Perlman launched OakNorth, the challenger bank focusing on SMEs, in 2015. Six months later it had reached profitability.

This is a significant feat, given rivals like Revolut, Monzo and Starling Bank, who more often steal the headlines, are not profitable yet.

In a new interview with Wired, Khosla reveals that the key to the success was simply to avoid spending money that the company cannot get back.

“Some people just say ‘I’ve raised X, therefore I’ve got X to spend’. Our whole approach and perspective was different,” Khosla told Wired.

Instead of tapping into the resources of angel investors and venture capital firms, which would have forced them to negotiate away their equity, the founders initially used money from selling their previous venture, the research firm Copal Amba.

They then held that money tight, reinvesting as much of the money into the business and to do as much of the work in-house. For instance, he personally wrote OakNorth’s compliance manual.

That does not mean that OakNorth has not raised money at all from outside investors. For instance, it raised $100m in 2018 from investors EDBI of Singapore, NIBC Bank, Clermont Group, GIC, and Coltrane Asset Management.

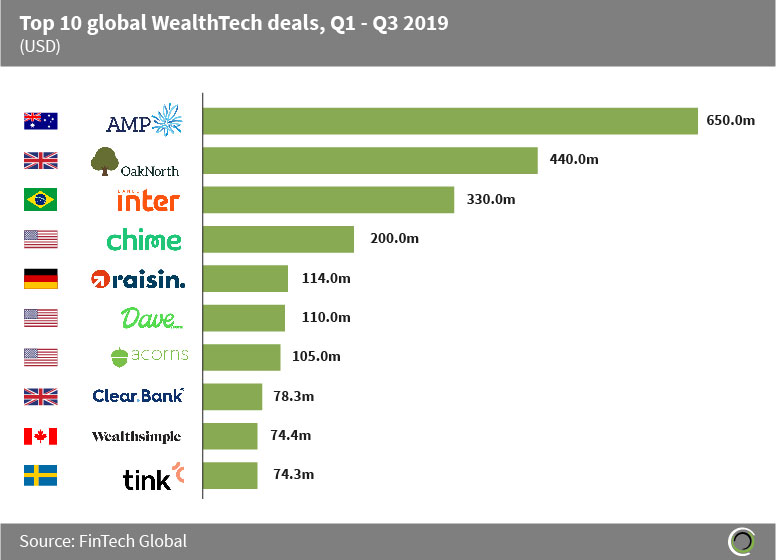

And in February 2019, OakNorth raised $440m from SoftBank Vision Fund and Clermont Group. The round gave the company a $2.8bn valuation. It was one of the ten biggest WealthTech deals in the world last year, according to FinTech Global’s data.

“The SoftBank money was really a call to say if we did raise this additional amount, could we go faster anywhere – and also, how much of a buffer would be nice to have,” he told Wired, saying it would create a safety net against macro-economic downturns such as a global recession. “It’s not like we have given a large percentage of the business away at an early point. We remain in control of our destiny,” Khosla added.

Taking a broader look at the UK challenger bank space, a new report from Accenture, the professional services company, has revealed that the sector is still growing. In 2019, the British industry had 19.6 million customers around the world, roughly three times more than the 7.7 million followers they had in 2018.

Copyright © 2020 FinTech Global