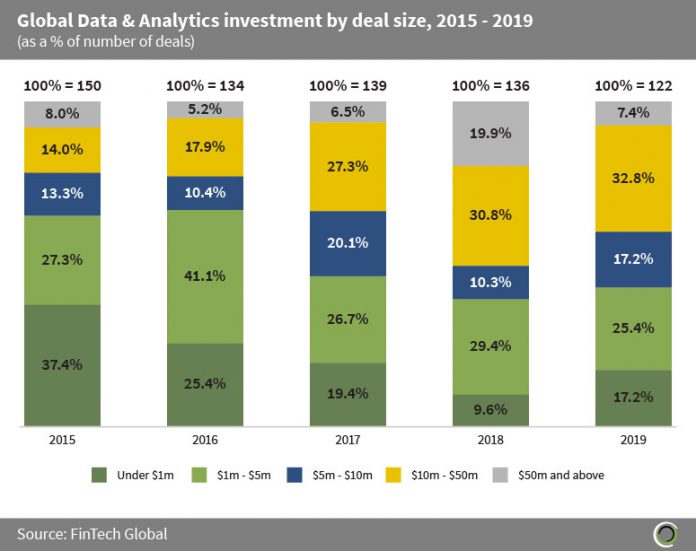

The volume of deals valued less than $1m dropped by more than half since 2015

- The number of Data & Analytics deals valued less than $5m dropped by 22.1 percentage points (pp), with investment moving towards later stage deals since 2015. The shift in investment towards larger transactions demonstrates the level of maturity and consolidation the the Data & Analytics subsector has undergone over the period.

- The sector is projected to continue to grow in the future due to the ever-increasing demand for Data & Analytics services worldwide. The main reason the subsector has matured moving towards later stage deals is due to the wide array of services it can provide to companies such as reducing expenses, identifying new business opportunities, improved quality control, and a better understanding of clients.

- In 2018, the subsector had an abnormally large share of deals valued at $50m and above nearly reaching 20% of total transactions that year, with a majority of this investment being raised by the more established US Data & Analytics companies.

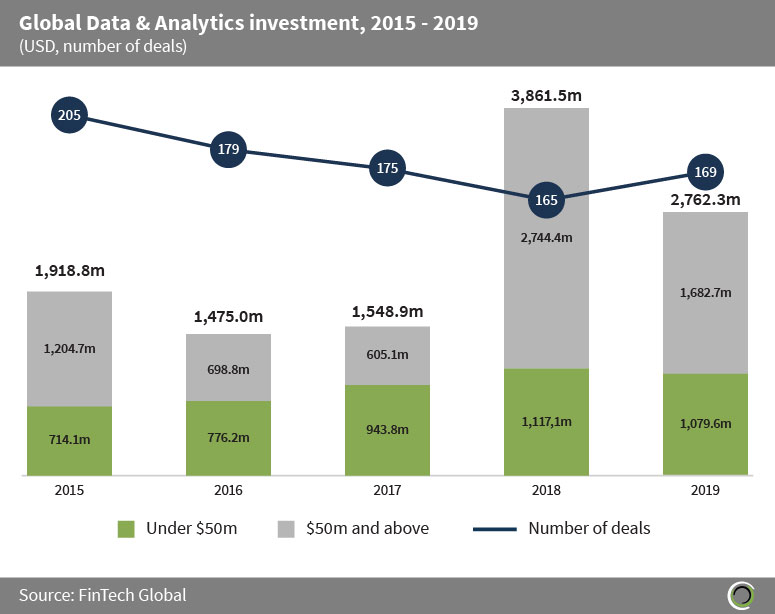

Data & Analytics investment dropped by more than a third in 2019 due to less funding coming from deals over $50m

- Data & Analytics companies raised more than $11.5bn globally across 893 transactions, with number of deals gradually declining from 2015 to 2019. As the more established companies become more dominant in the market the size of funding rounds get larger as investors back consolidation.

- Investment in the subsector dropped by 28.5% in 2019 compared to the previous year, with most of this decreased investment originating from deals valued at $50m and above. The drop in investment for large size transactions ($50m and above) was due to the abnormally high number of funding rounds in that size bracket in 2018.

- However, despite the drop in investment during 2019, the subsector has greatly matured throughout the period, with the average deal size almost doubling from $12.8m in 2015 to $22.6m in 2019.

- Investment in deals valued less than $50m has remained consistent throughout 2015 and 2019, which shows the stability of the Data & Analytics subsector by consistently experiencing new entrants in the market.

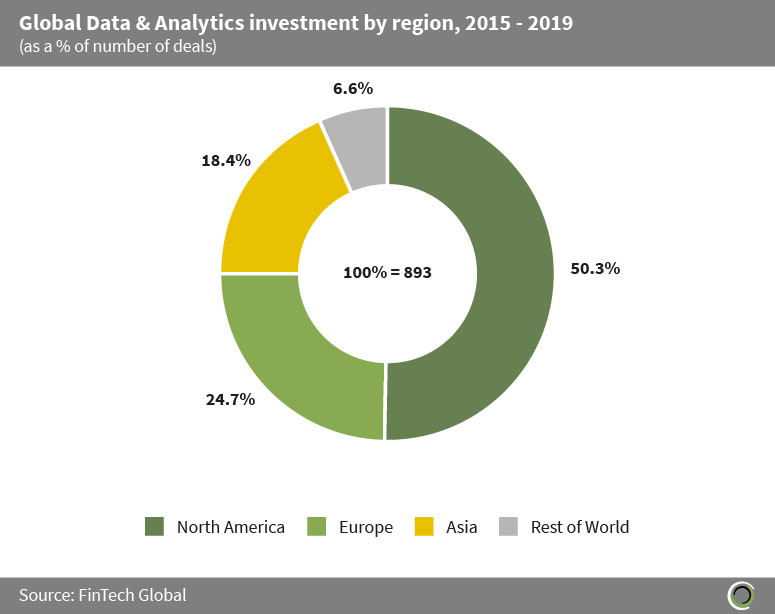

North American Data & Analytics companies captured more than half of global deal activity since 2015

- North American companies accounted for 50.3% of global transactions in the Data & Analytics subsector between 2015 and 2019, with US companies capturing 93.3% of North American deal activity during the period. An explanation for the region’s success stems from its strong access to investors (Venture Capitalists) and being home to the world’s leading technology hubs such as Silicon Valley.

- The European Data & Analytics companies received 24.7% of global deal activity since 2015, with UK companies accounting for 43.2% of the continent’s transactions. The growing usage of cloud computing, data generation, and increased connectivity will lead to future growth in the Data & Analytics industry for Europe and the rest of the world in order to keep up with the data eruption.

- Asian companies in the subsector captured 18.4% of global transactions between 2015 and 2019. Wecash, a Chinese online credit assessment company, raised $160m in a series D round led by ORIX Asia Capital and Sea in March 2018, the largest Asian Data & Analytics funding round to date. The company used the funding to expand its service portfolio and to widen the application of their AI capabilities.

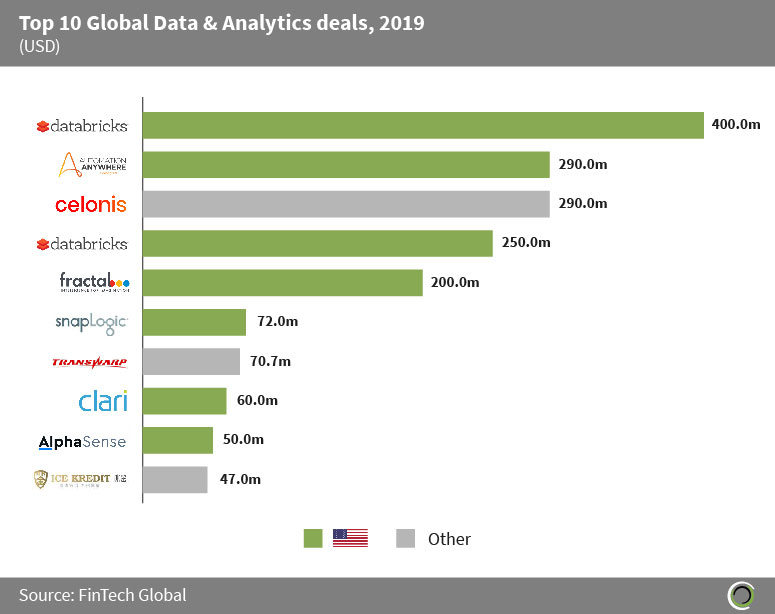

Seven of the top 10 global Data & Analytics deals were raised by US companies in 2019

- The top 10 Data & Analytics deals collectively received over $1.7bn in funding, with seven of these transactions being raised by US companies (Databricks, Automation Anywhere, Fractal Analytics, SnapLogic, Clari, and AlphaSense).

- Databricks, a US data analytics SaaS company, raised $400m in a series F round led by Andreessen Horowitz in October 2019, the largest Data & Analytics deal globally. The company will use the funding to build engineering team to further advance their open source technology, invest in the European Development Centre in Amsterdam, and expand in Africa, Asia Pacific, Latin America, Europe, and the Middle East.

- Celonis, a German market leader in AI enhanced process mining and excellence software, raised $290m in a series C round led by Arena Holdings in November 2019. The company plans to use the funding to further invest into their sales and marketing efforts, whilst also expanding their platform.

- The Rest of World category contains one Data & Analytics company operating in Germany (Celonis), and two in China (Transwarp and IceKredit).

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global