Cryptocurrency exchange Binance will roll out peer-to-peer (P2P) trading for Brazilian Real, Argentine Peso, Colombian Peso, Mexican Peso and Peruvian Sol just weeks after digital money was tied to crime in the region.

From now on, Binance users can buy and sell bitcoin, etherum, tether, Binance coin and Finance USD using these five Latin American currencies without having to pay any transaction fees on the Binance P2P platform.

The platform also offers an escrow service that it claims ensures that 100% of the digital money will be sent to users’ wallets.

“Latin America is one of the most active regions for cryptocurrency trading and peer-to-peer trading is widely used in the Latin American community,“ said Changpeng Zhao, CEO of Binance. “To better serve our users’ large demand for crypto, we are offering an open marketplace with the best P2P trading experience.”

Launched in October 2019, Binance’s P2P platform has supported six fiat currencies and attracted over 100 merchants globally to offer fiat-to-crypto trades.

Binance’s Latin America launch comes just weeks after IntSights, the threat intelligence company, and CipherTrace, the leader in cryptocurrency intelligence, released a report suggesting that cryptocurrencies play a massive role in turning the region into a haven for cybercrime.

The Dark Side of Latin America: Cryptocurrency, Cartels, Carding, and the Rise of Cybercrime study suggested that digital money contributed to the rising tide because criminal networks use the technology to launder money.

“LatAm cybercriminals are operating almost exclusively through unregulated cryptocurrency exchanges, capitalising on the anonymity cryptocurrency offers,” said Pamela Clegg, director of financial investigations and education at CipherTrace, at the time. “While these exchanges are popular, some bad actors still use trusted networks or illegal peer-to-peer exchanges to launder their cryptocurrency. Although this method is not novel, it is evolving with the introduction of cryptocurrencies in the criminal underground and is enabled by widespread political corruption in many countries.”

The report is not the first one to tie cryptocurrencies to crime.

When Chainalysis, the crypto researchers, traced $2.8 billion in bitcoin being moved from criminal entities to exchanges in 2019, it found that over 50% went to the top two exchanges Binance and Huobi. The researchers did note that it was only a small fraction of the total amount of transactions being processed by these crypto exchanges.

In August 2019, Neil Walsh, chief of the Cybercrime and Anti-Money-Laundering section of the United Nations’s Office on Drugs and Crime, argued the anonymity provided by many cryptocurrencies made it even more difficult to bring in criminals before justice.

“It’s what makes it really hard for cops and investigators to manage some really big risks because in the past when we looked at some of those really big threat areas, like kids getting abused online, it had to be paid for and now with the use of cryptocurrencies it is exceptionally difficult for [investigators] to track that and try to manage that risk,” he said.

Authorities around the world are of course of the threat of cryptocurrencies being used to launder money and other criminal ventures. Therefore, countries like the US, the UK, Estonia, Switzerland and others have made their laws stricter in regards to digital money.

Of course, that by no means mean that all cryptocurrencies are being used with nefarious intent.

There are many legitimate reasons to invest in both cryptocurrencies and blockchain ventures.

And many people are indeed doing so.

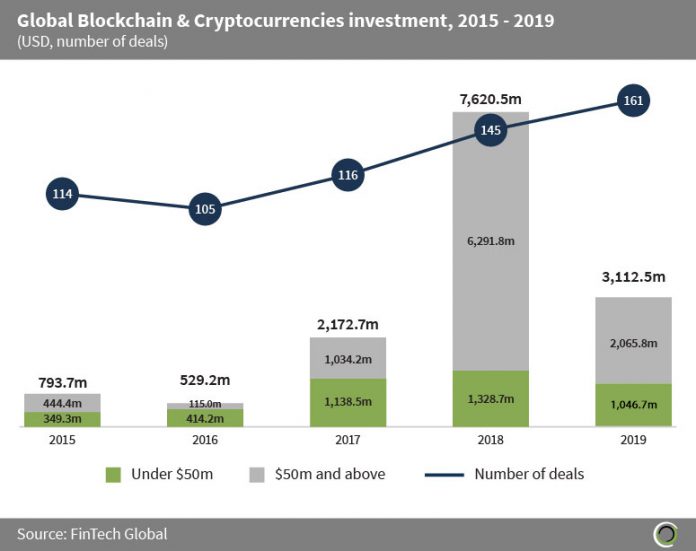

According to FinTech Global’s data, blockchain and cryptocurrency companies collectively raised over $14.2bn in global investment across 641 transactions between 2015 and 2019.

Investment in the global sector jumped from $793.7m in 2015 to $7.62bn in 2018 to then shrink to $3.11bn in 2019. The slowdown occurred at the same period when major cryptocurrencies traded way below their historical peaks.

Investment in the global sector jumped from $793.7m in 2015 to $7.62bn in 2018 to then shrink to $3.11bn in 2019. The slowdown occurred at the same period when major cryptocurrencies traded way below their historical peaks.

Copyright © 2020 FinTech Global