US-based DriveWealth will give access to its digital trading technology to UAE-based WealthTech company Wealthface.

This is DriveWealth’s first initiative in the Middle East and North Africa (MENA) region, bringing the firm’s technology and brokerage execution services to one of the region’s first investment robo-advisors.

Employing DriveWealth’s proven technology, Wealthface will offer U.S. stock market access to a wide range of regional investors with varying investment amounts. Wealthface clients will also be provided access to fractional shares in familiar U.S. brands, an offering that DriveWealth has pioneered.

“We are truly pleased to help Wealthface – an innovator in the MENA region – bring investors affordable, robust access to the U.S. markets,” said Robert Cortright, CEO of DriveWealth. “This partnership is a great opportunity to establish our first presence in this important region, and we’re delighted to continue on our geographic expansion.”

Wealthface founder and CEO Bilal Majbour seemed equally excited about the partnership. “Our partnership with DriveWealth is a significant manifestation of our vision to make the US equity market accessible to everyone everywhere,” Majbour said.

“We want to enable all types of investors to access investment solutions previously unavailable to online investors using our cutting-edge technology at a low cost. In addition, we are committed to offering value-added services to millions of customers in the Middle East and North Africa region. DriveWealth is the ideal partner to help launch our offering to regional clients using the latest and most innovative technologies.”

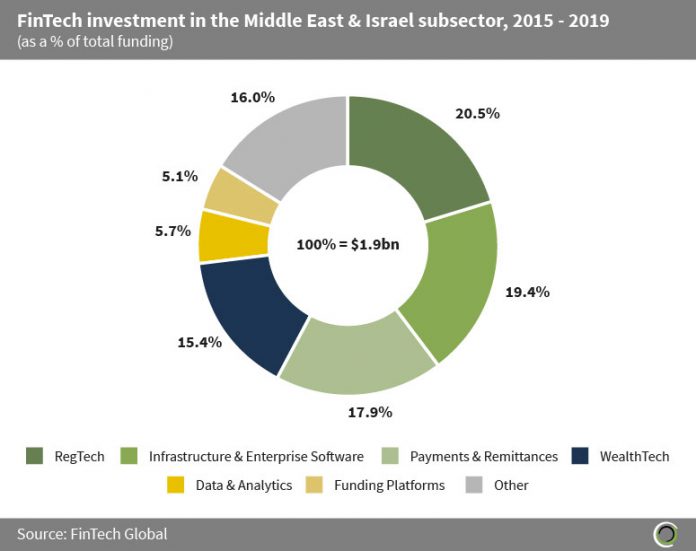

WealthTech is the fourth largest FinTech sector in the Middle East in terms of investment, according to FinTech Global’s research.

WealthTech made up 15.4% of the total FinTech investment flowing into the region between 2015 and 2019. In comparison, RegTech, infrastructure and enterprise software, and payments and remittances companies attracted 20.5%, 19.4% and 17.9% respectively during that period.

Copyright © 2020 FinTech Global