UK challenger bank Revolut is now live in the United States and already has tens of thousands of customers lined up in the nation.

Having originally aimed at launching stateside in the end of 2018, the neobank has faced a lot delays mainly due to it not having secured a banking licence as of yet.

However, last year it began to hint again that it was about to go across the pond soon. The rumours were then supported with the hiring of Ronald Oliveira as its new US chief executive.

Now, following a massive $500m funding round in February that pushed the neobank’s valuation past the $5.5bn mark, Revolut is live in the US.

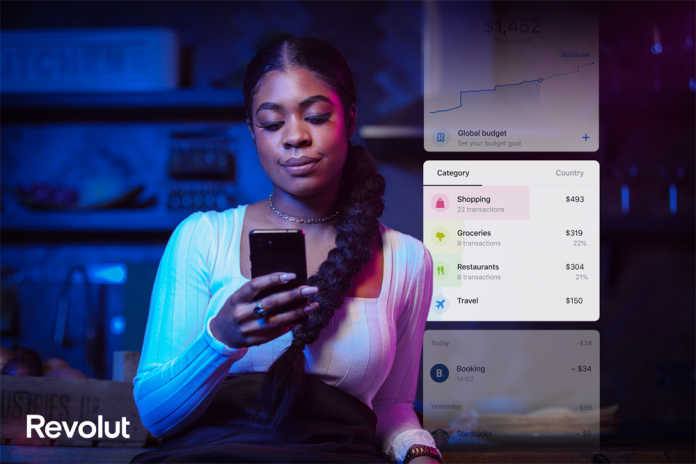

At the launch, American customers can set up a Revolut account in minutes from their smartphone. Once they have downloaded the app for iOS or Android, customers simply need to enter their personal information and upload their identification documents. After that, their account should then be verified within a matter of minutes.

Once approved, users will receive their new account details, which can then be used to make payments and deposit a salary. Customers in the US will have their deposits insured by the Federal Deposit Insurance Corporation (FDIC). Deposits up to the value of $250,000 will be insured through a partnership with Metropolitan Commercial Bank.

Moreover, customers are also able to get their salary up to two days in advance via direct deposit.

?As the cost of living increases disproportionately to people take home salaries, now more than ever, people need to know exactly what is coming in and out of their account. They should have the tools to help them manage their money more conveniently and accurately,said Nikolay Storonsky, founder and CEO of Revolut.

Other features available at the launch includes bill splitting options, the option to round up all transfers to the nearest dollar and spare the change, freeze and unfreeze cards, and sending and requesting money from other users.

Moreover, US customers can also spend and transfer money globally at the interbank exchange rate, hold and exchange 28 currencies in the app, and withdraw cash from over 55,000 ATM machines in the United States and globally without fees.

?When spending or transferring money overseas, most people are unaware of the hidden fees that banks are charging them,said Storonsky. ?The world is becoming more connected, and financial services should be supporting this notion, not hindering it.p>

The news about the US launch was slightly dampened by rumours spreading across the Twitterverse about Revolut and its UK rival Monzo might be about to go bust due to the coronavirus outbreak. Storonsky and Monzo CEO Tom Blomfield have both denied that either of their businesses are on the brink of collapse.

Copyright ? 2020 FinTech Global