Credit card payment company Plastiq has attracted $75m in fresh capital to grow its team, develop more solutions and help small businesses to pay their suppliers, which may be getting trickier during the coronavirus crisis.

B Capital Group, the investor that recently supported Payfazz’s latest raise, led the Series D round. Other investors included Brex backer Kleiner Perkins, Roofstook investor Khosla Ventures, Accomplice and Top Tier Capital Partners.

With the new money, Plastiq has raised more than $140 million, including a $27m round in 2018.

The terms of the raise was already agreed upon at the end of last year, but the company timed the announcement to coincide with the US tax season, according to TechCrunch.

However, the timing might have be particularly good for the company due to the coronavirus outbreak.

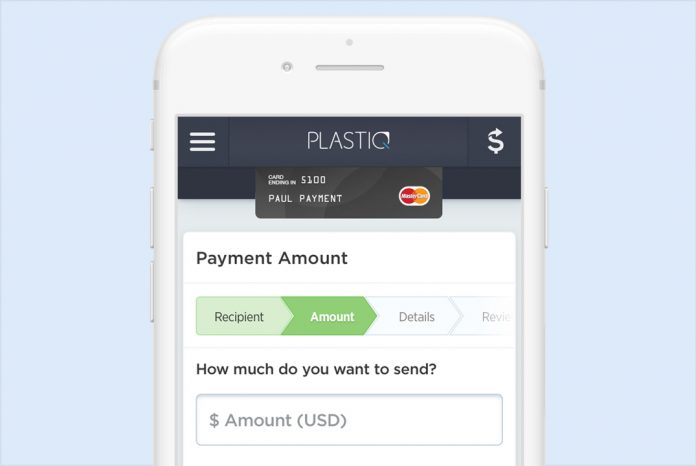

Plastiq’s works as a middleman for users looking to use their credit cards to pay for bill, which is not something every vendor and organisation accepts. Users can enter their credit card details and Plastiq will pay the bill and charge 2.5% of the money to do so.

This, the company argued, gives SMEs a reliable cash flow even in seasons when they may not have as much business or, as is the case now, when they are dealing with the impact of a global pandemic.

“Our customers are more thankful for solutions like ours as traditional sources of lending are drying up and not as easy to access” Eliot Buchanan, CEO and co-founder of Plastiq, told TechCrunch. “Hopefully, we can measure how many businesses make it through this because of us.”

Copyright © 2020 FinTech Global