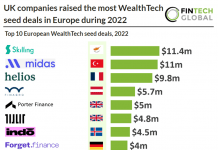

Icelandic challenger bank indó has secured €1m in its seed funding round, as it progresses with its banking license application.

The company, which claims to be the first challenger bank in Iceland, raised the funds across three rounds, with the last one having over 30% excess demands. The round was made up primarily of unnamed angels and private individuals.

This fresh equity will be used to support indó’s banking license application process, as well as enhancing its technology suite.

indó is currently in the middle of getting its banking license from the country’s financial regulator Fjármálaeftirlitið (FSA).

The challenger bank will provide consumers with a current account which has no annual fees and boasts full transparency.

indó co-founder Tryggvi Björn Davíðsson said, “We saw an opportunity to offer a banking service that is cheap, simple and puts the customer first,”. “We’ll offer a debit card account that is 100% safe and with much better interests than the market currently offers. We will launch with an app that is simple, convenient and fun.”

There have been a number of challenger banks to close funding rounds this year. UK-based Revolut recently hit a $5.5bn valuation after it closed a $500m Series D.

Copyright © 2020 FinTech Global