On the back of closing a €1m seed round, Icelandic challenger bank indó is almost ready to go live.

A bunch of “crazy gamers, marketing people and bankers” are reinventing banking in Reykjavik. The ragtag team of developers and financial experts have come together to create Iceland’s first challenger bank indó in an effort to rebuild trust in the banking industry. While the plan was to make it go live this summer, the coronavirus has slammed the breaks on the rollout and on normal life around the globe. Although, that may not be a bad thing.

The idea behind indó was simple: rebuild the trust in the banking industry. The FinTech startup has its job cut out for it as Iceland was hit particularly hard by the global recession. In the aftermath of the financial meltdown, all three of the country’s major private commercial banks defaulted. Now, another crisis could be just the thing to prove the need for the new neobank. “We think there’s more need and more awareness from people who want to make sure their money is safe,” says Tryggvi Davidsson (pictured left), co-founder and COO of indó, adding that the 900 people on its beta waiting list has to wait until “the markets open up again” for them to enjoy the full scope of the challenger bank’s services.

indó can afford to wait. The venture closed a €1m seed round in April to fund the development of its platform and to clear out the last obstacles of it being granted a banking licence from Iceland’s financial regulator Fjármálaeftirlitið. “We have a long runway and we think there will be more demand for our product once the markets open up,” Davidsson says.

The capital injection is the culmination of two years of grit from Davidsson and his co-founder and childhood friend Haukur Skúlason (pictured right), indó’s CEO. They founded the neobank in the summer of 2018. By then, Davidsson had clocked up over a decade’s worth of experience in the banking industry, first at Barclays and later as managing director at Íslandsbanki. During that time, he’d been convinced that banks had to change to become safer and more consumer-centric. He was equally certain that this change was impossible to kickstart from the inside. Established banks were just too big. “Changing the direction of that oil tanker is very difficult,” he argues. Skúlason shared his diagnosis, having also worked in the banking and financial sector for over a decade.

Rather than changing it from the inside, they decided to launch a bank of their own. From the outside, indó looks like just another Revolut or Monzo with it having no physical branches and only existing through an app. Like its rivals, it will offer accounts, credits cards and all the other nuts and bolts customers have learned to expect from neobanks.

However, the bank is very different on the backend. “When you want to build a bank, you want to become a powerhouse,” Davidsson says. “You want to be the centre of deposits and you want to be the centre of loans. And that’s because that gives you a lot of power. Now, we basically turn it around and say, let’s create a bank that has no power at all.”

What that means, more specifically, is that it will invest all money saved in its account in government securities to make the bank as safe as possible. By doing so, he argues that the bank will not be the centre of power, but that all the power will remain with the customer. “We’re looking to create the least powerful bank in the world,” he says.

It was with that vision in mind that they began to work on their new project in April 2018. Over the next months they worked from home, in cafes and in the National Library to create their business plan and to began to approach investors for an initial capital raise. They eventually raised €300,000 from Eldhrímnir and a close circle of friends and family.

They also recruited a team of engineers who had previously worked at the popular video game company QuizUp. “[They] had built one of the most successful gaming apps that has been created out of Iceland,” Davidsson says. “It had about 80 million users, I believe, at some point.” The QuizUp team had ended their previous project in 2015 and had also looked into developing a challenger bank. While they definitely had the technological knowhow to build the platform, they lacked experience of the banking sector. For Skúlason and Davidsson it was the other way around. “So it’s like a match made in heaven,” he says.

Once launched, indó’s plan is to establish the FinTech in Iceland. “Our intention is to build a bank, which is very cost effective, will be sustainable in operations, based on the domestic market and our core product will be a 100% safe bank account,” he says.

indó is hardly alone. Several Nordic challenger banks have launched in recent years. Danish Lunar extended its Series B round by adding €20m to its coffers in April 2020 after having originally raised €26m in the round in August 2019. Lunar is live in Denmark, Sweden and Norway. Similarly, Swedish rival Northmill was granted a banking licence in September last year. Rocker, formerly known as Bynk, raised $54.4m in Sweden in 2019.

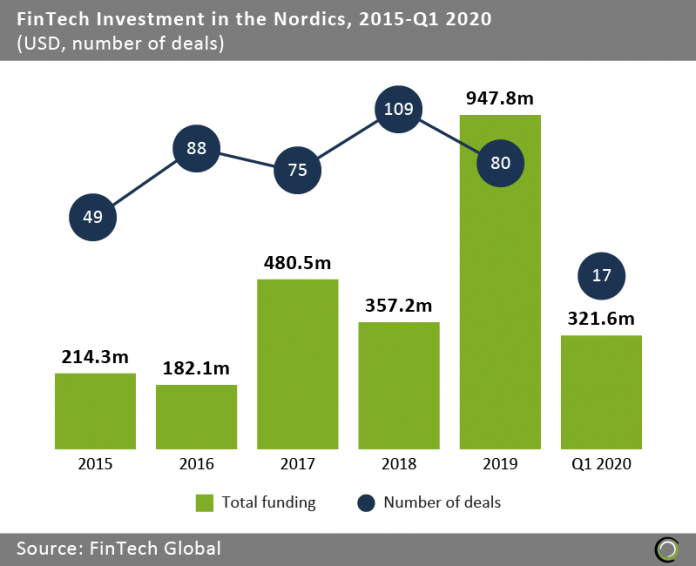

These raises comes at a time when FinTech investments in the Nordics have gone from strength to strength. Over the past five years, the region’s FinTech industry has gone from attracting $214.3m in 2015 to seeing an influx of fresh capital to the tune of $947.8m in 2019, according to FinTech Global’s research. In the first quarter of 2020 alone, $321.6m was injected into the region.

With that in mind, one would assume that the Scandinavian neighbours would be the next destination for indó. But while Davidsson agrees that the Nordics have a certain allure, he adds that you might be missing the point if you think going into the region is the best next step after indó has established itself in Iceland.

With that in mind, one would assume that the Scandinavian neighbours would be the next destination for indó. But while Davidsson agrees that the Nordics have a certain allure, he adds that you might be missing the point if you think going into the region is the best next step after indó has established itself in Iceland.

The whole idea, he argues, is about creating trust. “[So you might] start thinking [about] which countries have [a] lack of trust towards the banking system,” he explains. “In which countries [is there] an increasing need for safety and [where people need] access to their money and in which countries [is the old] banking system very costly and impose high costs on their depositors? [In] my view these countries would be the ones that indó would step into next.”

That being said, he agrees that the Danske Bank money laundering scandal that has swept across the Nordics and the Baltics over the past few years have created a vacuum of trust that could eventually become perfect for indó to step into. “So will be interesting to where the next step would be for us,” Davidsson says. “I don’t necessarily see it as a next step [for us] to go to Nordics. It’s possible it is what I want to do now, but then you would need to see that there is there’s a demand in the Nordics for a fully transparent and safe bank.”

But for now, Davidsson and his team is focused on rolling out indó across Iceland in its campaign to rebuild trust in the banking sector.

Copyright © 2020 FinTech Global