The European neobank app updates are coming fast right now with Revolut unveiling the latest version of its app just days after Dutch rival bunq did the same.

UK challenger bank Revolut’s new 7.0 app release is said to be reimagining and redefining what the FinTech unicorn can do for customers around the world. It said the redesign was aimed at boosting the safety and ease of which its customers can manage their financials in a more intuitive way.

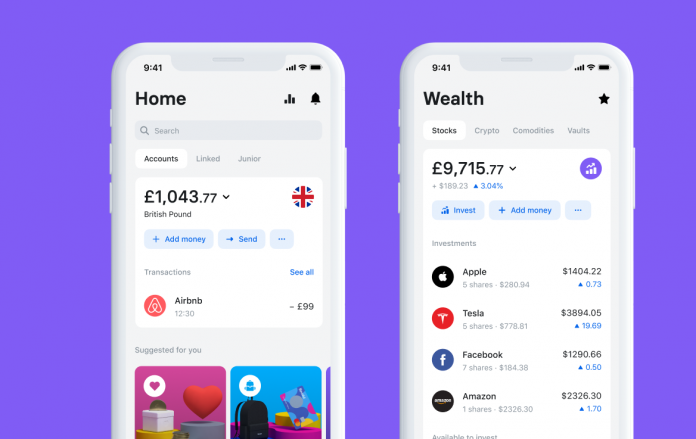

It does that by splitting its customers daily essential financial needs into two main sections: Home and Wealth.

The Home is designed to make it easier to stay on budget for customers linking their Revolut accounts and other open banking linked accounts to budgeting and analytics tools.

The new Wealth section brings together stocks, crypto, commodities and vaults to help customers easily save, invest and manage their money at the touch of a button.

Customers can save effortlessly with interest paid daily into their Savings Vault, or choose to stash away cash, together with a Group Vault. Revolut said it has made investing more accessible, with trading access to global companies, cryptocurrencies, and commodities from just $1.

The Rewards feature provides customers with a curated selection of cashback offers and discounts from top brands to help give their balance a boost.

Over the next few months, Revolut will roll out a smattering new products across several markets to help customers get more from their money, including more personalisation and products to help customers manage their subscriptions. In the meantime, customers can update their Revolut app to the latest version now to start exploring.

The announcement of the updated version of the app comes just days after bunq, the Dutch challenger bank, revealed its latest iteration of its platform on Friday. The update included new charity versions aimed at making it easier for customers to support small businesses struggling because of COVID-19.

Of course, Revolut has also upped its charity contribution lately, having teamed up with the Trussell Trust foodbank network and Medecins Sans Frontieres (MSF) in March and April in a bid to help those suffering from the global pandemic.

Yet, as FinTech Global has reported in the past, the coronavirus could benefit the digital-first bank. The challenger bank’s co-founder and CEO Nikolay Storonsky has told the Financial Times that he’s seen “a real opportunity” to use money from the neobank’s $500m investment round earlier this year to acquire competitors who are suffering due to the pandemic. As a side note, the raise saw Revolut’s valuation increase to $5.5bn.

Revolut is planning to use that money to buy startups in areas such as travel aggregation, which would enable the unicorn’s customers to buy flight tickets or rent cars through the app.

Many startups in that sector are under pressure due to the coronavirus, with many of their investors being reluctant to give them more money because of the crisis. As FinTech Global has reported in the past, this is a situation that a lot of the FinTech industry could find itself in as the virus takes its toll on the markets.

Copyright © 2020 FinTech Global