UK-based international money transfer FinTech TransferWise has announced that it may start to offer investment products in the future after picking up a new licence.

That means that companies in Britain could soon be able to make the money they’ve deposited into TransferWise work for them, TechCrunch reported.

Although, TransferWise has so far not given away any details about what the potential investment product would look like.

Although, the FinTech firm did say that up to £85,000 of money held as investments within a TransferWise account will be protected under the Financial Services Compensation Scheme and that the offering is slotted to be launched within the next year.

TransferWise co-founder and CEO Kristo Käärmann told TechCrunch that the company has no plans of getting a banking licence and join the smattering of neobanks like Revolut and Monzo that already hail from the UK. He even criticised the current model used by many banks.

“I do think the way current accounts work with banks is not sustainable in the long term,” Käärmann said. “That the money we keep in banks is being lent out to mortgages and business loans and overdrafts and so on, yet the customers holding that money, they’re not really getting much benefit from it. So why do it?” he asks, somewhat rhetorically.

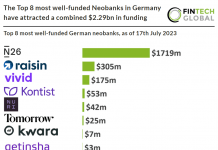

The news comes on the back of TransferWise extending its partnership with German challenger bank N26, enabling the neobank to offer more options for foreign currency transfers. Now available in over 30 currencies, the digital bank said that it has also enhanced the in-app design for a more transparent customer experience.

In March, TransferWise announced that it had teamed up with Alibaba-owned Alipay. The partnership was set up to give Chinese customers new ways of sending and receiving money. All users need to send is the intended recipient’s name and Alipay ID.

Copyright © 2020 FinTech Global