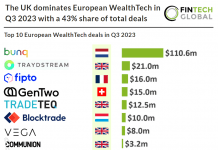

Stocktrading app Robinhood has scraped its plans to expand to the UK. Now, the founder of bunq is concerned that it could just be the first FinTech to up sticks.

Ali Niknam is the CEO and founder of bunq, the Dutch neobank he founded back in 2012. While it may have been founded in the Netherlands, he recently told FinTech Global that the challenger bank has always had international ambitions. In fact, he initially thought that the UK would be the first European nation bunq should expand to.

However, when the referendum on the UK’s membership of the EU happened in 2016 Niknam was hesitant that the country would be a good fit for international FinTechs. Still, the digital-first bank did jump across the English Channel and set up shop on the British Isles in October 2019.

Nevertheless, recent developments have made Niknam worried about the FinTech ecosystem of the UK.

“Part of the beauty of FinTech is its global potential,but the uncertainty caused by Brexit, then compounded by coronavirus, has caused obstacles in Britain’s global reputation as a financial hub,” said Niknam. “Just yesterday, US FinTech Robinhood announced that it will be scrapping its UK launch and this may be the first company that starts a trend.”

He is not alone in being worried. Four out of five financial leaders across the Europe are worried that the pandemic could cause a recession and that Brexit should be delayed until the situation has been properly handled, according to a recent survey by Coupa Software, the business spend management firm.

The same survey showed that 32% of British financial leaders believe that Brexit should be delayed for more than a year. Those figures were 31% and 21% in France and Germany respectively.

These concerns are nothing new, with FinTechs having expressed their concerns about Brexit long before the Covid-19 pandemic broke out.

For Niknam, these concerns are something the UK government must take seriously going forward.

“Many companies are concerned about the longevity of staying in the UK or indeed breaking into the UK market and Ron Kalifa, [non-executive Director on the Bank of England’s court of directors], needs to urgently evaluate the FinTech sector’s needs to ensure Britain maintains its attractiveness, competitiveness and a global reputation for financial innovation,” he said.

“I hope the UK government put serious consideration and effort into ensuring the financial landscape remains attractive for global FinTechs, so they are able to continue to invest and remain in the UK.”

Copyright © 2020 FinTech Global