Robinhood pulled the plug on its UK expansion this week. Now, some fear that other FinTechs will also leave the nation.

Guillaume Pousaz is proud to call London the home of Checkout.com. “The UK, and in particular London, remains a great place for FinTechs to both launch and expand into,” says the founder and CEO of the FinTech unicorn. “It remains a centre of finance and technology in Europe and no other city can claim the attraction and energy it does.”

Add to that a tech-savvy customer base as well as an innovative ecosystem of new startups and it’s easy to see why the nation has long kept its position as the FinTech leader of Europe. “The UK is not only the birthplace of FinTech, but has continued to demonstrate its ambition over the last 20-plus years,” says Fiona Roach-Canning, co-founder and chief marketing and product officer at Pollinate International, the software business connecting merchant to banks.

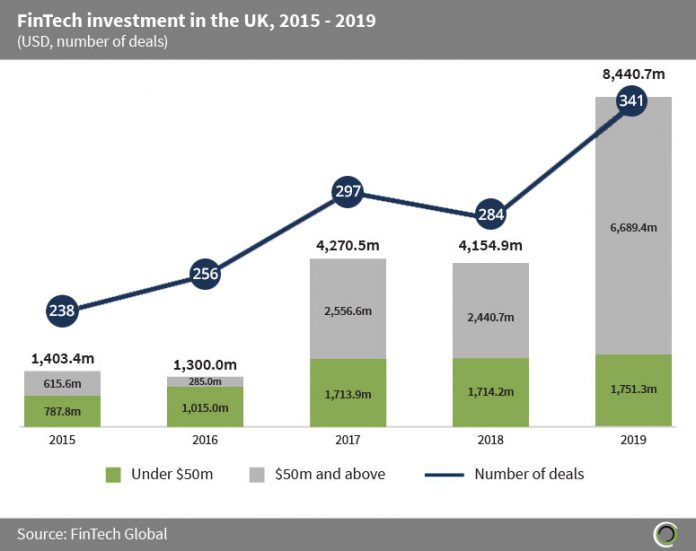

In fact, the amount of capital getting pushed into the country’s industry grew six-fold in the last five years. Back in 2015, investors injected $1.4bn into UK FinTech ventures. That number grew over the next few years with the ecosystem receiving $8.44bn in 2019 alone. By all accounts then, the British FinTech industry should be thriving. So why are some people worried about the nation losing its shine?

These concerns came to the forefront of the conversation this week when US stocktrading platform Robinhood scrapped its plans to expand to the UK. It had previously acquired a license to operate in the country and had even opened a waitlist in November 2019. However, it has now binned the plans, apparently to better focus on its home market.

These concerns came to the forefront of the conversation this week when US stocktrading platform Robinhood scrapped its plans to expand to the UK. It had previously acquired a license to operate in the country and had even opened a waitlist in November 2019. However, it has now binned the plans, apparently to better focus on its home market.

For bunq founder and CEO Ali Niknam, Robinhood’s abandonment of its expansion plans for the British Isles represents a growing concern about the nation losing its attraction for FinTechs. “Many companies are concerned about the longevity of staying in the UK or indeed breaking into the UK market,” Niknam said earlier this week, urging the government to “put serious consideration and effort into ensuring [that] the financial landscape remains attractive for global FinTechs, so they are able to continue to invest and remain in the UK.”

Two huge factors are at the forefront of these worries: Brexit and Covid-19. Starting with the UK’s exodus of EU, FinTechs have expressed their trepidation about the divorce process for years. Regulatory and market uncertainty as well as access to the European markets are the chief issues they have worried about.

The global pandemic has exacerbated the anguish felt about the market uncertainty. Even though the country has opened up some of the economy, the UK is still under semi-lockdown. While Boris Johnson has expressed bullishness that everything could basically be back to normal by Christmas, no one truly knows when the pandemic will be over.

Because of this uncertainty, four out of five financial leaders across Europe are worried that the pandemic could cause a recession, according to a recent survey by Coupa Software, the business spend management firm. Therefore, they want to delay Brexit until the situation has been properly handled. The same survey showed that 32% of British financial leaders believe that Brexit should be delayed for more than a year.

Still, regulatory concerns are not the only thing worrying businesses which could lead to a FinTech exodus. “The pull-out will largely be driven by immigration concerns, followed by moves to geographies where an unrestricted supply of FinTech talent is expected to be available,” says Krishna Subramanyam, CEO of Lithuanian banking FinTech Bruc Bond‘s Singapore office. He does think that the government will move to avoid a brain drain. “When industry sees that this type of talent is receiving policy support in the UK, the trend will be reversed,” Subramanyam says.

Nevertheless, some believe that the Brexit and coronavirus chaos could create challenges as well as opportunities for innovative entrepreneurs. “Let us not forget that many of the successful technology-led businesses that are around today were born from the last recession – think the likes of WhatsApp, Instagram and Uber,” says James Tucker, CEO of mortgage technology provider Twenty7Tec.

“Whilst it may be true that some of the tech and heavily funded firms from last year may not make it through this time as their model has disappeared overnight, we see the vast majority adapting to the ‘new normal’. After all, the technology, and FinTech in particular, has so far always shown itself as an innovative model with the willingness and capabilities to adapt to an ever changing environment.”

Pointing at projects like the Financial Conduct Authority’s Innovation initiative and other regulatory and FinTech sandboxes, Roach-Canning suggests that the country’s leadership is trying to nurture the ecosystem. “Our expertise in innovation, entrepreneurialism and technological development are all supported by the UK’s rule of law,” she argues. “This is why, regardless of Brexit or Covid, we will continue to see great FinTechs working in the UK, and only a small number – such as RobinHood – turning away.”

Copyright © 2020 FinTech Global