Magnetis, which offers Brazilian investors a wealth management solution, has reportedly raised $11m in its new funding round as it looks to become a full-service brokerage.

Contributions to the round came from Redpoint eventures and Vostok Emerging Finance, according to a report from TechCrunch.

With the fresh equity, the company will launch its own brokerage service and build new features that will improve the customer experience.

The company has allegedly created 350,000 investment plans and has over 430 million reals under management. The company is hoping to reach 1 billion reals by the end of 2021, the article states. Magnetis provides consumers with an advisory service that helps them invest their savings to achieve financial goals.

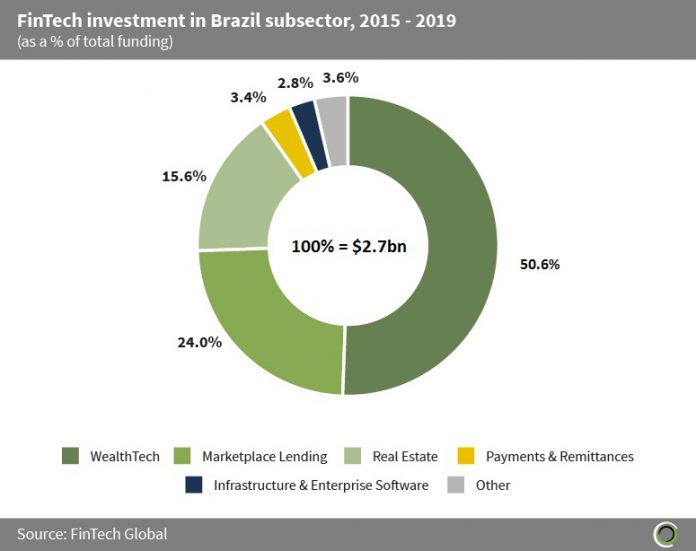

There is a sizeable FinTech market in Brazil, with a total of $2.7bn being invested into the sector between 2015 and 2019, FinTech Global data shows. WealthTech, which Magnetis comes under, is by far the most attractive sector in the country, with it representing 50.6% of the total capital raised by FinTechs.

Interest in the sector skyrocketed last year, with a total of $1.6bn invested through 44 deals compared to just $481m deployed through 40 deals in 2018.

Brazil is home to NuBank which is one of the world largest FinTech companies. Last year, the challenger bank raised $400m in its Series F round, which valued the business at an eye-watering $10bn.

Brazil is home to NuBank which is one of the world largest FinTech companies. Last year, the challenger bank raised $400m in its Series F round, which valued the business at an eye-watering $10bn.

Appetite for Brazilian FinTechs has continued in 2020, with a number of companies closing rounds. Earlier in the month, payment tool developer Swap closed a $3.3m funding round.

Copyright ? 2020 FinTech Global