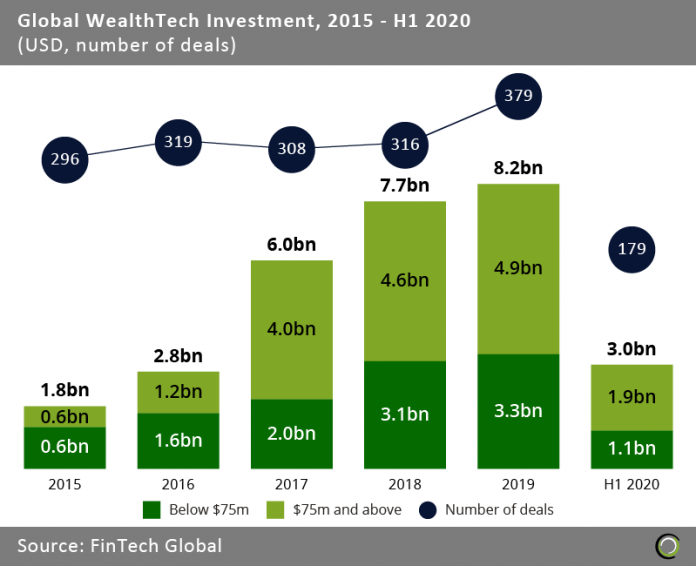

Investment in the sector is expected to slow down for the remainder of the year as the momentum from a record H2 2019 wears off

- Global WealthTech funding increased steadily from 2015 to 2019 then dipped from $5.1bn in H2 2019 to $3.0bn in H1 2020, mainly because of the economic uncertainty created by Covid-19, which reduced the disposable income of the millennial population, thereby impeding the prospect for WealthTech companies to grow.

- Funding from deals more than or equal to $75m has demonstrated a steady increase from 2015 to 2019, as investors double down on larger, more mature WealthTech companies. Moreover, there has been a steady growth in funding from deals under $75m, indicating that investors were still willing to back new innovative ventures, especially outside of developed markets.

- Despite seeing a decrease in the number of deals and total funding this year, we can expect a strong growth in WealthTech investment over the next few years, driven by the creation of new banking products for SMEs, adoption of diversified products by challenger banks, as well as developments in AI and data technology. In fact, the amount of funding raised in H1 2019 and H1 2020 remains the same at $3.0bn, demonstrating that investors still see opportunities in WealthTech companies as the world adjusts to a ‘new normal’ heavily dominated by digital services. For instance, CEO Anne Boden claimed that Starling Bank is taking advantage of remote working, “delivering lots of new products and being very efficient with lots of new customers signing upâ€.

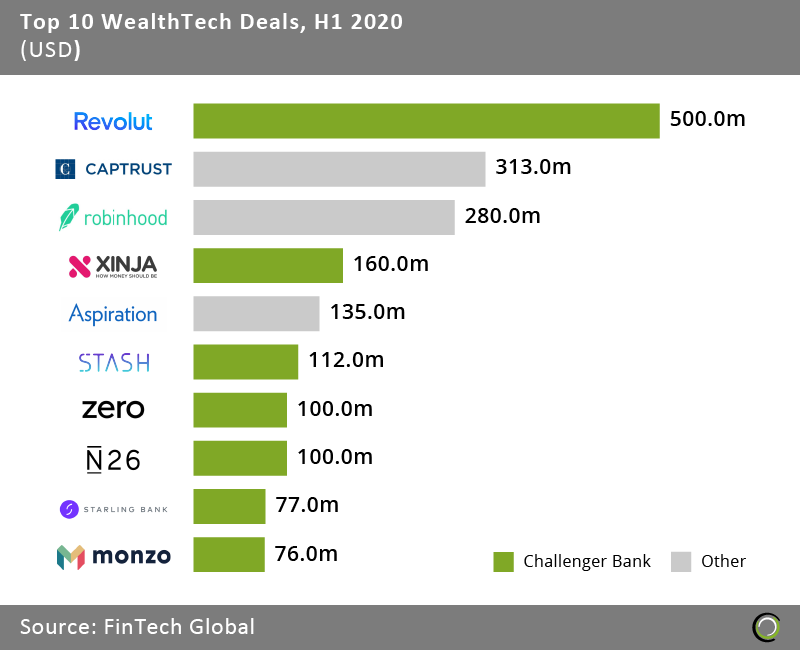

Online banking sector becomes increasingly prominent in developed economies, negating the use of physical bank branches for millennial consumers

- Among the companies which completed the top ten deals in H1 2020, seven of them (Revolut, Xinja, Stash, Zero, N26, Starling Bank, Monzo) develop products in the digital banking space. With the exception of Sydney-based Xinja, all of these companies are headquartered in North America or Europe.

- Although many challenger banks have been negatively affected by Covid-19 due to a drop in consumer borrowing and spending, those that have diversified products, engage with SMEs and provide trading platforms have been able to attract investment and grow. For example, Stash said in April that it would use its recent $112m Series F round to attract more Americans to use its investment and trading platforms, helping them achieve their financial goals regardless of their income or net worth.

- Based on findings by Allied Market Research, the online banking market size is expected to reach $29.9bn in 2023 from $7.3bn in 2016, growing at a CAGR of 22.6% over the period. This is largely due to the fact that challenger banks are making borrowing, saving, money management, investing and trading easier and more accessible to the population. In the United States and Europe, many neobanks are providing online banking services to younger consumers who do not necessarily need a bank account with physical branches. These banks target tech-savvy millennials owing to their lost cost structure and personalized customer services, such as but not limited to money tracking tools.

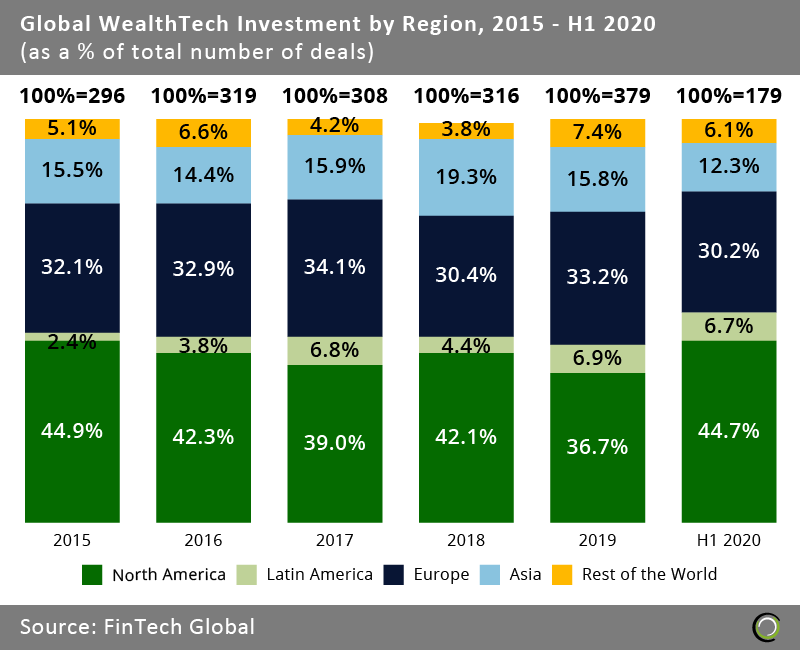

North America experienced an increase in WealthTech investment share YoY largely driven by developments within the challenger bank market and roboadvice services

- North America saw an increase in share from 37% in 2019 to 44% in H1 2020, with a growth in its number of deals from 63 in H1 2019 to 80 in H1 2020. This can be largely attributed to a growing presence of challenger banks, which are less hampered by regulations and have less hefty organizational structures compared to traditional banks. The increase in its number of deals was also fueled by a growth in roboadvisors, which charge lower fees and yield higher transaction volumes compared to traditional wealth managers.

- Asia experienced an increase in share from 14% in 2016 to 19% in 2018, followed by a decrease to 12% in H1 2020. This is likely because Asian markets were the first to be affected by Covid-19. A similar trend may be later observed in other continents as they continue to struggle against Covid-19.

- Latin America observed an overall increase in share, from 2% in 2015 to 7% in H1 2020, as 78% of its population is expected to use a smartphone by 2025, up from 64% in 2018, according to CrunchBase news. The increasing widespread use of internet services on smartphones is fuelling demand for online banking and personal finance services in Latin America.

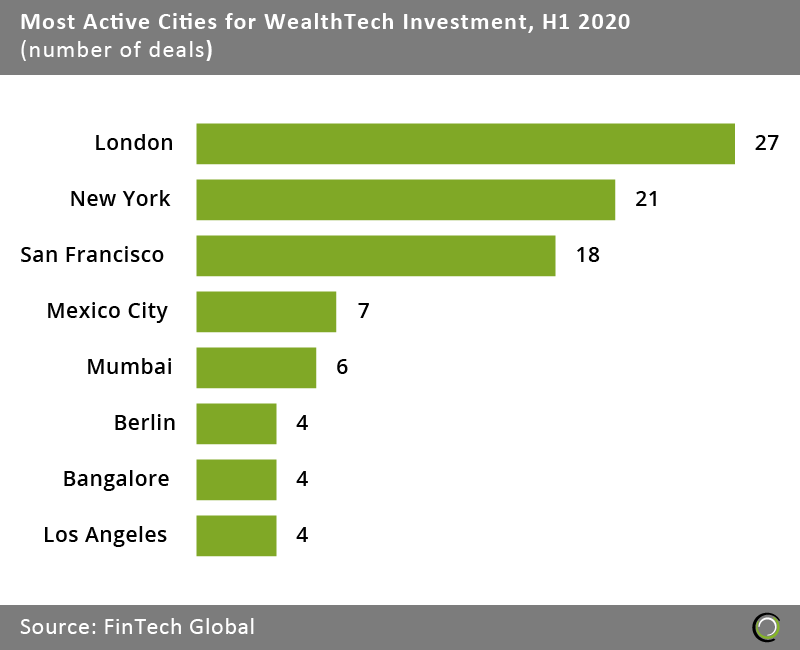

London leads WealthTech investment due to its prominent financial center and strong challenger bank market

- London, New York and San Francisco were the three most active cities for WealthTech investment in the first six months of 2020, followed by Mexico City, Mumbai, Berlin, Bangalore and Los Angeles. H1 2019 yielded similar results, with London, New York and San Francisco in the top three. London has been a leading hub for WealthTech investment due to the global presence of its financial center and its myriad of neobanks. As an example, challenger bank Revolut is developing an app where customers can manage all of their daily finances. It also raised a massive $500m round in February, the biggest in the WealthTech segment in H1, to expand its banking operations across Europe. It should be noted that the neobank topped up its Series D with another $80m in July.

- Mexico was also in fourth position in H1 2019. With a population of 130 million, the country is projected to have 100 million mobile phones in service soon and an increasing number of internet users year after year, according to a study by BBVA research. Furthermore, a large proportion of Mexico’s population lives in rural areas, thus necessitating investment in WealthTech services to help many of them achieve greater financial stability without the need for physical bank branches. As claimed by BBVA research, as of now, only 16% of Mexico’s total banking transactions are carried out online, so there is much room for growth in its online banking sector.

- Mumbai and Bangalore were not among the top ten most active cities for WealthTech investment in H1 2019. India’s growing ability to attract WealthTech investment may be attributable to its increasing number of online shoppers and bankers. As increasingly more Indians are able to access internet on their mobile phones, major cities like Mumbai and Bangalore are expected to observe a further rise in their online banking investment, leading to significant improvements in its customer experience and cost structure.

If you want to find out about the latest trends and innovation in WealthTech join the Virtual InvesTech Forum, taking place on 19 & 20 August. It’s a FREE to attend digital event hosting over 1,000 senior-level industry leaders and innovators.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global