Nordic challenger bank Lunar has launched a new business bank and paid-for business accounts for smaller firms and freelancers.

The new initiative from the Danish neobank is said to enable entrepreneurs to control their finances through a mobile app.

“There is a huge appetite for business accounts, and our ambition is to move up in segments fast,” said Ken Villum Klausen, founder and CEO of Lunar in a statement seen by EU Startups. “Charging an annual fee will give us the opportunity to invest in more power features, explore own business loans and cater for larger companies as well.

“The business product will be one of the big revenue streams in Lunar and we’ve given early access to 2,000 users and close to 90% has been monthly active users and willing to pay the subscription upfront.”

The news comes after the Lunar extended its Series B round with another €20m in April this year, having originally raised €26m in its Series B round in August 2019. At the same time it announced that it had acquired its European banking licence from the Danish Financial Supervisory Authority. It had previously raised €4.2m in 2016.

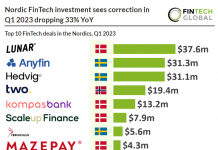

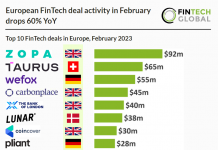

Lunar is part of a wave of new challenger banks that have launched in the Nordics over the past few years.

For instance, Swedish challenger bank Northmill was granted a banking licence in September 2019. It has since launched a new card and a savings account. Rocker, formerly known as Bynk, raised the fourth biggest FinTech investment round in Sweden in 2019.

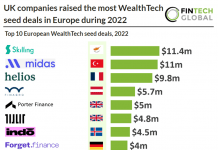

In May, FinTech Global interviewed Icelandic neobank indó’s founder about the challenger bank’s goal to create “the least powerful bank in the world” and how it aimed to do that on the back of a recent €1m round.

Copyright © 2020 FinTech Global